Do you use QuickBooks Payroll to manage your business? If you do, then you must be aware of various payroll liabilities, such as taxes and insurance premiums. However, in some cases, QuickBooks Desktop payroll liabilities not showing error can occur, and you will not see those liabilities in the Payroll Center. It can be a huge problem since these payroll liabilities help you fulfill tax obligations.

Additionally, since the payroll liabilities not showing up QuickBooks Desktop, you won’t be able to create accurate financial reports or audit your financial data. This can be a frustrating issue and significantly impact your business’s financial strategies. In this blog, we will delve into various troubleshooting procedures to get rid of the QuickBooks Desktop payroll liabilities not showing.

QuickBooks Payroll Liabilities Not Showing – A Quick View

Below is a concise summary of the information available in this blog regarding the payroll liabilities not showing in QB Desktop, as well as paying payroll liabilities in QuickBooks Online, in a tabulated format:

| QuickBooks Desktop payroll liabilities not showing | In some cases, you may not see payroll liabilities in the Payroll Center, which makes it impossible for you to create accurate financial reports or audit your financial data. |

| Its causes | Incorrect payroll items mapping, inactive payroll liability account, invalid date range in liability checks, outdated QuickBooks Desktop version, outdated payroll tax tables, improper categorization of QuickBooks payroll lists, antivirus and security software interfering with QB Desktop, and an unassigned payment schedule for a new payroll item. |

| Troubleshooting methods | Activate the payroll liability account, correct the date range on payroll liabilities checks, schedule payment frequency, update the QuickBooks payroll tax table, update the QB Desktop program, correct the mapping of payroll items, add exclusion for QuickBooks from the Firewall, use verify and rebuild utility to repair the data file, check the payment info and solutions sent by the agency, assign a deposit schedule for new payroll items, adjust the payroll liabilities, delete the tax payment, update QB company file, review QuickBooks payroll liability report, review payment made for payroll liabilities. |

| Tools used | Verify and Rebuild Utility |

Proven Solutions to Resolve the QuickBooks Desktop Payroll Liabilities Not Showing Problem

In order to resolve the QuickBooks payroll liabilities not showing, you can take assistance from the following methods for self-troubleshooting.

Method 1: Activate the Payroll Liability Account

For cases when payroll liabilities not showing in QuickBooks Desktop, it might be because your payroll liability account is inactive. Without an active account, you can not view payroll obligations. Therefore, take the following steps to activate your payroll liability account and view payroll tax data, such as federal income tax, social security tax, and more.

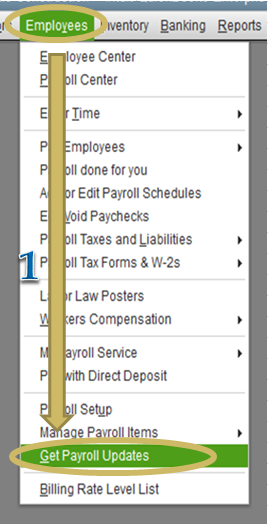

- Head to QB Desktop and locate the Lists menu.

- Click on Chart of Accounts and then find the names of relevant payroll liability accounts, like federal income tax and insurance contribution tax.

- Verify that the relevant payroll liability account is displayed as ‘Inactive‘ in the list.

- If it is, then click on Edit, tick the ‘Make Account Active’ checkbox, and hit Save.

Once this process is complete, QuickBooks Desktop payroll liabilities not showing should be resolved. If you are still unable to access payroll liabilities information for all your tasks, then move on to the following method for correcting the dates on payroll liabilities checks.

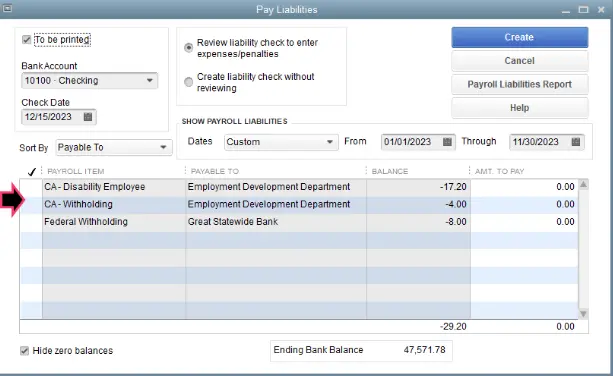

Method 2: Correct the Date on Payroll Liabilities Checks

Payroll liabilities not showing in QB Desktop occur when you accidentally enter an incorrect date range during payroll taxes submission. Follow the steps listed below to verify your date range on payroll liabilities in QuickBooks Online, and also how to correct them.

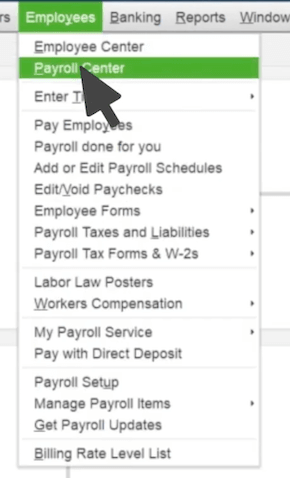

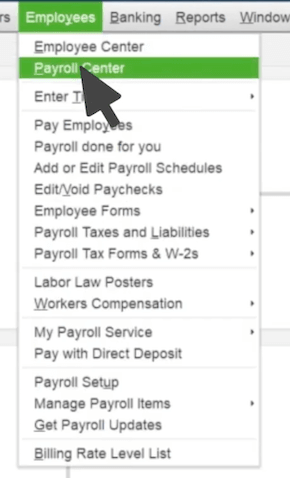

- Head to QuickBooks Desktop and open the Employees menu.

- Select the Payroll Center tab followed by the Transaction tab.

- Click on the Liability Checks option and choose Date.

- Now, locate This Calendar Year option from the dropdown menu.

- Verify the Paid Through Date and click Edit if the date range needs to be modified.

- Lastly, hit Save and try to access paying payroll liabilities in QB.

Do you continue to face the QuickBooks Desktop payroll liabilities not showing problem? Then, let’s move on to the next method for resolving it by scheduling payment frequency.

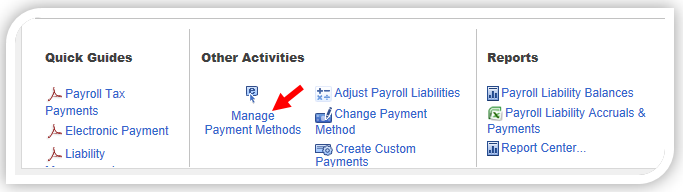

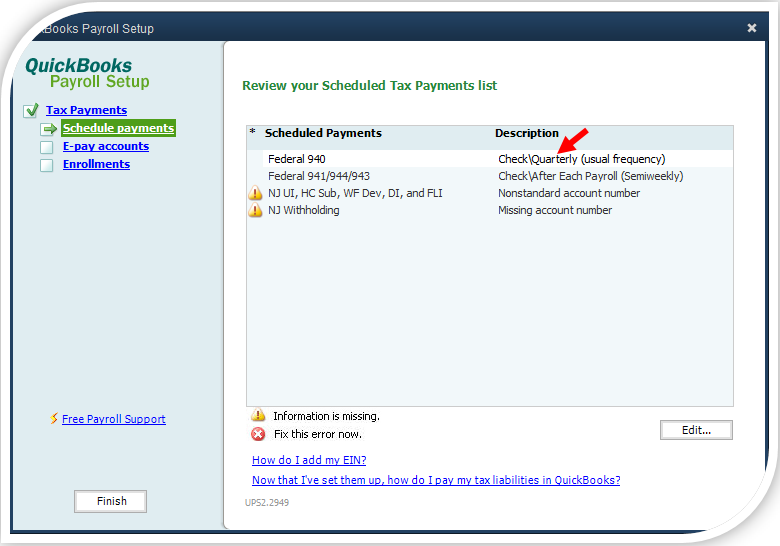

Method 3: Schedule Payment Frequency

If you did not schedule payment frequency for payroll taxes, then that could result in the problem of company payroll liabilities not showing up in QuickBooks. Let’s learn how to schedule payment frequency to prevent this error.

- Go to QB Desktop homescreen and click on the Employees menu.

- Expand the Payroll Center options and tap Manage Payment Methods.

- Then, select “Benefits & Other Payments,” and find “Schedule Payments” in the “Tax Payments.”

- Click on the Payroll Liability, then select Edit.

- Now, specify a frequency in the Payment (deposit) frequency.

- Once done, close the window by hitting Finish.

If you still face the QuickBooks Desktop payroll liabilities not showing after completing this method, then proceed to the next solution for updating QB payroll tax tables.

Method 4: Update QuickBooks Payroll Tax Table

If you have outdated payroll tax tables, then it can cause issues and lead to company payroll liabilities not showing up in QuickBooks. Follow the steps below to update your QB payroll tax tables.

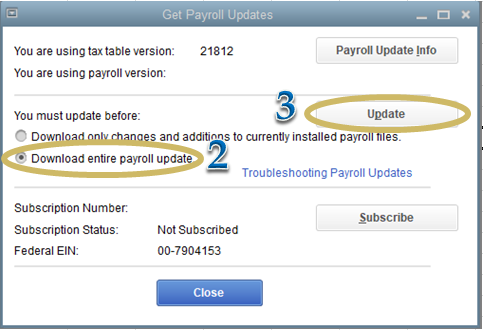

- Select the Employees menu on QB Desktop

- Tap on Get Payroll Updates

- Tick the Download Entire Update checkbox

- Now, select Update.

Alternatively, you can follow this guide to update the QB payroll tax table with a more detailed process and steps. If you still face QuickBooks payroll liabilities not showing, then follow the next process for updating QB Desktop.

Method 5: Update the QuickBooks Desktop

If you have an outdated version of QBDT, then it can often lead to common issues and problems like QuickBooks Desktop payroll liabilities not showing. Therefore, we advise you to update QB Desktop to the latest version by following the steps below.

- Visit the Intuit website and go to the “Downloads & Updates” section.

- Select the QuickBooks Product from the dropdown menu on the Product menu.

- In the Version menu, specify the model year and version of QuickBooks.

- Pick the “Get the latest updates” followed by “Save/Save File“.

- The download of the update files will start.

- Install the update now by following the instructions.

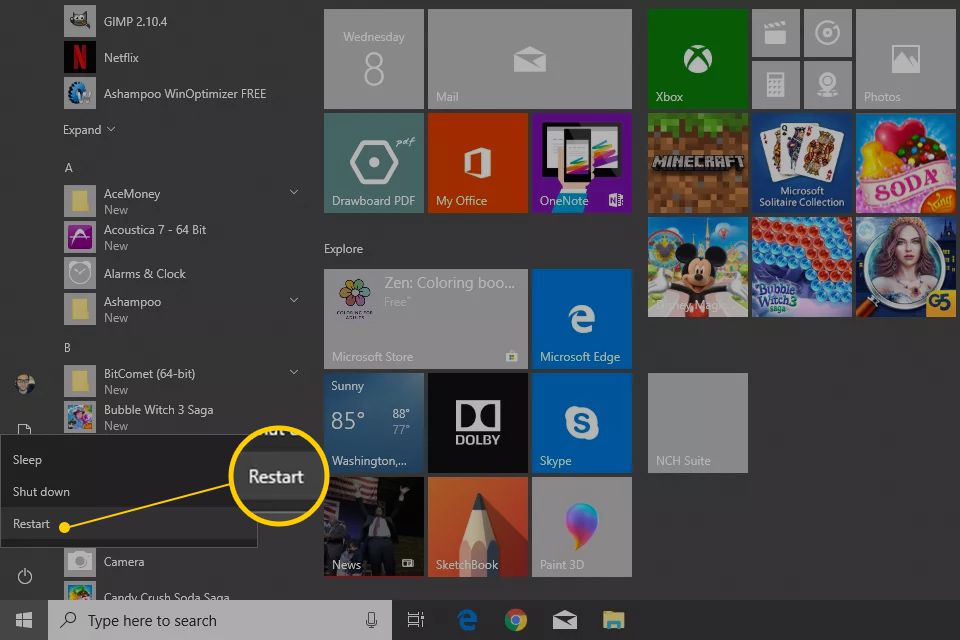

- After finishing, restart your computer.

The QB Desktop payroll liabilities not showing may be resolved after updating it to the latest version. Is your QuickBooks update stuck? Follow this guide to resolve the issue. If you are already up to date, then skip this method and correct the mapping of payroll items with the next process.

Method 6: Correct the Mapping of Payroll Items

Company payroll liabilities not showing up in QuickBooks could be a result of unmapped payroll items. Follow this process to check the mapping of payroll items to correct liability accounts.

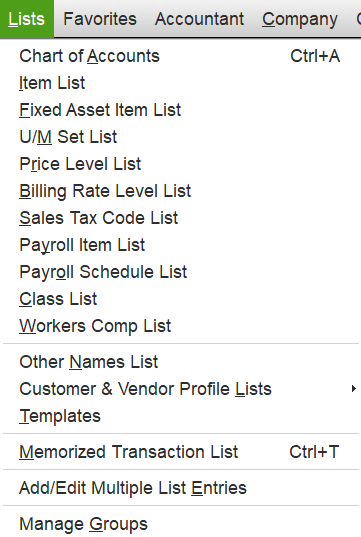

- Select the Lists menu after opening QB Desktop.

- Select the Payroll Item Lists tab.

- Now, pick the relevant payroll item icon from the list.

- Tap on the Edit Payroll Item tab by right-clicking the payroll item icon.

- After clicking Next, choose Accounts.

- You can modify the payroll liability account and verify correct mapping with the payroll items.

- Lastly, to save the modified settings, press Finish.

If the QuickBooks Desktop payroll liabilities not showing persists, then try the next solution to fix it by excluding QB from the Microsoft Firewall.

Method 7: Exclude QuickBooks from the Firewall

The Windows Firewall or antivirus softwares can often break the internet connection between QB Desktop and the Intuit server for security purposes and leads to QuickBooks payroll liabilities not showing issue. To resolve this issue, refer to the guide on setting up Firewall and Antivirus settings for QuickBooks Desktop to prevent disruptions or blockages.

Once you complete this step, check if the payroll liabilities not showing in QuickBooks Desktop still occur. If it does, then follow the next process for verifying and rebuilding the QB data file.

Method 8: Verify and Rebuild the Data File

If the child support not showing up in payroll liabilities in QuickBooks, then you may have a damaged data file. Don’t worry, you can use the Verify utility to confirm whether your data file is damaged or not. In case it is damaged, you can use the Rebuild utility to repair it easily. But remember to create a backup of your company file before you resort to using the rebuild utility for fixing the data file.

If the QuickBooks backup failed, then resolve it with the assistance of the referred guide. The Verify and Rebuild utilities are built-in tools on QB Desktop that you can use to diagnose and repair damage to your file seamlessly. Using these tools may require proper guidance; therefore, refer to this blog to verify and rebuild the company file in QuickBooks Desktop using simple steps to prevent QuickBooks Desktop payroll liabilities not showing.

Note: We advise you to re-run the verify utility and verify your data file again after you have rebuilt it so that there’s no additional damage.

If the QuickBooks payroll liabilities not showing issue persists, then try the following method for checking the payment info and solutions sent by the Agency.

Method 9: Check the Payment Info and Solutions Sent by the Agency

In some cases, a paycheck submission to make a payment may be rejected, and it provides a reason code in the Status column. When you remove uncleared payments rather than checking the reason code, it will lead to payroll liabilities disappearing from the Payroll Center. This may be the reason why payroll liabilities are not showing up QuickBooks Desktop. Therefore, follow this guide to resolve the reason code sent by the agency and fix the issue.

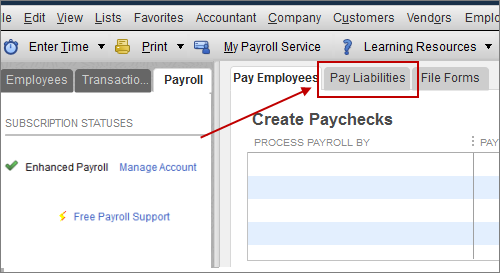

- Drop down the Employees menu and click on Payroll Center

- Then, open the Payroll Liabilities tab.

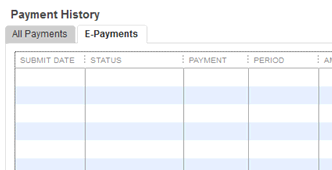

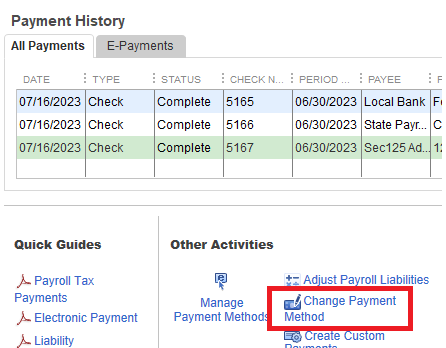

- Locate the E-Payments section under the Payment History section.

- In case the status won’t update, switch between the All Payments tab and the E-Payment tab repeatedly to refresh the list.

- If the Status column is labeled as Agency Rejected, then the agency has rejected the payment with a reason code and plausible solutions.

- Open the Agency Rejected link and tap on the E-Payment Rejected window.

- Now, verify the payment information and the problem and solution messages sent by the agency.

- Finally, hit the Void Rejected E-Payment option.

You may want to generate a printed liability check or resubmit the e-payment after you have verified the reasons. Please be sure to check the status after resubmitting the e-payment again.

Now, move back to the Payroll Center and check the payroll liabilities. If you still find QuickBooks Desktop payroll liabilities not showing, consider assigning a deposit schedule for the new payroll item by following the next procedure.

Method 10: Assign a Deposit Schedule for New Payroll Item

In some cases, you may be able to access Wage Garnishment for another previously set-up employee. However, the issue of child support not showing up in payroll liabilities in QuickBooks can occur when you add a new employee. If you have a deposit schedule that is yet to be assigned for the new payroll item then it may have caused this issue; therefore, assign a proper payment schedule by taking the following steps.

- Launch QuickBooks Desktop and navigate to the Payroll Center.

- Select the “Change Payment Method” option under the “Pay Liabilities” menu.

- Scroll down to “Benefits and Other Payments” and tap Continue.

- Click Edit after choosing the child support.

- Hit Finish after assigning the appropriate payment schedule.

Now, the QB payroll liabilities not showing should not occur, and there won’t be any issue for you in paying payroll liabilities in QuickBooks Online. If this is the case, you may need to adjust the payroll liabilities using the steps mentioned next.

Method 11: Adjust the Payroll Liabilities

To resolve the QuickBooks Desktop payroll liabilities not showing, you can try to adjust the payroll liabilities. With the help of the process below, liability adjustments can be made by you for the purpose of correcting your employee’s year-to-date (YTD) or quarter-to-date (QTD) payroll information.

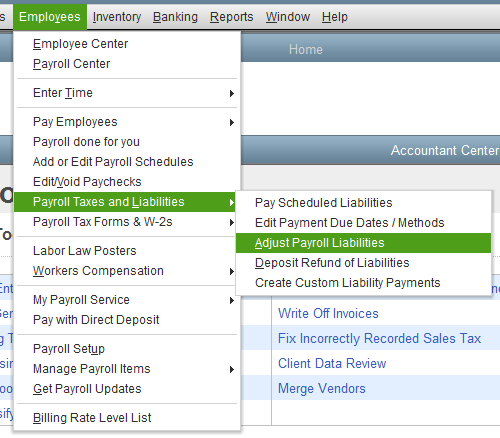

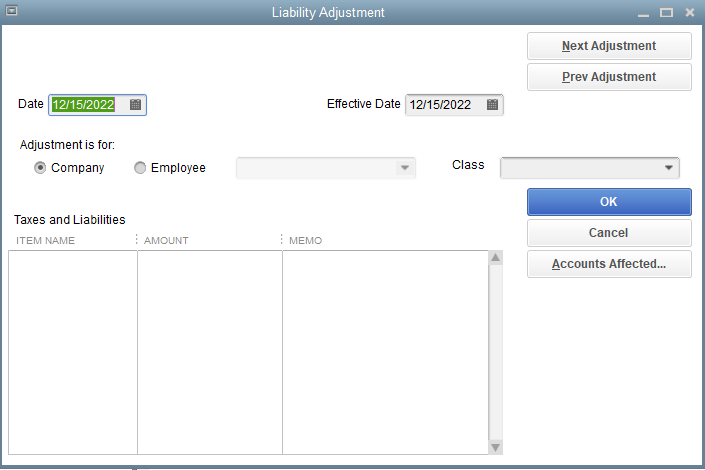

- Drop down the Employees menu, click on Payroll Taxes and Liabilities.

- Open Adjust Payroll Liabilities, and enter the necessary details.

- Then, select the employee from the dropdown

- Type in details in the Taxes and Liabilities section.

- Click OK after selecting the Accounts Affected option.

The payroll liabilities not showing up QuickBooks Desktop should be resolved after this. If the issue persists, then try deleting the tax payment through the next step.

Method 12: Delete the Tax Payment

E-Pay won’t process prior payments if you wish to use it for paying payroll liabilities in QB Online. Additionally, you will fail to access E-file forms for historical periods. You can also delete the previously recorded tax liability payments from Quarter 1 to Quarter 3 in 2019, which was for record-keeping purposes. Before you begin this step, be sure to note down specific details or back up your payroll data entirely to restore it later, in case of an issue. The QuickBooks Desktop payroll liabilities not showing will be resolved by this method for deleting the tax payment.

- Tap to open the Lists menu and choose Chart of Accounts (COA).

- In the COA window, click on the account for paying liabilities.

- Locate the transaction and select it.

- Then, choose Delete Bill/Pmt-Check or Delete Check.

- Now, head to the Payroll Liability tab for clearing tax payments.

- Select the Accounts Affected option, click Do not affect accounts to settle differences.

After you have completed this step, the payroll liabilities not showing in QuickBooks Desktop issue should no longer occur. If you still face the same issue while paying payroll liabilities in QB Online, then move to the next step for updating QuickBooks Company File.

Method 13: Update QuickBooks Company File

A damaged file can cause a number of errors and issues, such as the QB Desktop payroll liabilities not showing. To resolve this, update your company file on QuickBooks Enterprise by taking the following steps.

Preparing the Company File

Take the steps below on your version of QuickBooks and prepare your company file for updating.

- Head to QB Desktop and open the company file to update.

- Hit the F2 key on your keyboard to see the Product Information.

- Navigate to the File Information section and note down the path where the company file is saved.

Updating the Company File

After updating your company file to QuickBooks Desktop 2024 and Enterprise 24.0, you will need to reset passwords for all users who are not admins to a temporary password. After the non-admin users sign in to QB Enterprise, they will see a window to create a permanent password.

- Sign out of the company file and ensure that all users do as well.

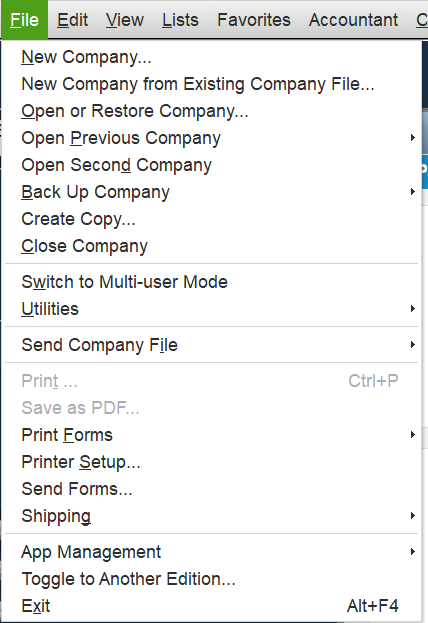

- Head to the latest QuickBooks Desktop version and open the File menu.

- There, click on Open or Restore Company, as shown below.

- Then, tap Open a company file followed by Next.

- Alternatively, you will have to choose Restore a backup copy, in case you have a backup company file (QBB) rather than a company file (QBW).

- Browse and select your company file, then click Open.

- If you are unable to find your company file, then press Windows key + E to open File Explorer, and search for your company file name or the .qbw file extension.

- Now, sign in to the company as the Windows Administrator.

- A backup will be created automatically by QuickBooks Enterprise of your existing company file. To save the backup file in a specific folder, click on Change this default location.

- After that, hit Update Now.

- Once the process is finished, hit Done.

Once you update the QB company file, common errors and issues should be resolved, and the QuickBooks Desktop payroll liabilities not showing should be gone as well. If not, then move on to reviewing the QuickBooks payroll liability report with the following resolution.

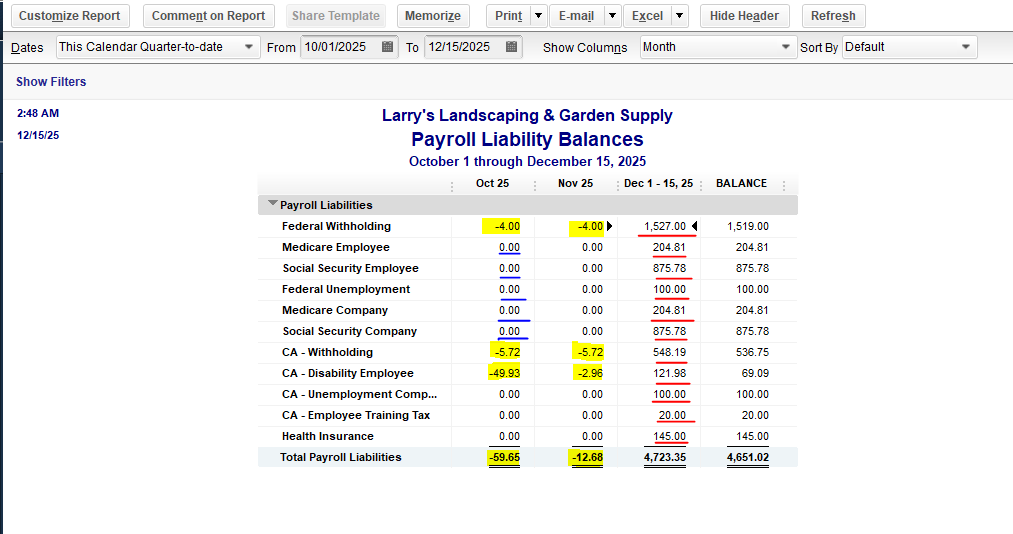

Method 14: Review QuickBooks Payroll Liability Report

If you have the QuickBooks payroll liabilities not showing issue, then check your payroll liability report to confirm whether you have unpaid liabilities in your company.

- Open the Reports menu and go to Employees & Payroll.

- Now, update the report date accordingly based on your liability schedule.

- To know whether you have a pending liability to pay on the report, check these:

- Positive numbers(highlighted) indicate a liability balance

- Negative numbers(underlined red) mean there is an overpayment

- Zero balance(underlined blue) is shown for paid liabilities.

- To see the liability history and payment details, click twice on the liability amount.

- In case of Overlapping Liability Payment(s), correct the dates for updating balances.

Alternatively, if you have already made an adjustment for a payment, the company payroll liabilities not showing up in QuickBooks issue can occur. Move to the next solution for verifying payments made.

Method 15: Review Payment Made for Payroll Liabilities

QuickBooks Desktop payroll liabilities not showing might occur because a payment or an adjustment has already been made under the Pay Liabilities tab. You can confirm this by following the method.

- Open QB Desktop and locate the Employees menu.

- Then, head to the Payroll Center and click on the Transactions tab.

- Check the Year-to-date Adjustments List, Liability Adjustments, or Liability checks.

- Filter out the payments that are dated this calendar year or the last calendar quarter.

- In case there aren’t any, then run the Payroll Liability Balances report.

- Change the date range and select ‘TOTAL balance’ to view details for each liability item.

- There must already be an adjustment and a liability check for each liability item.

We have discussed various procedures that you can perform to get rid of the payroll liabilities not showing up QuickBooks Desktop error; you can also refer to relevant guides for more assistance.

Reasons Behind the Payroll Liabilities Not Showing in QuickBooks Desktop

The following list outlines the key factors that may cause QuickBooks Desktop payroll liabilities not showing on your device.

- The payroll items to various liabilities accounts may have been mapped incorrectly, which is why payroll liabilities not showing up in QB.

- The payroll liability account may have been inactive; therefore, it was removed from the QuickBooks payroll processing system. Consequently, it won’t calculate liabilities for that specific tax or deduction by itself.

- The date range in liability checks may have been invalid, which prevented payroll tax liabilities from being correctly authenticated and categorized.

- You may have an outdated version of QuickBooks Desktop, which now has incompatibility with Windows.

- You might be managing payroll taxes and deductions by using outdated payroll tax tables, which can lead to several issues.

- If you had improper categorization of QuickBooks payroll lists, then that can also lead to QB payroll liabilities not showing.

- Antivirus and security software on your system might interfere with and prevent QB Desktop from operating normally.

- You may have included a new payroll item, but did not assign a payment schedule for it; hence, payroll liabilities not showing in QB Desktop.

Now, we have a clear understanding of what causes and triggers the company payroll liabilities not showing up in QuickBooks. Let’s review some of the known working methods that can help us easily troubleshoot it.

Bringing It All Together

In this comprehensive guide, we have discussed the QuickBooks Desktop payroll liabilities not showing problem in great detail. Additionally, the primary causes and methods for resolving this issue have also been listed. You can follow the procedures and instructions to prevent the payroll liabilities not showing in QB Desktop issue in the future.

Frequently Asked Questions (FAQ)

Why are my Payroll Liabilities not showing up QuickBooks?

There may be numerous reasons why QuickBooks Desktop payroll liabilities not showing, some of the primary causes of this problem are incorrect mapping of your payroll items, having an inactive payroll liability account, invalid date range in the liability checks, an outdated version of QuickBooks Desktop, or outdated payroll tax tables, improper categorization of QuickBooks payroll lists, or an unassigned payment schedule for a new payroll item.

How to fix payroll liabilities in QuickBooks?

Suppose you want to fix payroll liabilities in QuickBooks. In that case, you will need to make liability adjustments and correct your employees’ year-to-date (YTD) or quarter-to-date (QTD) payroll information with the following process:

1. Drop down the Employees menu and open Payroll Taxes and Liabilities.

2. Locate and select Adjust Payroll Liabilities and fill in the required details.

3. Choose the employee from the dropdown menu.

4. Enter the details in Taxes and Liabilities.

5. Click on the Accounts Affected option and hit OK.

What to Do if QuickBooks Payroll Liabilities are Not Showing Up?

You can take various steps to resolve the QuickBooks Desktop payroll liabilities not showing issue, such as activate your payroll liability account, correcting the date range on payroll liabilities checks, scheduling the payment frequency, updating the QuickBooks payroll tax table, properly mapping payroll items, review the payment info, reason code and solutions sent by the agency, adjust the payroll liabilities, delete the tax payment, review QuickBooks payroll liability report, and review payment made for payroll liabilities.

You May Also Read-

How to Fix a File that Cannot be Opened?

How to Make QuickBooks Antivirus Exclusions?

How to Fix QuickBooks Time Error Code 10000?

How to Resolve QuickBooks Migration Error 1009?

QuickBooks Migration Tool: Seamless Data Transfer Made Easy

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.