A balance sheet is a financial statement that carries the assets and liabilities of your company. A miscalculation in the balance sheet makes it unbalanced. Due to this fact, it will make the decision-making process for your company hard, which may also affect your profitability. So, how do you correct an imbalanced balance sheet? Before discovering the answer, you must know why you have an imbalanced balance sheet. Several reasons are mentioned in this blog why you are facing QuickBooks balance sheet out of balance issues.

What is a balance sheet in QuickBooks?

Total assets and liabilities are listed on a balance sheet, a statement of business information. The balance of the asset side and liability side must match to avoid QuickBooks balance sheet out of balance Issue, which could stall your work in progress. This mistake involves comparing the totals of assets and liabilities. This mistake could have several causes, some of which will be covered later in this post. A balance sheet gives you a report of how your business is running. It shows you the business equity as the difference between assets and liabilities.

Assets – Liabilities = Equity

Solutions for solving problems related to unbalanced sheets of QuickBooks desktop

If you are facing issues related to the balance sheet, the method below will resolve your issue. “The transaction is not in balance” states the number of differences in your expenditures and products added overall compared to all. These are the amounts you entered in the Expenses section and the Items section of the transaction. Are they accurate and entered correctly?

Cross-check the numbers: After verifying the numbers, click the Recalculate button. This will automatically make QuickBooks Desktop recalculate the amount based on the new amount in the transaction.

Solution 1: Run the report on an accrual basis

First, use the accrual technique to run the report. If you haven’t run that on accrual already, first, you must run the report on an accrual basis.

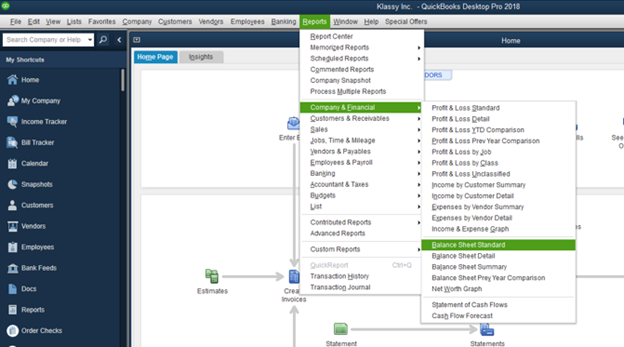

- Go to the Report menu, click on company and financial, then choose an overview of the balance sheet.

- Select “Customize Report.“

- Visit the display tab and choose accrual on a report basis.

- Press OK.

You must first rebuild your company file if it shows your accrual QuickBooks balance sheet out of balance. If the rebuild doesn’t fix the problem or is simply out of balance on a cash basis, move on to step 2.

Important: Determine if your balance sheet is out of balance using accrual alone or with accrual and cash. The stages that follow will use this information.

Solution 2: Determine when your balance sheet started to lose equilibrium.

Determine the date on which this report goes out of balance to identify the transactions or transactions that are the source of the issue.

- Reports>> Financials & Company>> Summary of the Balance Sheet.

- Select “Customize Report.”

- Select All from the Dates drop-down box on Display to access the Report Basis section. Select Accrual if your balance sheet’s accrual component is the only one out of balance. If not, go with Cash.

- Choose the Year under Display columns by dropping down in Columns.

- Press OK.

- Compare your total equity and liabilities to your total assets. Determine the point at which your balance sheet becomes unbalanced.

To get the precise date, use the same procedures after determining the year.

- Repeat steps 1 through 6. This time, choose Month from the Display columns by drop-down option.

- Once the month has been determined, repeat steps 1 through 6. Choose Week now.

- Finally, repeat the steps after you’ve located the week. Choose Day this time.

- Proceed to step 3 now that you know the date your report became unbalanced.

Solution 3: Search for those transactions that make your balance sheet out of balance in QuickBooks

Run a Custom Transaction Detail report for the selected date.

- From the Reports menu, select Custom Report, then Transaction Detail.

- In the Modify Report box, find the Report Date Range section. Enter the date the report was out of balance in the From and To fields.

- Go to the Report Basis section. If your sheet shows an out-of-balance accrual, choose Accrual. If not, choose Cash.

- Under the Columns section, uncheck Account, Split, Clr, and Class. Select Amount. The report will become readable. Select the column labeled “Paid Amount.”

- Press OK.

- The spent amount should equal the ending balance in the paid amount column. Look through the report to find the transactions that add up to this amount.

Solution 4: Redate the transactions in this step.

- You will alter the dates on the transactions once you identify the transaction or transactions that are the source of the issue. Take note of their current dates. Next, set each transaction’s date to 20 years in advance.

- Keep track of each transaction.

- If you found the proper transactions, update the report so that the Paid Amount column is zero.

- Determine which transactions you assigned a future date to. Return them to their initial date. Note: Your links are reestablished and perhaps fixed in this “re-dating” process.

If these things don’t work, move to the next step.

Solution 5: Enter transactions clearly and reinput

If updating the date on the transaction or transactions does not resolve the issue, you should clear and rekey them.

You must contact our experts if your QuickBooks balance sheet out of balance.

Read these steps to know when your balance sheet went out of balance

- First, you will need to open the Reports.

- Then you must choose Company and Financial.

- Now, you would go to the Balance Sheet Summary.

- You should just choose Customize Report and tap on the Display tab.

- You have to set the report basis to cash, then.

- After Date, Month, Week, and Day, modify the column when the balance sheet goes out of balance.

Reasons Why QuickBooks Balance Sheet out of Balance status

Data damage or lost data

If you are using QuickBooks, data damage is a possibility. Sudden discrepancies in reports could cause file damage. For instance, if you pull up a balance sheet for “all dates” while everything is balanced, “this fiscal year” will have an out-of-balance report, which will most likely be transaction damage. A way to fix this problem is by re-sorting the list and rebuilding the data.

Data can also be lost due to human errors. You can prevent this by confirming that you must perform an audit to obtain an accurate balance sheet. Auditing will also help discover changes made to the financial bookkeeping.

Wrong transaction entered

This is a human mistake, and all owners must consider that such mistakes are bound to happen. The entries may be wrong in numbers or forgetting the entry, entering only one of the two sides, the debit or credit side, among many others. To correct such flaws, you have to crosscheck your financial records and train your employees to avoid such mistakes.

Dealing in different currencies

If you trade with other countries, it would be in other currencies. In this case, you can’t maintain a single book for all the transactions. Fluctuations in the exchange rates would make determining which should go into the books challenging. Therefore, if you enter the wrong rates, you might have a QuickBooks balance sheet out of balance.

Change in inventory

This variation in the inventory affects the cash flow statement because you need to reduce the inventory from the last month to one from the current month. Then, you need to deduct that amount from your cash balance. The computation of the amount is a little tricky and can cause problems with your balance sheet. Therefore, consulting with experts or accountants will keep you away from mistakes that may harm your business in terms of equity.

Equity Calculations

Then, the total worth should be cross-checked with the owner’s equity. As assets increase in value, so does equity and vice versa. Your balance sheet will not work out if equity does not show this representation of the difference between assets and liabilities. Hence, your tallying error might be due to arithmetical errors made in equity.

Misclassification of transaction

Your general ledger might contain incorrectly classified transactions. For example, the transfer from a connected account might be considered income or expense, while it should be classified only as the movement of funds-liability or assets. Incorrect classification of transactions may result in a QuickBooks balance sheet out of balance. Income deposited to a liability account may be recorded incorrectly, affecting both the balance sheet and income statement.

Unrecorded fees or adjustments

Some payment platforms, like Stripe or PayPal, charge fees not accounted for in your QuickBooks balance sheet, which may lead to an imbalance in your system. If the fees are not accounted for correctly in your system as expenses or deductions, your system will have an inflated balance. Thus, this will result in the QuickBooks balance sheet out of balance.

Different ways to review an Unbalanced Balance Sheet

Assets and liabilities on a balance sheet report for your business must balance out all categories to zero. This specifies the balance between equity, assets, and liabilities should not be more than zero. If it crosses zero, our balance sheet report is imbalanced and has an error. Thus, knowing where to look will help you point out the mistake and correct it so you can generate correct reports.

Accounting Equation

Accounts on the balance sheet are those whose account numbers are not directly related to income and expense numbers. The asset balance sheet categories are comprised of asset accounts, including cash, accounts receivable, and prepaid contracts. The liability balance sheet category comprises liability accounts such as accounts payable and equity accounts. In Accounting Coach it writes that an accurate trial balance is constructed using proper classifications and knowing which accounts appear on the balance sheet.

Trial Balance

The Trial Balance Report can start with viewing balances in one place for all of your accounts. The trial balance report lists all ledger accounts with a balance for the reporting period. You only view accounts with a balance for the reporting period, saving time and not creating confusion regarding zero-balance accounts. Review the trial balance report’s account balances. Be sure to put a note on a piece of paper or highlight which accounts are off on your list as you search so when you go through those accounts to see if that’s the problem in them.

You can reorder, re-date, and re-enter any account entries if you believe incorrect balances are due to errors in your accounting software. Accounting software such as QuickBooks includes a feature to help correct any balancers.

Check Ledger Activity

Check the ledger activities to pinpoint why you have an imbalanced balance sheet. If there are accounts on which you have a question regarding the balance, enter each ledger account independently. Check the list of transactions for the period and mark any that appear typical. Verify all inappropriate transaction entries posted to a balance sheet account. To adjust the balance, reclassify any erroneous transactions with a general journal entry.

Journal Entries

One of the journal entries that was not done correctly will cause the balance sheet to have errors. Walk through each journal entry you made in accounts you are unsure about. Check to make sure that you entered the proper amounts. Verify that it is posted and to the correct period with the paper support for the journal entry. Review details in the journal ledger to ensure that your posting is accurate, with no system problems, so you don’t accidentally post your journal entries twice, which will leave some of your accounts unbalanced.

Equity Computations

Review the data reported in the Owner’s or Stockholder’s Equity if you have a sole proprietorship. The equity class explains the difference between assets and liabilities. This is one good sign since assets are more significant than liabilities. That means your business has equity. Equity rises in proportion to assets. Equity also declines when assets or liabilities rise or fall. If the result of this equity calculation is not equal to the gap between your assets and liabilities, your balance sheet will not be in balance.

First, Try them out if you are suffering from QuickBooks balance sheet out of balance:

You can perform these quick solutions to solve your “QuickBooks balance sheet out of balance” issue:

The screen is lagging, reload the report: Log out and return to your balance sheet report and QuickBooks file. Good news! If it balances again, you are not out of balance.

Periodically repeat out-of-kilter reports on the Balance Sheet: Modify the system’s default date. For example, replace “This Fiscal year-to-date” with “All” in the “Year” column. Please memorize and execute this report using the memorized report, changing the date range if this balances the report. Please click the “subscribe now” or “communication” button.

The company’s data file has been damaged. If none of the above solutions could restore equilibrium to the balance sheet report in QuickBook, use this article to troubleshoot data damage. You can fix an out-of-balance balance sheet using the accrual method or an unbalanced balance sheet.

Conclusion

In summary, a QuickBooks balance sheet out of balance can result from data damage, transaction errors, currency variation, changes in inventory, and wrong equity calculation. However, the good news is that there are many ways to rectify such imbalances or errors, such as changing settings on a report, rebuilding data, or going through transactions carefully. If these steps fail, then the transactions in question must be entered back, or consulting experts from QuickBooks are required. Such strategies will help restore balance to your reports and ensure accurate business decisions.

FAQs

How to run a balance sheet in QuickBooks?

Go to Reports.

Business overview.

Balance Sheet.

This is the date range of the report:

Select Run report.

How do you print balance sheets in QuickBooks?

Follow the steps for answering the above question ( How to run a balance sheet in QuickBooks ). Now, you will see the balance sheet report; you can preview it and export it as a PDF.

How do I make sure my balance sheet is in balance?

Balance sheet information is always in the form of the following equation: assets = liabilities + equity. A balance sheet should always be balanced. Assets must be equal to the sum of liabilities, and equity must be equal to the difference between assets and liabilities.

How does a balance sheet report differ from other reports?

Your Balance Sheet report, while the same filters are applied to other reports, will probably not tally. This is because:

Your Balance Sheet report is a summarized report with a roll-forward of a beginning balance.

According to other reports, you simply select a date range that will apply to the date range for the net income in that particular account you selected within the report.

Why does my QuickBooks balance not match my bank balance?

The relationship between QuickBooks Online and your bank is a live picture. This means that your bank balance and the balance in QuickBooks Online will only match if you do not have any outstanding checks. Take your QuickBooks online balance as balance in your checkbook.

Why is the balance sheet essential in QuickBooks?

A balance sheet is a financial statement report that keeps information about the liabilities and assets of your company.

It helps make your company’s decision-making process hard, affecting your profitability.

A balance sheet report explains how your business runs and shows business equity as the difference between assets and liabilities.

You May Also Read-

QuickBooks Error 557 Eliminated Using Best Techniques

Methods to Rectify the QuickBooks Not Loading Problem

How to Resolve Delivery Server Down in QuickBooks Issue Easily

QuickBooks Error 6175 – Quick & Easy Troubleshooting Methods

A step-by-step easy Guide to Fix QuickBooks Error H505

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.