Payroll management is one of the larger tasks every organization needs to process. On-time, correct employee pay will increase morale among your staff and keep your business in good standing with any taxing authorities. QuickBooks Payroll can be listed as the most trustworthy payroll application for small and medium enterprises because it automates tax calculations and uses direct deposit. On the other hand, just like any other high-end application, QuickBooks Payroll has the tendency to generate errors in payroll processing equally.

If you have problems processing payroll, you are not alone. QuickBooks Payroll Most Common Errors that can lead to underpayment, overpayment, or even tax misfilings happen when using QuickBooks. Such an error may lead to serious trouble and delay employee payment processes, file taxes wrong, and cause compliance penalties.

In this comprehensive blog, we’ll share with you QuickBooks payroll most common errors that take place, describe why they happen, and give step-by-step solutions to fix them. With this information, you will be able to run your payroll process without glitches and errors.

Common Issues and Their Causes with Solutions in QuickBooks Payroll

Having a deeper understanding of QuickBooks Payroll Most Common Errors and their causes will help you take precautions and troubleshoot faster once it happens.

Wrong Employee Tax Calculations

Tax miscalculations, specifically under deduction for correct amounts for federal, state, or local taxes, are the most frequently occurring QuickBooks Payroll Mistakes. These can be expensive because an incorrect calculation of taxes might result in overpaid and underpaid taxes, translating into eventual filing errors made by the IRS or other tax authorities.

Causes:

- Outdated tax tables – Because tax rates change regularly if QuickBooks hasn’t been updated with updated tax tables, payroll tax deductions will be calculated based on outdated rates.

- Improper Employee Tax Setup – Employees might have filed their W-4 forms with the wrong filing status or several allowances. This will result in the wrong amounts being withheld.

- Changes in State and Local Tax – QuickBooks will not update changes in any state or local tax rates unless the updating of the tax tables is performed or the local tax rates are set up correctly.

Solution:

- Keep your QuickBooks Payroll software updated with the current federal, state, and local tax rates. In that regard, navigate to the Payroll Center, then click Get Payroll Updates to download the most current tax tables.

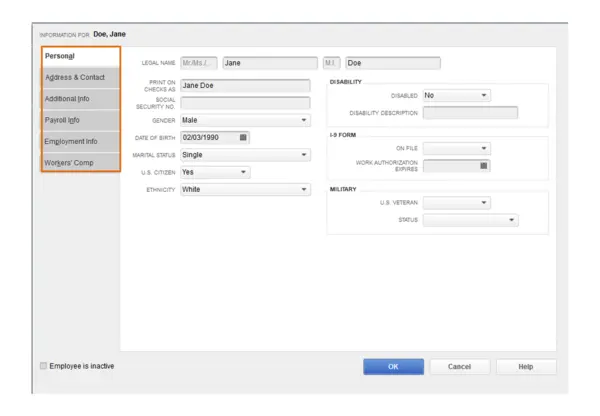

- Make sure that all employees are correctly set up for taxes, including their W-4 information regarding filing status, number of allowances, and any additional withholding amounts.

- QuickBooks Online Payroll automatically updates all the tax tables reduces the chances of manual errors and keeps your payroll calculations compliant with updated rates for taxation.

Whenever adding a new employee, set up all the available required tax information of the employee, such as residency for tax purposes, locality, and exclusions of the employee.

Misclassifying Employees as Independent Contractors or Vice Versa

The most common QuickBooks Payroll Mistakes is misclassifying the worker, taking him either as an independent contractor instead of an employee or vice versa. Misclassification could range from tax filings like failure to withhold payroll taxes to even legal penalties for failing to pay employment taxes correctly.

Causes:

- An employee is set up to be a contractor when he/she should be an employee. An employee may also be marked improperly as a contractor.

- The status of a worker might change from an independent contractor to an employee and vice versa. QuickBooks might not state that itself.

- Human error at the setup or payroll processing stage can lead to incorrect classification of workers, especially if the person creating the entries is inexperienced in differentials between contractors and employees.

Solution:

- Confirm through the onboarding process and add new workers whether they are correctly classified as an “Employee” or a “Contractor.” Workers who come in as employees should have the right taxes withheld. Those who are misclassified may have their taxes withheld inappropriately.

- Periodically go through your existing list of employees and contractors and perform a check to make sure the classification of the workers is appropriate. This will especially be true if the workers switch between contractor and employee status.

- If a worker was misclassified as a contractor, then you will have to file corrected tax forms with the IRS, such as Form 941. You may also want to adjust your payroll tax filings for past pay periods to reflect the proper classification.

The IRS has guidelines that check that the worker is a contractor or an employee. In case of confusion, refer to the common law rules based on IRS decisions for classifying employees versus independent contractors.

Payroll Not Syncing with Accounting Software

One of the very common problems reported by a good number of QuickBooks users is payroll failing to sync with their accounting software. In this regard, one will face discrepancies on financial reports, an inability to reconcile accounts, and only confusion as to whether payroll-related expenses are correct or not.

Causes:

- Payroll items such as wages, taxes, and deductions. Payroll data will not sync to your financial books if these are not mapped to the correct account that already exists in the QuickBooks Chart of Accounts.

- If you have mismatched versions of QuickBooks Desktop and Payroll or if either app is out of date, sync problems can occur.

- Payroll expenses not being mapped to the proper accounting categories or incorrect accounts being chosen during the payroll setup might lead to failure in syncing.

Solution:

- Depending on your QuickBooks payroll settings, payroll items must be mapped to the correct general ledger accounts. In QuickBooks Desktop, this can be done via “Edit” > “Preferences” > “Payroll.” Make sure each of the payroll items-such things as Salaries, Taxes, and deductions- are assigned to the appropriate expense account.

- Keep both QuickBooks Desktop and Payroll updated to the latest versions. Updates can fix syncing issues and make sure your accounting and payroll software are compatible.

- If the problem in syncing persists, then you can manually resync the payroll data. You may also try resyncing it through QuickBooks Desktop by clicking “Send/Receive Data” in the “Employees” tab.

Also, review your payroll reports and general ledger regularly. Discrepancies are much easier to locate early rather than later, which saves lots of headaches in the future.

Wage and Salary Mistakes

Paying too little or too much begins with irritation and dissatisfaction among the employees. All wage and salary errors arise from incorrect pay rates, failure in accounting for overtime, or even errors in the calculation of bonuses or commissions.

Causes:

- Incorrect pay rate- every time an employee gets a raise unless updated in the QuickBooks system, he will not get paid for the right amount of his increased wages or salary.

- Overtime calculation – the overtime setting is not set up correctly, people who work over 40 hours in a week may not have the correct calculation of overtime at 1.5 times the regular hourly rate. Bonus and commission are sometimes wrongly mentioned, thus creating a mess in paychecks.

Solution:

- Make sure that the pay is correct for each employee. For hourly employees, this includes confirming an appropriate hour’s pay rate. For salaried employees, this needs to ensure a correct annual salary is entered.

- Overtime rules need to be specified by setting rules so that time-and-a-half overtime can be calculated when an employee is working over 40 hours in a week. You can easily set this in the Employee Profile section, where you select the pay item applied to overtime.

- If bonuses or commissions are to be paid to the employees, these should be entered separately as different payroll items so they get correctly calculated. This ensures that the amounts are properly accounted for and paid.

Run payroll reports from time to time and cross-check them with your records for discrepancies. It is way easier to identify errors in a report than afterward when the paycheck has been processed.

Wrong or Missing Deductions

Payroll deductions are an important feature in any payroll system. However, when deductions aren’t captured or are keyed in incorrectly, thereby causing either a tax problem or an unhappy employee. This may be for employees paying reduced amounts in taxes or the wrong amount on benefits such as health insurance or retirement contributions.

Causes:

- Deductions that should be made for benefits, taxes, or retirement contributions are sometimes not updated to reflect the changed amount, hence the wrongful withholdings.

- If the deductions are not applied because of incorrect setup or mere lack of attention, employees miss important contributions that could affect their take-home pay or their tax filings.

- If employee benefits change, such as a change in the type of health insurance, and the change is not entered into QuickBooks, payroll deductions will be incorrect.

Solution:

- Verify all deductions and benefits on every employee to ensure that correct deduction amounts are applied, including federal and state tax withholdings, retirement plans, and health insurance, among other benefits.

- Employee deductions often change for various reasons, such as when health insurance premiums go up. In QuickBooks, the master file change needs to be updated to reflect the new dollar amount of the deduction.

- Periodically check payroll reports to ensure deductions are being deducted appropriately and in the right amount, taken from an employee’s benefits package or tax obligation.

Direct Deposit Failures

Big problems, such as employee pay delays and frustration, occur when direct deposit fails. Problems usually occur with a direct deposit when bank account details are wrong, or there is an issue with your business bank account.

Cause:

- If the bank account number or routing number of the employee’s account is incorrectly entered, a direct deposit will fail.

- If the funds in your business account are not enough to cover payroll, direct deposit payments can be returned.

- Banks, at times, hold direct deposit processing, which in turn delays the actual payments.

Solution:

- Verify that the bank and routing numbers are present correctly in QuickBooks for all employees to avoid any direct deposit issues. You may do so by following the employee profile.

- Before running payroll, make sure your business account has enough money to pay the expenses of payroll, which include employee salaries along with tax withholdings.

- If the case is about direct deposit failure, ask your bank if there was some problem with the transaction. Sometimes, you just have to wait for the bank’s processing time for the money to go through.

Encourage employees to validate their bank account details and notify you about any changes to avoid direct deposit errors.

Most Common QuickBooks Payroll Error Codes and its Troubleshooting

While earlier we mentioned the ways QuickBooks users could mess up their payroll and attract technical error notifications, this section will discuss the numerous QuickBooks Payroll Mistakes, which might demand professional intervention and knowledge of the troubleshooting solutions:

List of 12xxx series error codes

| 12002 | The request to the server has timed out |

| 12007 | QuickBooks cannot establish a connection to the internet |

| 12009 | Issues with the server or internet connection settings |

| 12029 | A network timeout preventing QuickBooks from connecting to the update server |

| 12031 | Misconfigured Internet Explorer settings or firewalls often cause connection issues. |

List of PSxxx series error codes

| PS032 and PS077 | Issues with payroll updates or damaged tax tables |

| PS107 | Issues downloading payroll updates |

| PS058 | Error during a payroll update installation |

| PS036 | Invalid Payroll Subscription status |

| PS038 | Unsent payroll data pending in the queue |

| PS033 | Damaged QuickBooks company file |

List of 15xxx series error codes

| 15102 | The download location is invalid or inaccessible |

| 15103 | QuickBooks update cannot be completed |

| 15104 | Unable to update QuickBooks due to improper configuration |

| 15105 | Failure to download the update due to antivirus or firewall settings |

| 15106 | The update program is damaged or not accessible |

| 15107 | Update error due to system or program issues |

| 15222 | Internet Explorer settings are misconfigured, preventing updates |

| 15223 | Issues with Internet Explorer or digital signatures |

| 15240 | File sharing permissions or system date/time settings are incorrect |

| 15243 | QuickBooks Update Service (QBUpdate.exe) is damaged |

| 15271 | A file cannot be validated during the update process |

| 15276 | A file cannot be updated |

Techniques of Troubleshooting to Resolve Most Common Payroll Errors in QuickBooks

We have finally reached the stage where learning to fix the most common Intuit payroll-related errors is seamless:

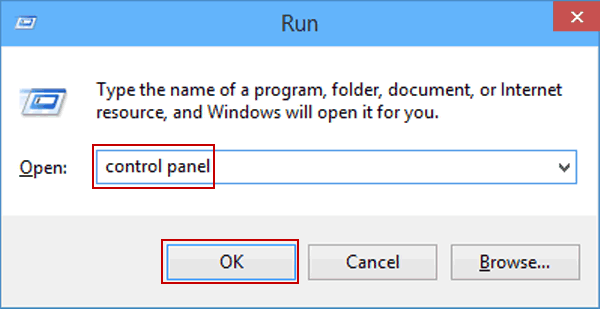

Approach 1: Troubleshooting way by turning off the User Account Control settings in Windows:

Although Windows User Account Control settings are crucial as far as security issues are concerned, you will find yourself having to turn it off when some of the frequently encountered QuickBooks Payroll errors occur. The steps you would have to follow to switch off UAC include:

Step 1: Expand the Control Panel

To implement this solution, the first thing you have to do is open the Control Panel using the Windows key on your keyboard. It opens the Start menu; now you have to type “Control Panel” and select it from the search results.

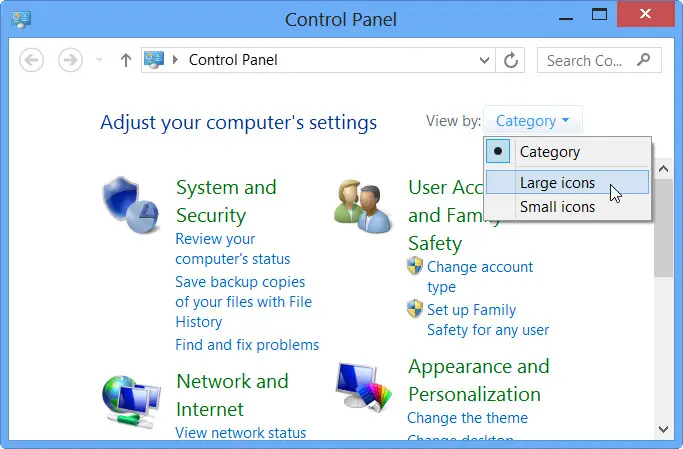

Step 2: Switch to the Control Panel view (if necessary)

Control Panel should be in the “Category” or “Large icons” view. If you have them set to “Small icons,” click on the pull-down menu by “View by” and select either “Category” or “Large icons” to change them to how you want them.

Step 3: Access User Accounts

Once you enter Control Panel, look for the option “User Accounts” and proceed with it.

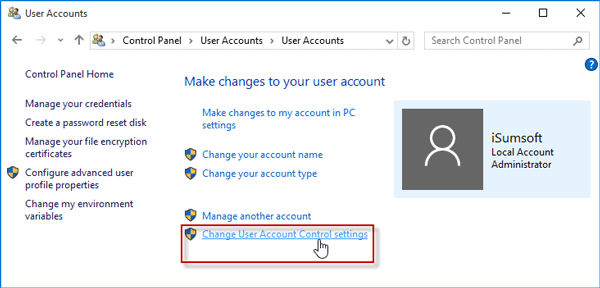

Step 4: Change User Account Control settings

You now need to click the “Change User Account Control settings” link in the User Accounts window.

Step 5: Change UAC Settings

You will see a vertical slider with different levels of UAC settings for your requirements. It is set, by default, to a level that notifies you when programs make changes to your computer. You’ll drag the slider down to move it to the “Never notify” position to disable UAC.

Step 6: Confirm the changes

After moving the slider to the level you want, you can confirm the changes by selecting the “OK” button.

Step 7: Complete the Process with a Restart

You can only be sure that the changes are in effect when you allow the restart button to run on your device. Again, you need to take good care of your files by saving those that are opened, and also close all running programs.

Troubleshooting Approach 2: Fix the Outdated QB and Payroll Tax Table Issue

An older version of the QuickBooks payroll and tax table can be updated by downloading and installing updates related to them. Since an older version becomes incapable of dealing with several bugs and requires immediate fixes, the following steps are involved in their resolution:

Step 1: Launch QuickBooks

Your direct action to update QB requires launching it on your computer by double-clicking its icon on the desktop or from All Programs.

Step 2: Investigate New Updates in QuickBooks

Next, you have to check for any new updates available, which you can do through the top “Help” menu, and then move forward with the option “Update QuickBooks Desktop“. When the most recent version successfully enters your system, through a wizard, it will let you know, “You are up to date!

In some other cases, after tapping the “Update Now” button, you will find the journey of the whole procedure appearing right in front of your eyes on the screen.

Step 3: Choose which updates to install

QuickBooks will show you a list of the updates and their descriptions, if any, which are available. You will go through them and choose those you want to install. However, experts recommend that you choose all the available updates so that you have the latest features and bug fixes.

Step 4: Click on “Get Updates”

Selecting the updates to be installed as per requirement then click on the “Get Updates” button. This command will prompt QB to download and install the updates. Wait time may be prolonged if your internet connection is slow or the size of the update is extensive.

Step 5: Restart QuickBooks

A prompt message will display stating that the installation has been successfully done and the update has been completed with no errors present. Click the “Close” button, then close the system and restart QuickBooks to implement the updates.

Step 6: Check for payroll tax table updates

Once your QB program is updated, you may turn your sight to payroll tax tables and their conditions. The payroll tax table updates will appear in the “Employees” menu at the top. One more step is involved, which includes clicking “Get Payroll Updates.”

Step 7: Download method selection

When the payroll updates appear on the screen, and you know you need the latest one for your payroll calculation, choose an appropriate download method for you in the “Get Payroll Updates” window. If you have an internet connection, choose “Download Entire Update” and click “Update” to begin our purpose.

Step 8: Let the update finish

QuickBooks will automatically download and install the newest payroll tax table update at its own pace, along with the most current tax rates, forms, and calculations to effectively process payroll on time.

Step 9: Verification – check if it was successfully updated.

Once the QuickBooks payroll tax table update is complete, you will receive a message that proves the payroll tax table update has been installed. Click “OK” to close this message.

Step 10: Test run

A payroll test run is recommended to make sure that the tax table updates and their calculations are working fine and the installation has been completed, not partial. A test can be made by creating a sample paycheck and reviewing all the deductions and withholdings to confirm their accuracy.

Troubleshooting Approach 3: Employ the Utilities from QuickBooks Tool Hub

QuickBooks Tool Hub has a set of utilities, such as Quick Fix My Program and QuickBooks Install Diagnostic Tool, that will help repair issues with the performance of the program, installation files, etc. The following set of detailed insights will help you scan through them:

Step 1: Proceed with downloading and installing the QuickBooks Tool Hub

The QuickBooks Tool Hub solution begins with insights into downloading and installing this utility. It involves visiting the official QuickBooks website and exploring the sections for “QuickBooks Tool Hub.”

When you find the latest tool hub installer package, download it, and respond to all the instructions that guide you to install it successfully on your computer.

Step 2: Discover the QuickBooks Tool Hub

Once the download and installation of the QB Tool Hub are complete, one proceeds to open it and put it to use. Thus, locate the tool hub icon or file in a place where you have saved it in your system and then double-click it to begin using it.

Step 3: Choose the correct tool

As the QuickBooks Tool Hub unfurls, you arrive at a place filled with a variety of tools to troubleshoot different kinds of problems. It would be worthwhile to investigate the path for a relevant tool to your problem. For example, if you’re facing installation issues, select the tab “Installation Issues”. Similarly, pick “Program Problems” when your application troubles you in its performance.

Step 4: Utilize the tool

As you work your way through the tabs that relate to your issues, you will notice options to Begin Scanning utilizing the tool. Installation problems have the QuickBooks Install Diagnostic Tool, while program issues have the Quick Fix My Program. Thus, select one and let all of those Wizards flash on the screen with which you should respond appropriately.

Step 5: View the results

After the completion of its analysis, it will display the outcome of the troubleshooting process. You might see step-by-step instructions to resolve the issue on your screen in the tool results window, or it might recommend further steps.

Step 6: Run Again or Other Tools as Needed

If these payroll errors continuously occur or the first tool does not fix the problem, you can try other tools that are available in the QuickBooks Tool Hub package. Choose any and run it in the same manner to get the desired results.

Why Do QuickBooks Payroll Most Common Errors Happen?

There can be numerous reasons for QuickBooks Payroll Most Common Errors. However, finding roots will also help to avoid the same mistake in the future. Some of the major reasons that happen due to which QuickBooks Payroll Most Common Errors are made are as follows:

- Software Bugs and Glitches: Sometimes, QuickBooks develops some technical issues or software bugs that may affect payroll calculation or payroll processing.

- Data Entry Errors: Probably one of the most frequent payroll mistakes made, this is often simple wrong information input at setup or during payroll entry, for instance, wrong pay rates, wrong tax information, and other bank details that result in expensive errors.

- Older Version of Software or Tax Tables: QuickBooks, regularly, updates its payroll tax tables since the rates change. Any lateness in any of those updates results in your payroll calculation on incorrect figures.

- Improper Configuration: Incorrect configuration regarding payroll settings, tax calculators, deductions, and benefit plans leads to employee pay discrepancies.

- Human Error: Payroll is complex, and even at that, expert users can sometimes miss some minute details. Mistakes do pop up in employee classification, setting up taxes, or setting up deductions.

Conclusion

QuickBooks Payroll is a great helper for any size of business, though it also can have some problems. However, QuickBooks Payroll Most Common Errors can be avoided or quickly fixed by having corresponding knowledge. By getting to know some of the most common issues with QuickBooks Payroll, including wrong tax calculations, misclassifying workers, syncing issues with accounting software, and failure to deposit money directly, you will be able to fix these issues with ease.

FAQ’s

How to fix QuickBooks payroll issues?

Resolving QuickBooks Payroll Issues

1. Regularly update your software for bug fixes.

2. Verify payroll settings for correct tax rates, employee information, and deductions.

3. Update the tax tables through QuickBooks to prevent errors in tax calculations.

4. Rebuild data files to fix corrupt systems.

5. Check and verify direct deposit and bank information to maintain smooth payments.

6. Payroll liabilities reconciliation must be regularly carried out.

What are the errors in payroll accounting?

Common Payroll Mistakes

1. Incorrect Tax Calculations – Tax tables have not been updated.

2. Misclassified Employees – Check the type of employees – employee vs. contractor.

3. Unreconciled Liabilities – Evaluate and regularly reconcile all payroll liabilities.

4. Wrong Pay Rates – Check employee pay rates.

What are the most common mistakes users make in QuickBooks, and how can they be avoided?

Common Mistakes Users Make in QuickBooks & Solutions

1. Not Updating Software – Keep QuickBooks updated.

2. Data Entry Errors – Recheck entries and utilize bank feeds.

3. Ignoring Reconciliation – Reconcile accounts periodically.

4. Not Backing Up – Backup your data on a regular basis.

What is the disadvantage of QuickBooks?

Disadvantages of QuickBooks

1. Not scalable for larger businesses.

2. Too complicated for non-accountants

3. It is much more expensive for higher functionality.

4. Difficulty with Customer Support.

5. Difficulty with third-party app integration.

What are the four types of errors in accounting?

Four Types of Accounting Errors

1. Transaction Errors – Incorrect amount or account.

2. Reconciliation Errors – Records don’t match.

3. Classification Errors – Incorrect classification of transactions.

4. Calculation Errors – Incorrect Math.

What are the most prevalent mistakes in accounting?

Most Prevalent Accounting Mistakes:

1. Poor recordkeeping

2. Cash Flow Mismanagement

3. Incorrect journal entries

4. The Bank account was not reconciled

5. Tax obligations ignored

You May Also Read-

Fix QuickBooks Error C=184 with Step-by-Step Troubleshoot

Troubleshoot guide to fix QuickBooks Error 6176

How to Fix QuickBooks Error 213 by Removing Duplicate Names

This Company File Needs to Be Updated QuickBooks- Quick Fixes

How to Resolve QuickBooks balance sheet out of balance Error?

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.