Is your QuickBooks payroll not calculating taxes and preventing you from calculating wages and processing paychecks? If so, this guide will help you fix this issue as soon as possible. Incorrect payroll calculation can lead to IRS, federal, and state penalties. Regarding the triggers behind this issue, outdated payroll tax tables or reaching the employee’s annual limit might be responsible. To troubleshoot it, you need to perform solutions, like updating the payroll tax tables, reviewing the deduction item, etc. In this article, we will discuss all the practical solutions to address this issue in detail.

Solutions to Implement When QuickBooks Payroll not calculating taxes

You won’t be able to calculate the employee wages and process the paychecks if QuickBooks Payroll is not calculating taxes. Thus, after understanding the reason behind this issue, follow the troubleshooting solutions mentioned below to fix it –

Solution 1 – Update QBDT and the Payroll Tax Tables

Firstly, ensure that QuickBooks Desktop and the payroll tax tables are updated to the latest release. This is because an outdated application or lack of tax table updates can affect the payroll tax calculation. To run the QBDT and tax table updates, follow the steps given below –

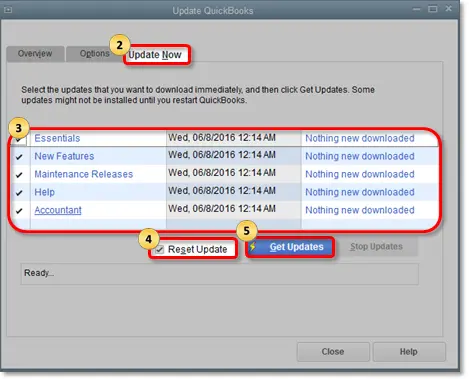

Download & Install QBDT Updates

Implement the steps given below to download the most recent QuickBooks Desktop updates –

- Launch QuickBooks, open the Help section again and select Update QuickBooks Desktop.

- Now, click Update Now, checkmark the Reset Update checkbox, then click Get Updates.

- Wait for the updates to download, then relaunch QB and select Install Now to install the updates.

Once done, download the tax table updates in the next section.

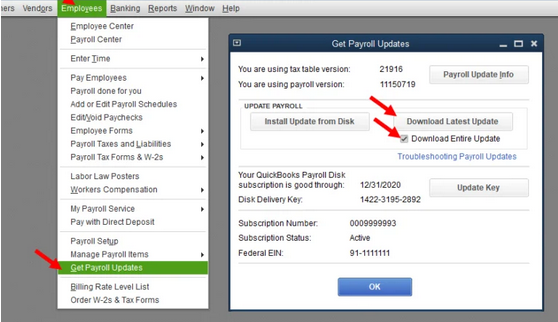

Update the Payroll Tax Tables to the Latest Release

To update the payroll tax tables to the latest version, follow the steps mentioned below –

- Open QuickBooks, select Get Payroll Updates from the Employees menu, and choose Download Entire Update.

- Lastly, select Update, and once the updates are downloaded, an informational window will appear confirming the success.

After the update process is complete, open QuickBooks and run payroll. Check if the payroll taxes are being calculated; if not, move to the next solution.

Solution 2 – Check the Employee’s Annual Limit

If the annual limit you set to withhold the payroll item calculation is reached, QuickBooks Desktop will not calculate payroll taxes. To fix this issue, run the tax and wage summary report and review the limit as follows –

- Select Lists, click Payroll Item List from the top menu, and right-click the payroll item you wish to modify/edit.

- Next, choose Edit Payroll Items, then scroll down to the next screen until you see the Limit Type screen.

- Further, verify that the box at the bottom is correctly set, then take the following actions –

- If the limit is correctly set, the employee’s payroll should stop calculating when that limit is reached.

- However, if the limit is not set correctly, update the amount.

- Now, move to the Limit Type section and ensure you have chosen the correct option from the following –

- Annual – Restart every year

- Monthly – Restart every month

- One-time limit

- If the option isn’t correctly chosen, modify the Default Limit or the Limit Type selection to suit your preferences, then click Finish to complete the process.

Rerun the QB payroll once the annual limit is reviewed and changed as required. Then, try processing the paychecks; however, if QuickBooks paychecks are being calculated incorrectly, move to the next solution.

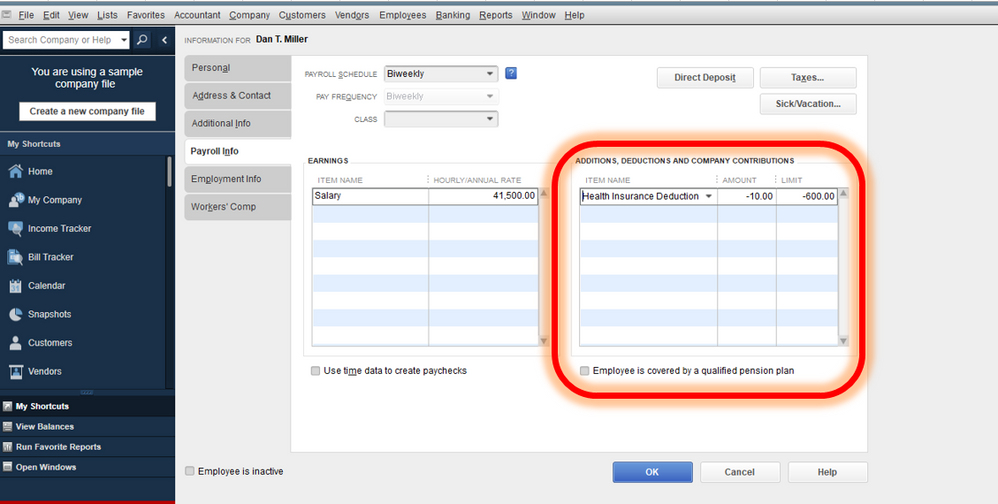

Solution 3 – Review How the Deduction Item is Set

If the payroll taxes aren’t calculating correctly, examine how the payroll item for tax deduction is set. The final calculations on the paycheck depend on the deduction item for both gross and net calculations. Follow the steps given below to verify the deduction item in payroll –

Check if the Payroll Deduction Item is Set Correctly

Firstly, check if the payroll deduction item is set correctly by using the following steps –

- Open QuickBooks, then from the Lists menu, select Payroll Item Lists, and right-click Deduction.

- Select Edit Payroll Items, click Next, and open the Net/Gross window.

- Next, check the deduction item to ensure it is set accurately, then click Next and Finish.

However, move to the next section if the item is incorrectly set.

Correct the Payroll Deduction Item that is Set Incorrectly

If the deduction item is not set correctly, follow the steps given below to correct the payroll items –

Note: Different criteria can be used to calculate every item; hence, you can confirm how a deduction item should be calculated according to your preference.

- Go to Lists, select Payroll Item List, then double-click the payroll deduction item that’s set up incorrectly.

- Now, edit the payroll item name by adding ‘Do Not Use’ to the end of the incorrect item’s name so that it will be used for future payroll.

- Select Next until Finish appears, then select Finish, and select the Payroll Item from the dropdown.

- Click New, then set up a new payroll item for deduction to replace the wrong one. Ensure you select the correct tax tracking type and taxability while creating the item.

You can use these steps to correct the payroll item for wage, addition, or company contribution. Then, create a payroll summary report to determine the YTD amount of the incorrect item.

Once the deduction item is correctly set, rerun QuickBooks payroll and check if the taxes are being calculated correctly. However, if QuickBooks payroll is not deducting taxes, move to the next solution.

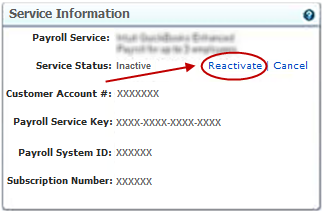

Solution 4 – Reactivate Your Payroll Subscription

An inactive or expired payroll subscription can prevent users from running payroll and calculating taxes. Thus, if your subscription is expired, reactivate it using the instructions below –

Through your company file

To activate the subscription via your company file, follow the steps given below –

- Open the QuickBooks Desktop company file, go to the Employees menu, and select My Payroll Service.

- Next, select Account/Billing Info, sign in using your Intuit Account login, and access the QuickBooks Account Page.

- Under the Status tab, choose Resubscribe, and follow the on-screen steps to reactivate your payroll service.

Through your Intuit account

Another way to reactivate the payroll subscription is via the Intuit account in the following manner –

- Sign in to your account using your Intuit credentials, then go to the Status tab and choose Resubscribe.

- Lastly, follow the on-screen steps to reactivate your payroll service, which can take up to 24 hours. Once reactivated, your subscription status will show as Active.

After reactivating the subscription, rerun the QuickBooks payroll and review the paychecks. If QuickBooks Desktop payroll is not calculating taxes, follow the next troubleshooting solution.

Solution 5 – Verify the SUI Tax Setup

Incorrect SUI rates can cause issues while calculating payroll taxes. Thus, you need to verify that you have the correct SUI rates, then update payroll and tax tables if required.

However, if the State Unemployment Insurance (SUI) shows as zero in the paycheck, follow the steps given below –

Step 1 – Check the SUI Wage Base Limit

If the SUI shows as 0.00 in the recent paychecks but is calculated correctly in the previous ones, the SUI wage base limit for the employee might have been reached. Thus, you must update this limit in QuickBooks Desktop and QuickBooks Online payroll.

In QBO payroll, the limits are updated automatically, whereas in QBDT payroll, the limits are updated by the tax table. Thus, you need to download the tax table updates in QuickBooks Desktop to update the wage base limits.

Once the wage base limit is updated, check for tax exemptions in the next section.

Step 2 – Check for SUI Tax Exemptions

To check and update the SUI tax exemptions, follow the steps given below –

QuickBooks Desktop Payroll

Follow the steps given below to review the SUI tax exemptions in the QBDT payroll –

- Go to the Employees section, select Employee Center, then double-click the employee’s name.

- Select Payroll Info, click Taxes, review the SUI checkbox, and make the necessary changes.

QuickBooks Online Payroll

To check for SUI tax exemptions in the QBO payroll, perform these steps –

Employee

- Go to Payroll, select Employees, and go to the Tax withholding section.

- Select Edit, review the SUI checkbox, make the required changes, then click Save.

Employer

- Go to Settings, click Payroll settings, and select Edit next to your state.

- In the Unemployment Insurance (UI) section, select Edit and click Continue.

- Review the rate and effective date, update if needed, and click Save and Done.

After checking and updating the SUI tax exemptions, update the SUI rate in the next section.

Step 3 – Update the SUI Rate

Verify your current SUI rate from your state agency, then update the rate in QuickBooks in the following manner –

QuickBooks Desktop Payroll

Implement the following steps to update the SUI rate in QuickBooks Desktop payroll –

- Go to the Lists menu, select Payroll Item List, and double-click [state abbreviation] – Unemployment Company.

- Now, click Next until the Company tax rates window appears, enter the correct quarterly rates, and hit Next & Finish.

However, if you have surcharges or assessments, follow these steps –

- Go to the Lists menu, select Payroll Item List, then double-click the State Surcharge item.

- Select Next, follow the onscreen steps, and then enter the rate as a percentage on the Company Tax Rate page.

QuickBooks Online Payroll

Update the SUI rate in QuickBooks Online payroll using the steps below –

- Sign in to QBO, click Settings, then select Payroll settings.

- Next to the state you want to update, select Edit, then move to the State Unemployment Insurance (SUI) Setup section.

- Select Change or add a new rate, then enter your new rate and its effective date.

Note: The effective SUI date for most states is 1/1. For TN, VT, and NJ, it is 7/1. However, if you can’t change the current year’s rate, contact us for help updating it. - Lastly, select or enter any updated surcharge or assessment rates and click OK.

Once done, rerun QuickBooks payroll and check if the SUI rates are correctly set. Then, try calculating the payroll taxes on the paychecks. If QuickBooks payroll is not calculating taxes, move to solution 6.

Solution 6 – Verify the Federal & State Withholding

If the federal or state income tax in QuickBooks is 0.00, the employee might claim an exemption or not have enough wages to reach the threshold limit. This scenario can explain why you find that taxes are not being calculated. Hence, if your employee has claimed exemption or the filing status is ‘do not withhold,’ the 0.00 tax on the paycheck is correct.

However, if you think the withholding tax should have been deducted and the paycheck tax calculation is incorrect, follow the steps below –

Step 1 – Check the Federal and State Withholding Forms

Get a federal form W-4 and state withholding equivalent form (if applicable) from each employee, then check the forms to ensure they are correct. The tax calculation on these forms depends on the following factors –

- How much and how often is your employee being paid?

- The employee’s marital status.

- Number of dependents on the said employee.

- Other sources of income.

Once these forms are checked and the calculations are reviewed, move to step 2.

Step 2 – Check the Employee’s Tax Setup in Payroll

Go to the Tax Withholding section of your employee’s profile (check out the Federal W-4 form in QuickBooks Payroll for steps). Then, the filing status and other application fields should match the employee’s W4 or state equivalent forms. Remember, the withholding tax won’t be deducted if the filing status is ‘exempt’ or ‘do not withhold.’

After checking the tax setup and filing status in the form, if you conclude that the employee shouldn’t be exempt, move to step 3 and change the filing status so that payroll taxes can be calculated correctly.

Step 3 – Change the Employee’s Filing Status

If the filing status in the federal form W-4 is set to Exempt or Do not withhold, edit the employee’s filing status in the following manner –

- Open QB, go to the Employees menu, then choose Employee Center, and double-click each employee’s name one at a time.

- Next, select Payroll Info on the left and ensure the Pay Frequency is correct.

- Click Taxes, move to the Federal tab, then check the Filing Status and Allowances fields.

- If the filing status displays as Exempt or Do not withhold, make the necessary changes, then hit OK twice to save the changes.

Once the filing status is changed, rerun QuickBooks payroll and review the paycheck. You can also try reverting the employee’s paycheck to see if the payroll taxes are being calculated. If QB payroll taxes are calculated incorrectly, move to the next solution.

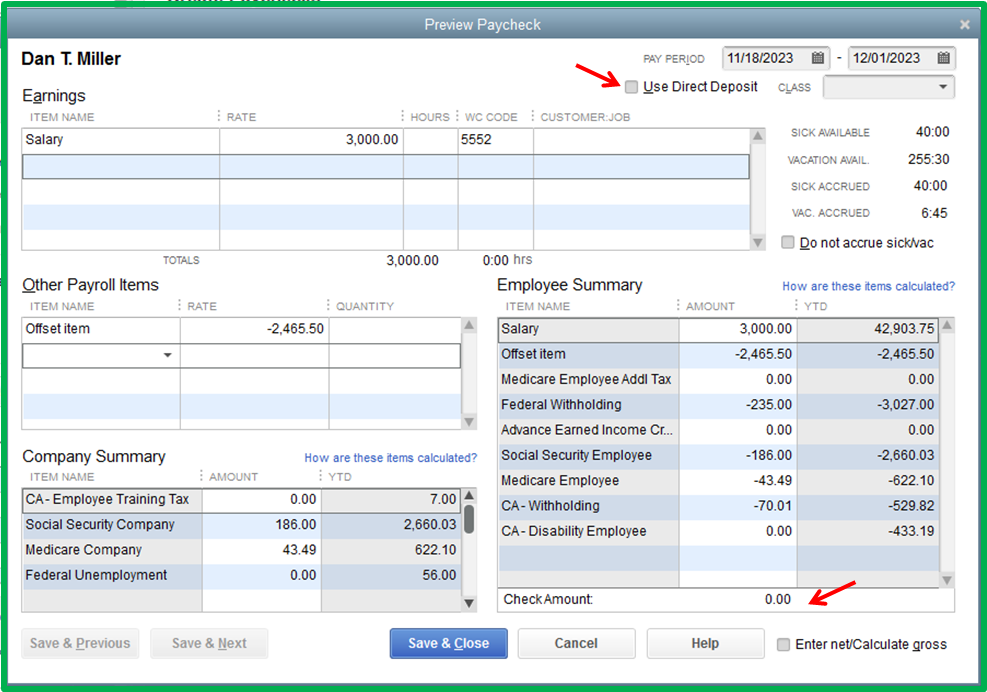

Solution 7 – Review the Paycheck with Zero Net Pay

If your paycheck shows the net pay amount as zero, it doesn’t always mean it is incorrect. Sometimes, the paycheck might be created to contribute towards an employee’s income tax, retirement or to record a gift made to an employee. Thus, if your QuickBooks paycheck is calculated incorrectly due to the zero net pay amount, review the paycheck and understand where the amount was contributed. This will help you determine if the tax amount in the paycheck is incorrectly calculated or if it shows zero due to the said contributions.

Solution 8 – Check the Employee’s Correct YTD Amounts

Incorrect year-to-date amounts can be why payroll taxes are not calculated correctly. If you’ve missed a payroll from the previous pay date and created it after submitting the payroll for the current pay date, the YTD amounts on the previous payroll will be larger than the payroll for the current pay date.

This doesn’t mean that the YTD amount is incorrect, as the current YTD amounts will show up on the most recent paycheck created, not the most recent pay date.

QuickBooks can’t correct the YTD amounts on a paycheck; thus, you need to run a payroll details report in the following manner to check the correct YTD amounts –

QuickBooks Desktop Payroll

To access the payroll details report in QBDT payroll, follow these steps –

- Go to the Reports menu, select Employees & Payroll, then select the report you want to view (select Payroll Details Report).

- Next, select Customize Report if you want to make changes, and check the YTD amounts.

QuickBooks Online Payroll

If your QuickBooks Online payroll taxes are not calculating correctly, access the payroll details report to check the correct YTD amounts as follows –

- Open the Reports menu, select Standard, then scroll down to the Payroll section or Find report by name from the search box.

- Next, find and select the report you want to view (select Payroll Details Report).

- Lastly, filter your report by date range, select Apply, and check the YTD amounts.

Once the correct YTD amount is found, rerun QuickBooks payroll and check if the taxes on the paychecks are calculated correctly.

Reasons Why QuickBooks Can’t Calculate Payroll

Problems while calculating payroll taxes can occur for many reasons. Understanding these reasons can help in the resolution process. Below, we have mentioned the leading causes why QuickBooks is unable to calculate payroll items on the paycheck accurately –

- QuickBooks payroll tax tables might be outdated, which can cause issues while calculating taxes.

- The annual limit for QB payroll item calculation has been reached.

- The deduction item in the paycheck is not set correctly.

- Incorrect employee, tax, or payroll item setup in QuickBooks might be inaccurate.

- Your QuickBooks payroll subscription is inactive or has expired, which can cause issues while calculating payroll.

- The year-to-date amounts in the paycheck might be incorrect.

- The paychecks have zero net pay due to contributions towards income tax, retirement, or gifts to an employee.

- The SUI rates or the filing status in the W-4 form might be incorrect.

Now that we know the reasons behind the payroll tax issues let’s learn how to resolve them in the next section.

Conclusion

The expert-recommended solutions provided in this detailed guide will help you resolve the issues with QB payroll tax calculation.

FAQs

What are the essential documents needed to calculate QuickBooks payroll taxes?

You need the following forms/documents to calculate the QB payroll taxes correctly –

Form W-4: Employee’s withholding certificate.

Direct deposit authorization form.

Form I-9: Employment Eligibility Verification.

State W-4, if applicable.

How can I run and customize the payroll report in QuickBooks?

If QuickBooks wages don’t calculate properly, you can run and customize payroll reports. This can help manage taxes and keep track of employee expenses. To customize the QB payroll reports, follow the steps given below –

-Select the Reports menu at the top, then choose Employees and Payroll, and select your desired existing report.

-Select Customize Report to modify your report, then click OK to save the changes.

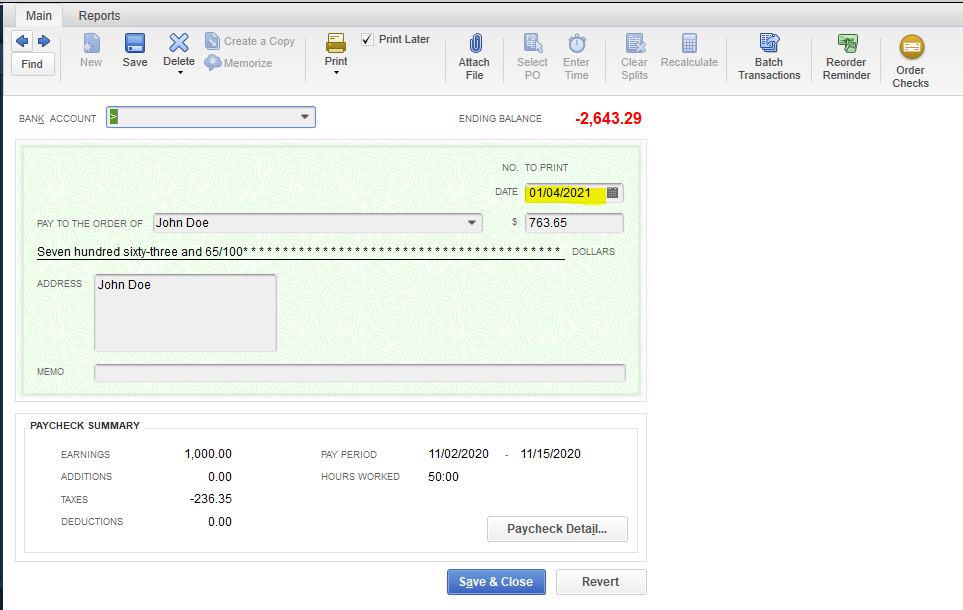

How do you revert an employee’s paycheck in QuickBooks Payroll?

Reverting the employee’s paycheck can refresh the info and help calculate the taxes. To revert the paycheck in QB payroll, follow these steps –

– Open the QuickBooks Employees tab, choose Pay Employees, and select between the Scheduled or Unscheduled Payroll options.

– Now, select Resume Scheduled Payroll, then find the employee’s names highlighted in yellow indicating changes.

– Lastly, right-click on the highlighted employee name for whom you wish to undo the changes and click Revert Paychecks.

Note: If you have already issued the employee’s paycheck, you can void or delete it and start from the beginning.

Can a damaged/corrupted company file be a reason for the QuickBooks payroll taxes not calculating correctly?

Yes, data integrity issues in the company file can cause problems while calculating or withholding payroll taxes. You can run the QuickBooks Verify/Rebuild Data utility from the File menu to fix the company file issues.

Why is QuickBooks not calculating payroll taxes correctly?

Outdated tax slabs, incorrect employee information, or minimum wage base limitations can cause QuickBooks payroll tax errors, resulting in inaccurate calculations. You have to verify your payroll preferences, active subscriptions, as well as pay items, frequently update, and check accurate tax calculations.

You May Also Read-

Payroll Service Issues in QuickBooks Desktop [Resolved]

Fix Quickbooks Payroll Update not Working in Windows or Mac

Expert Fixation QuickBooks Error 1327: Installing Issue

QuickBooks Application with Revoked Certificate Issue [Fixed]

Accurate Methods for FreshBooks Conversion to QuickBooks Online

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.