With the aim of achieving perfect payroll runs without errors using QuickBooks, updating the tax tables is required with the most recently released updates. Where the QuickBooks Payroll Tax Table Update ensures accurate payroll tax filing for users with an active subscription to QB payroll, in this blog, We have mentioned all the relevant information that might be needed while downloading and installing updates related to QuickBooks Payroll Tax Table Update. Follow the complete blog to the end for detailed information.

Get the latest news and other updates related to payroll in QuickBooks Desktop.

Get information about the newest payroll update (22416) and earlier release updates. Overview QuickBooks Desktop Payroll supplies payroll updates to all QuickBooks Desktop Payroll subscribers. These updates contain the most recent and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and E-file and pay options. Get the latest QuickBooks payroll tax table update to see the steps for downloading and installing payroll updates. The latest Payroll Update is 22416, dated September 19, 2024.

What’s in Payroll Update 22416 (September 19, 2024)

Tax Table Update

Federal: No Federal updates

Arkansas: Revised withholding tables effective 1/1/2024. New withholding tables effective 1/1/2024.

Delaware: Delaware Paid Family & Medical Leave program, effective 01/01/2025.

District of Columbia: DC Paid Family Leave rate increased to 0.75% from 0.26% effective 07/01/2024.

Kansas: New withholding tables effective 7/1/2024.

Forms updates

There are no form updates in this Payroll Update.

E-file and e-pay update

There are no e-files or pay updates in this payroll update.

Find recent payroll updates.

To get the complete overview of the most recent payroll update, select your product year from the list below:

Or access this info from your QuickBooks Desktop company file:

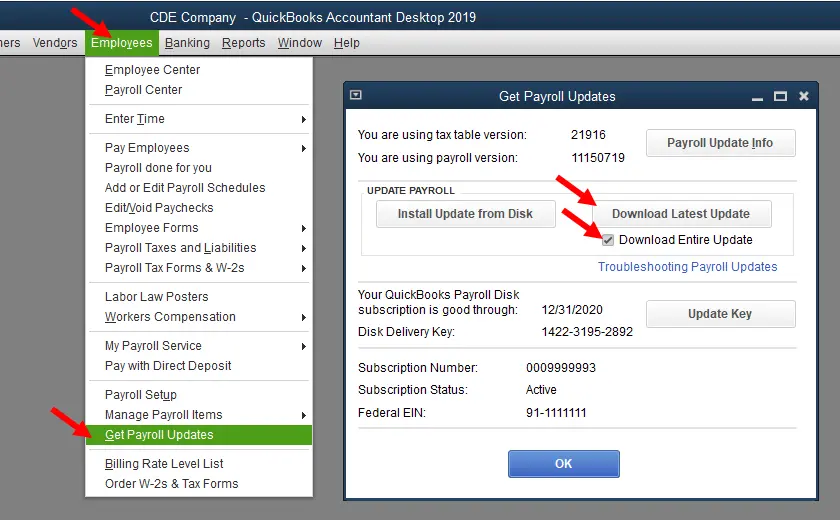

- Select Employees, then select Get Payroll Updates.

- Select Payroll Update Info.

Past Payroll Updates

| Payroll Update Number | Date Released |

|---|---|

| 22413 | 7/18/2024 |

| 22412 | 6/20/2024 |

| 22410 | 5/23/2024 |

| 22408 | 3/21/2024 |

| 22404 | 1/25/2024 |

How to Download the most recent Payroll Tax Table in QuickBooks

It is a good practice to refresh the tax tables in QuickBooks every time you pay employees. Intuit recommends you do this at least once every forty-five days. At this time, the tax table within QuickBooks does not refresh on its own. Follow the steps below to download the most recent Tax Table inside your QuickBooks software. An active payroll subscription is necessary – call our local QuickBooks trainer in your area if you have further questions.

- Select Employees, then Get Payroll Updates. If using the Simple Start in QuickBooks, select the icon labeled Payroll. Once you are in the Payroll Center, select Set up and Maintain/ Get Payroll Updates.

- Select the Download entire payroll update.

- Now click on Update

Once done downloading, it should give you the message that your payroll tax form updates have been installed or a new QuickBooks Payroll tax table update has been installed. Just click OK now.

QuickBooks payroll tax table update will provide the user with accurate and updated rates and calculations for the following:

- E-file options

- Supported provincial and federal tax tables

- Payroll tax forms

How do you find out the version of QuickBooks?

- Included in the new update are July 2018 payroll tax tables updated

- The current version is 108

- Release date is June 28, 2018

- The effective date is July 1, 2018, to December 31, 2018

The process to check the version of QuickBooks requires these steps from the user:

- Click on the ‘Employees menu’ in QuickBooks and then go on ‘My Payroll Services.

- After that, the user has to click on ‘Tax table information.’

- The first three numbers represent the tax table version in “You are using Tax table version.”

Note: The user must be QuickBooks 2018 QuickBooks Desktop 2018 or QuickBooks Desktop Enterprise Solution 18.0 to download the update for the tax table.

Check out the Current and historical TD1, CPP & EI amounts:

TD1 Amounts:

| Effective Date | Tax Table Version | Federal | AB | BC | MB | NB | NL | NT | NU | ON | PE | QC | SK | YT | ZZ (employees outside Canada) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 7/1/2018 | 108 | 11,809 | 18,915 | 10,412 | 9,382 | 10,043 | 9,247 | 14,492 | 13,325 | 10,354 | 9,160 | 15,012 | 16,065 | 11,809 | 0 |

| 1/1/2018 | 107 | 11,809 | 18,915 | 10,412 | 9,382 | 10,043 | 9,247 | 14,492 | 13,325 | 10,354 | 8,160 | 15,012 | 16,065 | 11,809 | 0 |

| 7/1/2017 | 106 | 11,635 | 18,690 | 10,208 | 9,271 | 9,895 | 8,978 | 14,278 | 13,128 | 10,171 | 8,320 | 11,635 | 16,065 | 11,635 | 0 |

| 1/1/2017 | 105 | 11,635 | 18,690 | 10,208 | 9,271 | 9,895 | 8,978 | 14,278 | 13,128 | 10,171 | 8,000 | 11,635 | 16,065 | 11,635 | 0 |

| 7/1/2016 | 104 | 11,474 | 18,451 | 10,027 | 9,134 | 9,758 | 8,802 | 14,081 | 12,947 | 10,011 | 8,292 | 11,550 | 15,843 | 11,474 | 0 |

| 1/1/2016 | 103 | 11,474 | 18,451 | 10,027 | 9,134 | 9,758 | 8,802 | 14,081 | 12,947 | 10,011 | 7,708 | 11,550 | 15,843 | 11,474 | 0 |

| 7/01/2015 | 101 | 11,327 | 18,214 | 9,938 | 9,134 | 9,633 | 8,767 | 13,900 | 12,781 | 9,863 | 7,708 | 11,425 | 15,639 | 11,327 | 0 |

| 1/1/2015 | 100 | 11,327 | 18,214 | 9,938 | 9,134 | 9,633 | 8,767 | 13,900 | 12,781 | 9,863 | 7,708 | 11,425 | 15,639 | 11,327 | 0 |

Canada Pension Plan (CPP)

| Effective Date | Tax Table Version |

|---|---|

| 7/1/2018 | 108 |

| 1/1/2018 | 107 |

| 7/1/2017 | 106 |

| 1/1/2017 | 105 |

| 7/1/2016 | 104 |

| 1/1/2016 | 103 |

| 7/01/2015 | 101 |

| 1/1/2015 | 100 |

Canada Pension Plan (CPP) – outside Québec

| Category | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|

| Maximum Pensionable Earnings | 55,900 | 55,900 | 55,300 | 54,900 |

| Basic Exemption | 3,500 | 3,500 | 3,500 | 3,500 |

| Contribution Rate | 4.95% | 4.95% | 4.95% | 4.95% |

| Maximum Contribution (EE) | 2,593.80 | 2,564.10 | 2,544.30 | 2,479.95 |

| Maximum Contribution (ER) | 2,593.80 | 2,564.10 | 2,544.30 | 2,479.95 |

EI amounts:

| Category | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|

| Maximum Insurable Earnings | 51,700 | 51,700 | 51,300 | 51,300 |

| Premium EI Rate (EE) | 1.66% | 1.66% | 1.63% | 1.63% |

| Premium EI Rate (ER) (1.4*EE) | 2.62% | 2.62% | 2.62% | 2.62% |

| Maximum Premium (EE) | 858.22 | 858.22 | 836.19 | 836.19 |

| Maximum Premium (ER) (1.4*EE) | 1,201.51 | 1,201.51 | 1,170.67 | 1,170.67 |

Québec Pension Plan (QPP)

| Category | Year 1 | Year 2 | Year 3 | Year 4 |

|---|---|---|---|---|

| Maximum Pensionable Earnings | 55,900 | 55,300 | 54,900 | 53,600 |

| Basic Exemption | 3,500 | 3,500 | 3,500 | 3,500 |

| Contribution Rate | 5.40% | 5.33% | 5.33% | 5.25% |

| Maximum Contribution (EE) | 2,829.60 | 2,797.20 | 2,737.05 | 2,630.25 |

| Maximum Contribution (ER) | 2,829.60 | 2,797.20 | 2,737.05 | 2,630.25 |

Employment Insurance (EI) – Québec only

| Category | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|

| Maximum Insurable Earnings | 51,700 | 51,300 | 50,800 | 49,500 |

| Premium EI Rate (EE) | 1.30% | 1.27% | 1.52% | 1.54% |

| Premium EI Rate (ER) (1.4*EE) | 1.820% | 1.778% | 2.13% | 2.16% |

| Maximum Premium (EE) | 672.10 | 651.51 | 772.16 | 762.30 |

| Maximum Premium (ER) (1.4*EE) | 940.94 | 912.11 | 1,081.02 | 1,067.22 |

Québec Parental Insurance Plan (QPIP)

| Maximum Insurable Earnings | 74,000 | 74,000 | 72,500 | 72,500 | 71,500 | 71,500 | 70,000 | 70,000 |

|---|---|---|---|---|---|---|---|---|

| Contribution Rate (EE) | 0.548% | 0.548% | 0.548% | 0.548% | 0.548% | 0.548% | 0.559% | 0.559% |

| Contribution Rate (ER) (1.4*EE) | 0.767% | 0.767% | 0.767% | 0.767% | 0.770% | 0.770% | 0.782% | 0.782% |

| Maximum Contribution (EE) | 405.52 | 405.52 | 397.30 | 397.30 | 391.82 | 391.82 | 391.30 | 391.30 |

| Maximum Contribution (ER) (1.4*EE) | 567.58 | 567.58 | 556.08 | 556.08 | 548.81 | 548.81 | 547.40 | 547.40 |

Commission des normes du travail (CNT)

| Maximum Earnings Subject to CNT | 74,000 | 74,000 | 72,500 | 72,500 | 71,500 | 71,500 | 70,000 | 70,000 |

|---|

Troubleshoot QuickBooks Payroll tax table update issues:

- If the TD1 amounts are not updated even after installing the latest QuickBooks Payroll tax table update, the user is required to do the following checks:

a) Confirm the tax table effective date, ‘whether it is on or after the date. - Once the user downloads the product update containing the new tax tables, he or she must begin with payroll or open and close QuickBooks Desktop to refresh the TD1 amounts.

- In case the user has ever updated the TD1 amounts manually for an employee, the new tax table will not override the previously adjusted amount.

- Employees set over the basic TD1 amounts? ‘Yes or ‘No’

- The reason is that QuickBooks Desktop will automatically update the TD1 amounts for only those employees with the basic amount for the prior tax tables.

The payroll tax table is now out of date, which is one of the most commonly encountered errors.

When the user accesses the payroll tax table on the computer, the user may be greeted by the pop-up that says the Payroll tax table is now out of date. Any of the calculations that the users do using this tax table will be either zero or will show as $0.00. There are some reasons behind this error, a few of them are listed below:

- The first reason could be that QuickBooks Desktop has not been updated to the latest payroll tax table release. If the user is accessing QuickBooks on a multi-user network environment, this error may occur.

- This might also be because all versions of QuickBooks present in the network might not have been upgraded to the latest tax table version.

Conclusion

We hope that this blog will help you to download the latest QuickBooks Payroll tax table update and gain better insight into it. You may handle the errors that you may stumble upon and many other related information after reading this blog.

FAQs

What is the latest payroll update for QuickBooks 2024?

The latest payroll update for QuickBooks Desktop is 22416, which was released on September 19, 2024. This update includes the most recent rates and calculations for federal and state tax tables, payroll tax forms, and e-file and pay options.

QuickBooks Desktop subscribers can receive payroll updates automatically or manually check for updates. To get the most recent features and security updates, users can accept the in-product update notifications that appear within QuickBooks Desktop.

You May Also Read-

Fixing QuickBooks Error 12007 due to Network Timeout

Fixing QuickBooks Error 12029 [Updated Solutions 2025]

How to Get Rid of QuickBooks Error 193: Updated Solutions

Fixing QuickBooks Error 1903: Updated Practical Solutions

Easy & Effective Solutions to Fix QuickBooks Error 15101

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.