QuickBooks error 3180 is a 3000-series error that occurs during the financial exchange between QuickBooks Desktop and QuickBooks Point-of-Sales. If this has been leaving you stuck, then try this very useful guide on quick troubleshooting and smooth error-solving. QuickBooks is righteously popularized for meeting the accounting needs of businesses, but no software is impeccable. So, just like any other software, there are error possibilities, too. Examples include QuickBooks Error 3180. Different QuickBooks Status Code 3180 status messages read like a status message: “There was an error when saving a sales receipt (or credit memo).”

Error message: “Sales tax detail line must have a vendor.”

What are the types of QuickBooks Error 3180 and their Troubleshooting Methods?

The QuickBooks status message 3180 can occur with the following on a user’s computer, which causes the following issues: users can troubleshoot the problems with proper solutions and general troubleshooting guidelines explained here.

Status Code 3180: Getting issues with saving the General Journal Transaction

This may occur with the QuickBooks Status code 3180 when the users open the application from QuickBooks Desktop or QuickBooks Point of Sales. It presents itself as an error saying, “There was a problem with saving the General Journal Transaction.” The reasons might be because of the following:

- The appearance of damaged vouchers will reflect the error.

- The account mapped for items sold is incorrect.

- Items are linked to an inactive account.

- It will even trigger the error when an account is removed.

To get out of this error, you will need to reissue the voucher and then run the account check again. Please find below steps:

- You are supposed to reverse the voucher.

- Then, you need to recreate it correctly and then perform a financial exchange.e

- Go to ‘Home’ > Sales History to check the accounts

- Be observant, and make sure you write down all the items that are affected.

- Then, go to Home > Item List > Edit.

- Make sure that account mapping is done correctly using QuickBooks’ option.

- Moreover, make sure that affected accounts are also active.

- Then, click on the save button, and then run the financial exchange.

QuickBooks Error Message: The Posting Account is Invalid

You might face an error message such as “Status code 3180: QuickBooks error message: The Posting account is invalid”. This error message is displayed due to using the wrong type of QuickBooks desktop account within a QuickBooks POS account. Map the solution to the issue, which lies in a few maneuvering accounts within QuickBooks Desktop and POS. Follow these to make this done:

In QuickBooks Desktop Point of Sale

- In the ‘File’ menu, click on ‘Preferences.’

- Go to ‘Company’ and then to ‘Accounts’ in the ‘Financial’ category.

- Look for accounts in the ‘Basic’ and ‘Advanced’ tabs for proper mapping.

- Now, hit the ‘Save’ button and process the financial transaction.

In QuickBooks Desktop

- Select ‘Item List’ from the ‘List’ menu.

- You have to verify all those things on the list so that each one of the items is utilizing the right account.

- Then, run financial exchange.

Changing the name and recreating each financial method:

- If you open QuickBooks Desktop, go to the List Menu.

- Go to customer and vendor lists and hit the payment method button.

- Double-click the right-click, and the Cash payment method select and click for Edit the payment method.

- You now want to append the letter X to the payment method filed. This will bring it across to look (XCash). Click Okay.

- Further, right-click the Cash method again and click New.

- Keep its name to Cash and now run the financial exchange.

- Do all this for all payment methods so they get renamed and re-created.

Status message: Sales Tax Detail Line must have a Vendor

This might have appeared in your error log or warning box when saving the Sales Receipt (or Credit Memo) and was something to this effect: “QuickBooks error message: Sales tax detail line must have a vendor.” We now examine why it does happen.

- In case there are no vendor associates for a sales tax item.

- Incorrect account mapping for the sales tax payable account.

- If the sales tax payable account is chosen as one of the receipt items or more.

- If a paid-out is to be generated on the sales tax payable account.

To correct this error, go with the following steps to assign a vendor to the sales tax item:

- Go to the ‘Lists’ menu in the QuickBooks Desktop application.

- Select the ‘Item List’ option.

- Choose the ‘Include Inactive’ option and go to the ‘Type’ header.

- Ensure that a tax agency is attached to all sales tax items.

To correct the error, you have to follow these steps to assign a vendor to the sales tax item:

- Open your QuickBooks Desktop application and proceed to the ‘Lists’ menu.

- Click on the ‘Item List’ option.

- Select the ‘Include Inactive’ checkbox and then scroll down to the ‘Type’ header.

- Make sure that a tax agency is attached to all sales tax items.

Next, you want to make sure that the problem receipt is not paid out using sales tax payable.

- Select QuickBooks Point of Sale and open Sales History.

- Right-click any column and hit the option that says Customize Columns.

- You want to make sure you’ve selected the QB status.

- Now, look for incomplete receipts. If these receipts contain any paid outs to the sales tax payable account, then go to the chosen receipt and click Reverse receipt.

- You now have to generate the paid-out from a non-sales tax payable account and reconcile the financial exchange.

Status Code 3180: Status Message: There was an Error while Saving a Sales Receipt

When there is an issue concerning a damaged payment item or the wrong type of item when running an exchange of finance, users suffer from QuickBooks error 3180. In all such cases, the QuickBooks error can be handled by following some troubleshooting ways:

- Open your QuickBooks Desktop and go to the Lists menu.

- Select the Item List and click on the Include Inactive icon.

- Click on the Type header to alphabetize the list.

- Next, you will have to rename the Point of Sale payment items. The process to do it is as follows:

- Right-click on the payment item that contains the text “POS.”

- Select the Edit items option.

- You have to include OLD in the payment item. For example, OLD POS Visa Credit Card.

- Click OK to save the changes.

- Then, process the financial exchange from your Point of Sale.

Also, you must merge the items that have duplicates in the QB Desktop, as shown below:

- Right-click the payment where you added OLD and hit the option Edit item.

- Delete the text “OLD,” which was written earlier, and select OK.

- QB Desktop will flash a message asking you to merge the items.

- Select Yes to proceed with this action.

Status code 3180: …QuickBooks error message: A/P (or A/R) detail line must have vendor

This error usually happens to users who make use of QuickBooks Desktop accounts payable or accounts receivable to generate a paid out in QuickBooks Desktop Point of Sale. The appearance of this error signifies incorrect QB settings. Some error messages may look like these:

- There was an error when saving a General Journal transaction. QuickBooks error message: A/P detail line must have a vendor.

- There was an error when saving a General Journal transaction. QuickBooks error message: A/R detail line must have a vendor.

You can attempt to correct this issue by doing the following:

- Go to the QuickBooks Point of Sale home page.

- Here, select the section that reads Sales History.

- Select the most recent receipt, which would be labeled as Payout.

- Now, click Reverse from the ‘I Want to…’ drop-down.

- Finally, re-issue the paid-out using an account other than the accounts receivable or accounts payable.

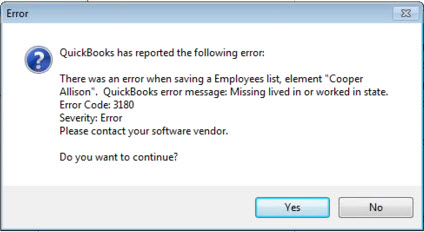

What is QuickBooks Error Code 3180?

QuickBooks POS Error Code 3180 is a series 3000 error. This kind of error is associated with financial exchange errors between the QuickBooks Desktop Point of Sales and QuickBooks Desktop applications. Sometimes, it may come up with various error messages.

“Sales tax detail line must have a vendor.”

Or,

“There was an error when saving an Employee list, element ‘Employee, Name’”

These messages can occur due to various causes and must be resolved through specific troubleshooting methods.

What are the Common Reasons that Trigger QuickBooks Error 3180?

Let us try to analyze why the error code 3180 occurs. An error occurs when saving data; a user can face this issue using QuickBooks. It can help solve the problem efficiently.

- The sales tax items in the QuickBooks Desktop may not have been attached to any of the vendors.

- Account mapping of the sales tax payable account can be wrong

- You might have generated a paid-out for the sales tax payable account

- Your sales tax payable account may have been targeted for more than one item on receipts.

- Your payment type might be wrongly entered or damaged.

- QuickBooks error saving employee lists can be caused by improper use of the QuickBooks Desktop account type when creating account mappings in QuickBooks POS.

- Antivirus apps running on the system can cause this problem to occur.

- This problem may be because a QuickBooks company file may have been damaged or corrupted.

- Incorrect, improper QuickBooks settings that concern the tax form, sales tax, etc., as below:

- Typically, company preferences display the use of the sales tax, but this round, company information hasn’t been correctly set up for use with a specific kind of tax form.

- The tax agency vendor isn’t set for a specific type.

- No type of tax is set up for accounts that are going to be interfaced.

- Improper QB installation is one of the reasons responsible for QuickBooks error-saving time tracking.

- This problem can also be brought about by faults in the Windows registry.

What are the Signs and symptoms of QuickBooks Error 3180?

When QuickBooks error 3180 inflicts in a system, the following things start happening to a user:

- Users get themselves in trouble by saving the sales receipts.

- Keyboard commands, along with the mouse click commands, are not being entertained at the proper time.

- Windows freezes up while all the active programs get affected

- QuickBooks crashes and will close automatically if QB POS also crashes.

- You will then see an error message with a specific message and description appearing on the screen.

Conclusion

We have explained the reason for the error along with all its methods of resolution in the given article. Discuss QuickBooks Error 3180 so that you can get rid of it easily by following the steps above if you get that error.

FAQ’s

What is error code 3180 in QuickBooks Desktop?

Error code 3180 by QuickBooks: “The Posting account is invalid.” Such an error appears because the account type used for the mapping with QuickBooks Desktop is of the wrong kind of QuickBooks Desktop account type. All that needs to be done is a bit of adjusting of accounts from QuickBooks Desktop and QuickBooks POS.

How do I fix QuickBooks error 3180?

Steps to troubleshoot QuickBooks error 3180:

1. Select Edit > Preferences > Sales Tax menu.

2. Click on the company preference tab.

3. Then, in the “Setup Sales Tax Items” menu, choose one item for “Most Common Sales Tax.”

4. Save the settings and attempt syncing again.

You May Also Read-

All About QuickBooks Desktop Cloud Hosting Services

Fix QuickBooks Error 6177 0 Using Proven Solutions

QuickBooks Error 1601: Installer is not accessible [Fixed]

QuickBooks Won’t Open Issue: 10 Easy Fixations

Fixing QuickBooks Update Service Pop Up Won’t Go Away Issue

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.