Direct Deposit is an essential QuickBooks Payroll feature that helps you transfer the payment straight into your employees’ and clients’ accounts. This eliminates the trouble of manually sending paychecks to each employee. However, you can run into the problem of QuickBooks Direct Deposit not working, which can cause a delay in your payment process.

In this blog, we’ll learn about this problem in detail and give you guided solutions so you can get rid of this error with no trouble. But let’s first see what actually causes this issue.

Fixing QuickBooks Direct Deposit Not Working – A Quick View

Presented below is a concise summary of this blog on the topic of QuickBooks Direct Deposit not working in a tabulated format:

| Description | QuickBooks Direct Deposit not working is a problem that users often face. This can render them unable to send paychecks, causing delays in payments and critical business operations. |

| Causes | You might have the wrong account or routing number, invalid employee or contractor details, an invalid bank account, insufficient balance, you might have submitted the paycheck after the given lead time, problems with your bank server, outdated QuickBooks Desktop applications, or outdated Payroll and tax tables. |

| Ways to fix it | Download and install the latest QB software updates, update your payroll and tax table, set up direct deposit the right way, change the direct deposit PIN, correct the accounting and routing number of your employees, and check the direct deposit lead time. |

Fixing the QuickBooks Send Direct Deposit Payments Not Working Issue

Mentioned below are some of the solutions proven to tackle the QuickBooks Payroll Direct Deposit not working problem. So go through them one at a time to eliminate issues specific to you.

Update Your QuickBooks Desktop Application

If you are using an outdated version of QB, it can be a significant factor contributing to the QuickBooks direct deposit not working issue. You should first update your QuickBooks application to the latest version in order to mend this error. This would eliminate any other bugs or problems you might be struggling with.

(Note: After May 31st, 2025, Intuit has discontinued the payroll service for the QuickBooks Desktop version 2022 and earlier, so make sure you have upgraded to version 2023 or later before you try to send paychecks through payroll.)

Download the Latest Payroll and Tax Table Updates

You should download the latest payroll and tax table updates to fix the QuickBooks Desktop Direct Deposit not working problem. Having an outdated tax table can give rise to various program issues and legal issues, as IRS and other tax agencies’ rules are ever-changing. If you’re still facing direct deposit issues, move on to the next solution.

Set Up Your Direct Deposit in QuickBooks Desktop and Online

You might not have activated your direct deposit for the QuickBooks platform you use. Enabling it is critical before trying to send paychecks to make sure you don’t encounter the QuickBooks Direct Deposit not working problem. To do so, first collect the following info:

- Business name

- Address and EIN

- Principal officer’s Social Security number and birth date

- Home address

- Online bank credentials

- Your company’s bank routing and account numbers

- Employees’ bank account information

After having this info in hand, proceed to connect your bank account with QuickBooks with the following steps:

For QuickBooks Online

To resolve QuickBooks Online Direct Deposit not working, connect your bank account with these steps:

- In the Connect your bank section, press Let’s go

- Now, choose Get started

- In the Business field, hit Edit

- Add info like the federal tax ID

- Press Next

- Add the following:

- Principal Officer name

- Address

- Date of birth

- Social Security Number

- Then, press Next and click on Add new bank account

- Search your bank name

- Enter your online banking user ID and password if asked

- If not, choose Enter bank info manually

- Enter your routing and account number

- Select Save and finally, press Accept and Submit

Note: You might be asked to enter a code sent to your phone for verification

For QuickBooks Desktop

You can connect your bank account in QB Desktop with the following steps:

- Open QuickBooks Desktop

- Sign in as an admin

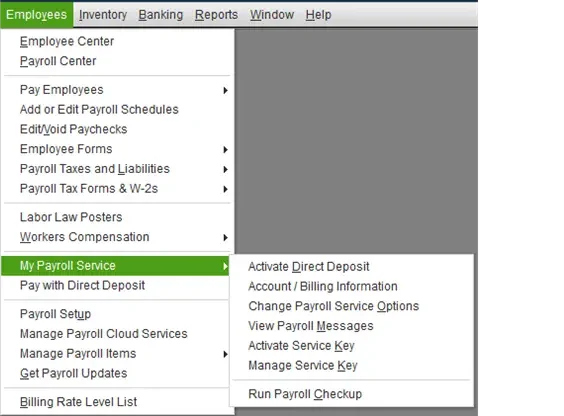

- Go to the Employees menu

- Click on My Payroll Service

- Then, press Activate Direct Deposit

- Click on Get Started

If Get Started is not visible, do the following:- Choose I’m the admin, and I’m the primary person who can…

- To continue, enter the admin’s email or user ID

- Press Continue

- Enter the email ID and password of your Intuit account

- Press Sign in

- Click the Get Started option

- Navigate to the Business tab

- Now, select Start

- Fill in the required info

- Click on Next

- Press Add new bank account

- Enter the name of your bank

- Type in:

- Either your online bank credentials

- Or your bank account and routing number

- Create a PIN

- The PIN will be used when you send payroll

- Confirm the PIN

- Press Submit

- Click on Next

- Choose Accept and Submit

- Confirm the Principal Officer’s complete Social Security number if asked, and hit Submit

- One of the two messages will pop up on your screen:

- Your bank account is connected – If you see this message, that means you are eligible to use direct deposit straight away. You can skip the verification section and proceed to the one below it.

- Thank you for signing up for QuickBooks Direct Deposit – If this message pops up, then that means you have to first verify your bank account with the next section.

To verify your bank account, QB will make a small test debit of less than $1.00. After the transaction has been debited, follow these steps:

- Open QBDT

- Sign in with your admin ID and password

- Navigate to the Employees tab

- Click on My Payroll Service

- Press Activate Direct Deposit and then, sign in with your Intuit account

- Enter the debit amount twice

- Click on Verify. Now, type in the payroll PIN you set up

- Tap on Submit and finally, hit OK

The last step in setting up direct deposit is connecting it with your employees. You can do so by implementing this:

For QuickBooks Online

- Have access to the direct deposit authorization form

- Go to the Filings section

- Then, press Employee Setup

- Now, in the Authorization for Direct Deposit field, click on Bank Verification

- Hit View

- Now, link direct deposit with your employee

- Choose your employee

- Click on Payment method

- Press Start or Edit

- Click on the Payment method dropdown menu

- Choose Direct Deposit

- Now, select a direct deposit method from the three options:

- Direct deposit to one account

- Direct deposit to two accounts

- Direct deposit with balance as a check

- Enter the routing and account numbers

- Finally, hit Save

For QuickBooks Desktop

- Get a cancelled check of the employee to acquire the routing and account numbers

- Now, connect direct deposit with the employee

- Open QBDT

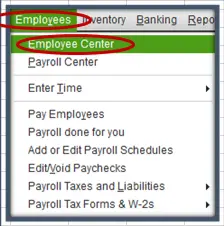

- Browse to the Employees menu

- Click on Employee Center

- Now, click the employee’s name

- Go to the Payroll Info tab

- Press Direct Deposit

- Then, click Use Direct Deposit for [employee’s name]

- Choose if the payment would arrive in:

- One account

- Two accounts

- Enter the following employee information

- Bank name

- Routing number

- Account number

- Account type

- Click OK to save

- Enter the direct deposit PIN when asked to

If you need to set up direct deposit for contractors to resolve the QuickBooks vendor direct deposit not working error, implement these steps:

For QuickBooks Online

- The first step is to add a new contractor

- Click on Add a contractor

- Then, press Bank account

- Enter the following info

- Account Number

- Account Type

- Routing Number

- Phone number of the account holder

- Full name of the account holder

- Finally, hit Save

If You Use QuickBooks Desktop Payroll Assisted

- Access the Vendor Center

- Select a vendor

- Double-click on their name

- Go to the Additional Info tab

- Click on the Direct Deposit button

- Enter your direct deposit PIN

- Hit Continue

- Follow the instructions you see on your screen

- You’ll get a Confirmation screen once it’s done

If You Use QuickBooks Desktop Payroll Basic, Standard, and Enhanced

- Click and open the Vendor Center

- Double-click on the vendor’s name

- Click on the Additional Info tab

- Press the Direct Deposit button

- Now, choose the Use Direct Deposit for: [Vendor Name] box

- Enter the bank info

- Now, click on Send confirmation direct deposits to [email address]

- QB will send the following info to you in the email two days prior to the payment deposit date into the contractor’s account:

- The name of your company

- Payment amount

- Date of the payment

- Last four digits of the contractor’s account number

- When asked, enter the direct deposit PIN

This would set up your direct deposit and eliminate the QuickBooks Direct Deposit not working problem.

Fix QuickBooks Direct Deposit PIN not working

If your direct deposit PIN is not correct, QuickBooks should tell you so. You can often see an error message like:

“Problem: The PIN you entered is not valid. Solution Re-enter your PIN. Your PIN must be between 8 and 12 characters and include at least one letter and one number. Make sure that Caps Lock and Num Lock is turned off and that you enter your PIN carefully. [Message Code 1001]”

This can lead to your QuickBooks Direct Deposit not working and give rise to various issues.

Therefore, it’s important to change the PIN, but before you do that, confirm the following things:

- Check if the PIN is correct, 8-12 characters long with at least one letter and one number, and no special characters

- If you entered the wrong PIN a lot of times, wait for a minimum of 15 minutes before trying again

If you verified the two fields given above and are still unable to send direct deposits because of the wrong PIN, it’s time to change it. You can do so with two methods:

Change the PIN in the Send Payroll Data Window

- Open QBDT

- Log in to your company file as an admin

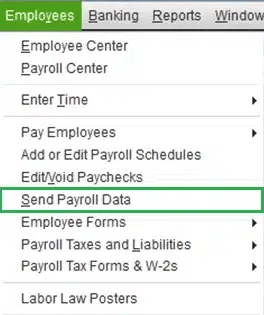

- Now, click on the Employees menu

- Select Send Payroll Data

- The Send/Receive Payroll Data window would open

- Press Send

- Click on Forgot your PIN? in the Payroll Service PIN window

- Enter the admin ID and password of your QB company file

- Click on OK

- Now, create a new PIN

- Confirm the PIN

- Finally, hit Submit

Use Payroll Account Maintenance Pages to Change the PIN

This requires your old PIN to work.

- For QuickBooks Desktop Payroll Basic, Standard, and Enhanced:

- Open QB and click on the Employees menu

- Select My Payroll Service

- Now, press Account/Billing Information

- Sign in to your Intuit account

- Click on Payroll Details

- Under Payroll Service PIN, press Update PIN

- Enter your old PIN

- Create a new one

- Confirm it

- Press Submit

- For QuickBooks Desktop Payroll Assisted

- Open the Employees menu

- Click on My Payroll Service

- Choose Billing/Bank Information

- Go to the Service Information section

- Click on Change next to My PIN

- Feed in your old PIN

- Now, make a new PIN

- Then, confirm the same

- Finally, hit Submit

This would fix the QuickBooks Direct Deposit not working problem due to PIN issues.

Wrong Accounting or Routing Number of the Employee

One of the reasons for QuickBooks direct deposit not working and your employee not receiving the paycheck is having the wrong account and routing number fed into the software. If that’s the case, you can be face-to-face with two scenarios here. Let’s learn how to deal with both of them.

Scenario 1. The Account is Live

You have to first request a direct deposit reversal. You can request the reversal if it meets the following criteria:

- It should be compliant with ACH or EFT laws that include duplicate or unintended payments

- The direct deposit was not rejected

- It should be done within 5 banking days before 12:00 PM PT of the paycheck date

- The bank account should exist in the employee’s profile

- The total amount deposited should be greater than $50, as the fee charged for reversal is $75

If you meet this criterion, you can submit a reversal request. The steps to do so are different for both the Desktop and Online versions of QuickBooks. So let’s fix the same in both.

For QuickBooks Online Payroll

- Select the Paycheck list

- Now, choose the paycheck you want to reverse

- Click on the Actions dropdown menu

- Select Reverse

- Now, click the Reversal reason dropdown menu

- Select the reason for the reversal of the direct deposit paycheck

For QuickBooks Desktop Payroll

- Open the Direct Deposit Reversal form

- Click on Add Request

- Enter the required info

- Enter the transaction info

- Click on Save

Following these steps would help you get the desired outcome of your direct deposit being reversed. Now let’s take a look at the second scenario.

Scenario 2. The Account Doesn’t Exist or is Closed

In this case, if you’ve confirmed that the deposit was rejected, void the paycheck in the QB platform you use.

Users of QuickBooks Online

- Select the Payroll menu

- Click on the Overview or Employees tab

- Now, press the Paycheck List

- Choose the paycheck you want to void

- Go to the Action column

- Click on the dropdown menu

- Press the Void Paycheck option

- Then, confirm and press Save

Users of QuickBooks Desktop

- Open QB and click on the Employees menu

- Press Edit/Void Paychecks

- Now, in the Show paychecks through/from section, change the date to the paycheck’s date you need to void

- Press the Tab key on your keyboard

- Select the check-in question

- Hit Void

- Enter Yes

- Again, click on Void

- Agree with the terms and conditions if prompted

This would eradicate the problem of QuickBooks Direct Deposit not working.

Verify the Lead Time of Your Direct Deposit

Different subscription tiers have different lead times for your direct deposit paycheck. The reason for your direct deposit not working in QuickBooks can be that you do not know the lead time of your paycheck. So, let’s list the lead and approval time for your direct deposit.

The Direct Deposit Lead Time

In the table below, the lead time for your direct deposit paychecks is given.

| QuickBooks Online Payroll Core | For this, you get a same-day or next-day lead time. However, in some cases, you can get a 5-day lead time. |

| QuickBooks Desktop Payroll Assisted | In this product, you have a 1-day (next-day) funding time. |

| QuickBooks Desktop Payroll Basic, Standard, and Enhanced | In this service, you get a 2-day funding time. |

Now, take a look at the approval time.

When to Approve or Submit the Payroll

The table below lists the deadlines you need to submit the payroll on. This is for different lead times for different QB platforms.

| Funding Time for Direct Deposit in QuickBooks | If the Payday Falls On | Then You Should Submit Your Payroll By |

| Same-day funding time | Wednesday Friday | Wednesday before 7:00 AM PT Friday before 7:00 AM PT |

| 1-day funding time | Wednesday Friday | Tuesday before 5:00 PM PT Thursday before 5:00 PM PT |

| 2-day funding time | Wednesday Friday | Monday before 5:00 PM PT Wednesday before 5:00 PM PT |

| 5-day funding time | Wednesday Friday | Wednesday (one week before) before 5:00 PM PT Friday (one week before) before 5:00 PM PT |

Ensure to comply with this table according to the service you use to patch the QuickBooks Direct Deposit not working problem.

Fix the Error: “Problem creating request file. We tried to…”

The error “Problem creating request file. We tried to send your payroll information, but the transmission failed” is a common problem that you can stumble upon and find QuickBooks Direct Deposit not working.

It renders you unable to send paychecks on time. To resolve it, you can follow these steps:

- Open QBDT and log in as an admin

- Now, click Switch to Single-user Mode from the File menu

- Then, go to the Employees menu

- Select Employee Center

- Click on the employee’s name

- The Employee Information screen would open

- Eliminate any special characters or double spaces

- Make sure that there are no blank employees in the list

- Click OK

- Now, send a zero payroll to verify the connection

Now, you’ll be able to send paychecks to your employees through direct deposit again.

Potential Reasons for QuickBooks Direct Deposit Not Working

Given below is a list of all the potential reasons for your direct deposit not working in QuickBooks:

- Having the wrong account or routing number

- Incomplete account details of an employee or contractor

- Your bank account might be invalid, not have sufficient funds, or be closed

- The paycheck was submitted after the cutoff time

- You might have entered the account for another employee

- An issue with your bank server can also cause this

- Your QuickBooks software is outdated

- Your QB Payroll and tax table are outdated

These are some of the reasons for your QuickBooks Direct Deposit not working. Now, let’s take a look at the methods to fix it.

Conclusion

In this blog, we talked about the QuickBooks Direct Deposit not working problem in great detail. Moreover, we provided you with a step-by-step guide you can use to get rid of this issue yourself.

FAQs

Why is my direct deposit not working in QuickBooks?

The reason for your QuickBooks Direct Deposit not working can be multiple, such as running an outdated QBDT software, having an inactive or outdated payroll, incorrect setup of direct deposit, wrong account or routing number, and many more. Read the blog above to know more and fix it.

How to enable direct deposit in QuickBooks?

To enable direct deposit for your employees in QuickBooks, first, you have to go to the Employees menu to access the Payroll Info tab situated within the Employee Center. Then, select the Direct Deposit button, and then click on Use Direct Deposit for [employee’s name]. Then just add the info, like the bank account and routing number, and hit OK.

What happens when QuickBooks Direct Deposit fails?

If you face the QuickBooks Direct Deposit not working problem and it fails, you receive the funds back into your account within a few banking days. After receiving the money, you should void the paychecks instead of deleting them.

The employee did not receive direct deposit in QuickBooks Online. What should I do?

If your employee did not receive the direct deposit in QuickBooks Online, then that means the account number you fed was incorrect. You can be dealing with two scenarios here: the account number being active, or the account number being invalid or closed. If the account is active, request a direct deposit reversal immediately within 5 banking days of the paycheck. If the account is inactive and the payment was rejected, void the paycheck in your records and update the employee’s banking info.

You May Also Read-

Easy Depositing Undeposited Funds in QuickBooks

QuickBooks Error 50004: Activate Direct Deposit with Ease

Recording a Deposit in QuickBooks Desktop and Online: Step by Step Guide

Fixing QuickBooks Update Service Pop Up Won’t Go Away Issue

No Option in QuickBooks Automatic Update Greyed Out [Fixed]

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.