Xero migration services allow users to transfer their data from one platform to another. However, since data migration needs to be seamless and secure, you need a handy guide to protect you from taking any wrong steps. Here’s a detailed guide explaining Xero migration services to assist you in your journey.

Xero accounting system is an excellent application for small and medium firms to handle accounting and bookkeeping tasks. It digitizes and automates several tasks, allowing firms to gain value and efficiency. If you’re using any other application and considering switching to Xero, you need this blog to guide you on how to avail yourself of professional migration.

What is the Xero application?

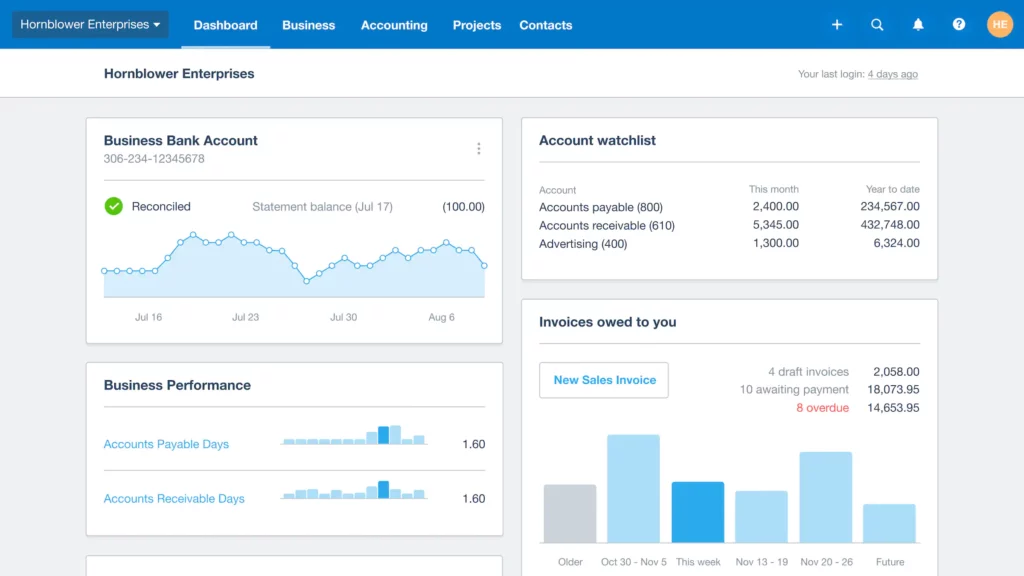

Before diving into Xero migration, let’s first understand the Xero application. Xero is a cloud-based accounting software application that assists small and medium-sized businesses handle their finances. It allows companies to track their income and expenses, create and send invoices, manage inventory, and handle payroll. Users can access the app from anywhere with an internet connection, and it can be used on desktops, laptops, tablets, and mobile devices.

Xero also offers extensive features and integrations with other business tools to help streamline processes and elevate productivity. For example, users can integrate Xero with payment processing tools, customer relationship management (CRM) software, project management tools, and more.

Overall, the Xero app is designed to simplify accounting and financial management for businesses of all sizes, making it easier to stay on top of finances and make informed decisions.

Read more :- Affordable cloud migration services

What are Xero Migration Services?

Xero migration involves transferring financial data from an existing accounting system to the Xero platform. These services are typically provided by Xero-certified accountants or specialists with the expertise and experience to ensure a smooth and successful migration.

The migration process typically involves transferring customer and supplier information, account balances, transaction history, and other financial data from the previous system to Xero. The migration specialist will work with the user to ensure the data is accurate and complete. Further, they see that any customizations or configurations from the previous system get carried over to Xero.

QuickBooks Xero migration services benefit firms looking to switch to Xero from another accounting software or system. When you outsource the migration procedure to an experienced professional, you can ensure efficiency and accuracy in transferring financial data, thereby reducing the risk of errors or data loss. Additionally, migration specialists can provide guidance and support to help firms extract the most from the Xero platform and optimize their accounting processes.

Ways to Migrate from QuickBooks to Xero

When you migrate from QuickBooks Online to Xero, you can opt for one of the several ways. Depending on the data complexity and business needs, your decision may vary. Here are some standard methods for migrating from QuickBooks to Xero:

Manual Migration:

One way to migrate to Xero is by manually entering data from QuickBooks into Xero. It’s a time-consuming method, but it allows for a thorough data review. Further, you can detect any errors or discrepancies in the data.

CSV File Import:

Xero enables businesses to import data from a CSV file. This method involves exporting the data from QuickBooks into a CSV file and later importing it into Xero. It’s a relatively simple method but may require some formatting and mapping of the data.

Xero Conversion Tool:

Xero offers a conversion tool that can automate the migration process. The tool assists in converting data from QuickBooks Desktop to Xero. Further, it can transfer a range of data, including customers, suppliers, invoices, and transactions.

Third-Party Migration Services:

Businesses can also use third-party migration services to migrate from QuickBooks to Xero. These services typically involve a team of migration professionals handling the migration process. They ensure accurate and secure data transfer.

Regardless of the method you choose, it is crucial to thoroughly review the migrated data to maintain its accuracy and completeness. Additionally, businesses should consider working with a Xero-certified advisor or migration specialist for a smooth and successful migration process.

Recommended article:- QuickBooks Data Recovery Services Guide

Steps to Migrate from QuickBooks to Xero

When you migrate from Xero to QuickBooks or vice-versa, the following crucial steps must be taken:

Step 1: Preparation Before Starting Migration

Before you start migrating from QB to Xero, you must consider the following points:

- You must add your organization to Xero.

- Opt for a date when you wish to start recording transactions in Xero.

- Ensure to add your bank account and opening balances.

Step 2: Begin importing data from previous systems

The next step involves preparing your data in the previous system to import to Xero. It should be accurate and up-to-date with the last accounting software. You need to create CSV files in your previous accounting system to prepare them for bulk import. Here’s a list of CSV files you can import in bulk from other accounting solutions:

- Fixed Assets

- Contacts

- Xero Chart of Accounts

- Supplier Bills

- Customer Invoices

A helpful tip

When you migrate from Xero to QuickBooks Online, consider importing invoices and bills before adding contacts. It will prevent duplication, as your suppliers and customers become contacts automatically in Xero. After this, export the Xero contacts, complete any missing details, and import the CSV file.

Step 3: Enter Historical Transactions

Beginning from the conversion date, enter the following details to migrate QuickBooks to Xero:

- Any sales invoices or bills not imported already into Xero

- Transactions where you received or spent money without entering any invoice or bill

Step 4: Undertake Payment Processing and Bank Reconciliation

Undertake the following steps to migrate Xero to QuickBooks in this procedure:

- Record the payment on the invoice or bill in Xero when you receive or pay on the invoice or bill.

- Import transactions from your bank to Xero automatically by applying for a bank feed. You can import bank statements manually also if you couldn’t apply or the feed couldn’t import older transactions.

- Match your transactions by reconciling your accounts with the transactions recorded in Xero. Tap OK to confirm the match if Xero recommends one between a statement line and a transaction in Xero. You can alter the match if it isn’t right.

- Mark a transaction as reconciled if you cannot manually set up a bank feed or import bank statements. Mark it when you see it go through the bank account.

- Import the bank statements first if you don’t want to enter items into Xero before passing them through the bank account. Later, you can add a spend or receive money transaction during reconciliation. Enter your invoices and bills into Xero to match payments and bank statements.

Step 5: Run business reports

Begin running the following reports for QuickBooks to Xero migration:

- Aged accounts payables and receivables summary to see a list of outstanding invoices or bills.

- Income statement showing net gains or losses in a month after deducting total monthly expenses from total income.

- Balance Sheet with currently owned assets, liabilities (the amount owed), and total worth (equity).

Step 6: Undertake your Taxes

Check the following tax reports:

- See your Sales Tax reports. You’ll notice the current sales tax period if you enter your sales tax settings.

- Scan through all the transactions entered in the current period through the Sales Tax Audit Report. Ensure everything you’re reporting on for the time is present at the correct tax rate.

- Open Xero, copy all relevant figures from your Sales Tax Report to the form, and submit it to the respective tax authority.

- End the sales tax period by publishing your report in Xero. The Sales Tax Report reloads, making it ready for the next period.

Contact Xero Advisory experts if you require additional assistance in undertaking these steps and Xero to QBO migration.

Bottom Line

We hope this in-depth guide to Xero migration services helps you transfer your data seamlessly without issues.

FAQs

Can I migrate from the QuickBooks application to Xero software?

Yes, you can easily convert your accounting system from QuickBooks to Xero. A few steps and professional assistance can help you carry out the process smoothly. For example, electronic conversion processes offered by third-party specialists can quicken the migration.

Which is better: QuickBooks or Xero?

QuickBooks and Xero accounting applications cater to similar audiences’ accounting and bookkeeping needs. Both apps offer an extensive range of features and value for money. While Xero is ideal for the in-house bookkeeping and accounting team, QuickBooks has a better intuitive interface. This difference arises because QuickBooks was developed keeping firms with accounting needs in mind, while Xero exists with accountants and bookkeepers in mind. Thus, both programs benefit many users depending on their individual needs.

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.