QuickBooks error 22304 is a common update error that can arise while installing payroll updates. This error can be caused by an outdated QuickBooks or an inactive payroll subscription, among other reasons. Various solutions, like updating QuickBooks and repairing the program, can help fix this error.

To learn more about the reasons behind this update issue and solutions to instantly fix it, keep reading this detailed blog.

Quick Solutions to Address QuickBooks Payroll Error 22304

You need to resolve this update error on time; otherwise, you won’t be able to install the payroll updates, which you will need to process payroll. Thus, once you are aware of the reasons behind the error, follow the effective solutions given below to address it –

Solution 1 – Download QB and Tax Table Updates as an Admin

Issues while installing payroll updates can occur if QuickBooks Desktop is not updated to the latest release. Thus, update QuickBooks with admin privileges and then try downloading the tax table updates in the following manner –

Step 1 – Log in to QBDT as an Admin

Firstly, run QuickBooks Desktop as an admin user by going through the following steps –

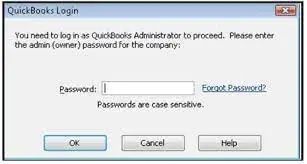

- Close your company files and exit QB, right-click the QuickBooks Desktop icon, and click Run as Administrator.

- When you get the “Do you want to allow this program to make changes to your computer?” message on your screen, click Yes to continue.

- Lastly, enter your admin credentials to log in to QuickBooks as an admin user.

Once done, move to step 2 and download the recent QB updates.

Step 2 – Download the Latest QBDT Updates

To download the latest QuickBooks Desktop updates, implement the following steps –

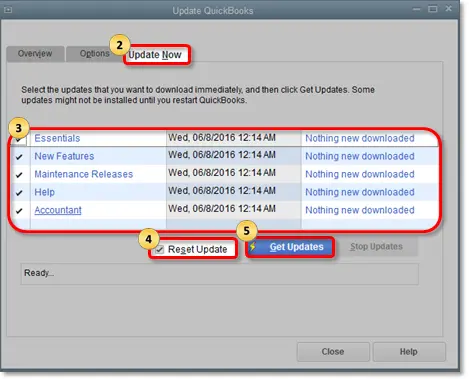

- Open the Help tab in QuickBooks, select Update QuickBooks Desktop, and click the Update Now option.

- Further, mark the Reset Update checkbox, select Get Updates, and wait for the download to complete.

- Once the QBDT updates are downloaded, reopen QuickBooks and click Install Now to install the updates.

Now, restart your PC and move to the next step to update the payroll tax tables.

Step 3 – Download the Tax Table Updates

The last step is to download QB tax table updates –

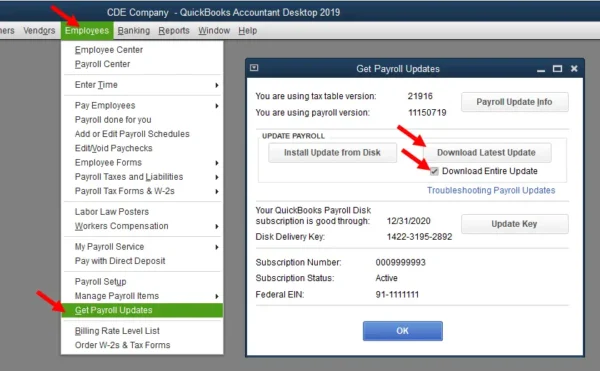

- Launch QuickBooks, navigate to the Employees menu, and select Get Payroll Updates.

- Now, click Download Entire Update, then choose Update, and once the process ends, wait for the informational window confirming the same.

Now, you will have the updated QB and payroll version on your PC. However, if you are still unable to install the payroll updates, move to the next solution to fix QuickBooks error 22304.

Solution 2 – Use the Verify and Rebuild Data Utility

A damaged or corrupted company file can cause problems while installing the payroll updates in QB. To address these data integrity issues, you can run the Verify and Rebuild Data utility in the following manner –

Step 1 – Use the QuickBooks Verify Data Tool

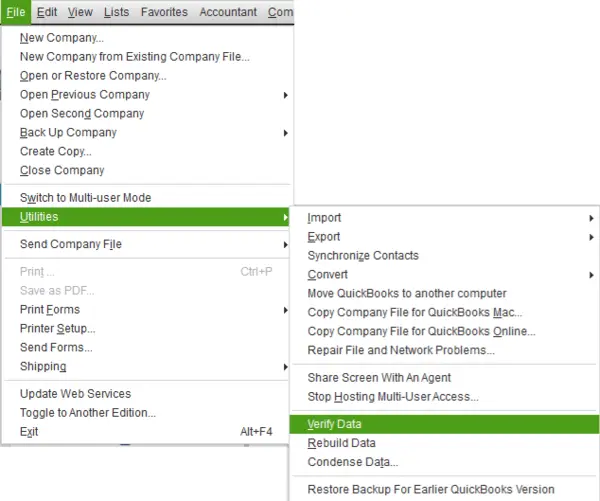

To verify the company file and identify the data integrity issues, use the Verify Data tool by following these steps –

- Go to the Window tab in QuickBooks, select Close All, then go to the File menu in QuickBooks.

- Further, click Utilities, select Verify Data, and take the following actions based on the results –

- If the Verify Data tool detects no problems with your data, it confirms integrity, and you don’t need to proceed further.

- If an error message appears, search for it on our website and learn about the solutions to fix it.

- If you encounter the “company data has lost integrity” message, the company file is damaged. To resolve the issue, rebuild the file using the QB Rebuild Data tool.

After running the Verify Data tool, follow step 2 and use the Rebuild Data tool to fix the identified data issues.

Step 2 – Run the Rebuild Data Tool

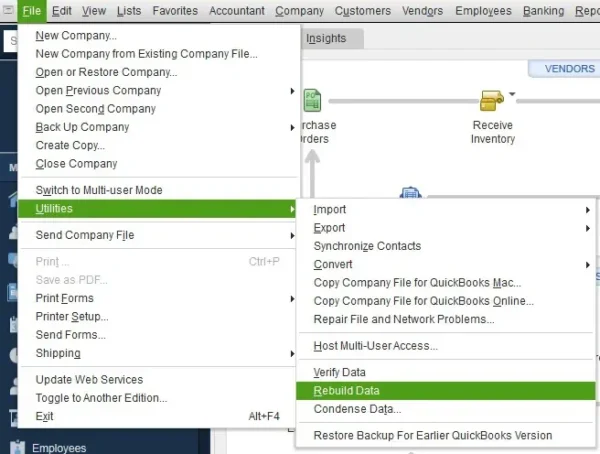

The Rebuild Data tool can fix the data integrity issues identified above in the following manner –

- Open QuickBooks Desktop, go to the File menu, and select Utilities.

- Next, click Rebuild Data, and when QB asks to create a company file backup, hit OK to create a backup.

- Select a location to save the backup file, hit OK, and ensure not to replace another backup file in the process. Then, enter a new name in the File Name field and click Save to save the file backup.

- Further, when the “Rebuild has completed” message appears, click OK and go back to the File menu.

- Click the Utilities tab, then select Verify Data to check for additional data damage, and undertake the following actions –

- If the Verify Data tool finds more data damage, manually resolve the identified issues by searching for the error(s) in the qbwin.log file and looking for troubleshooting solutions on our website.

- If no errors or issues are identified, restore the company file backup by going to the File menu and clicking Open or Restore Company.

Note: When creating the company file backup, do not replace your existing company file. This is because you’ll need to re-enter information after the company file backup is made.

After running the Verify/Rebuild Data tool, reopen QuickBooks and try to install the payroll updates again. If you still encounter the QuickBooks error message 22304, move to the next solution.

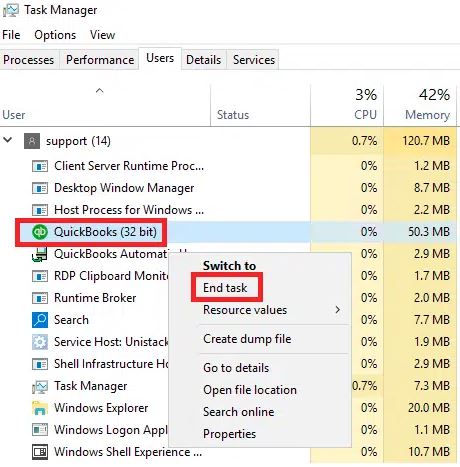

Solution 3 – Terminate QB Processes

Terminating the background processes used by QuickBooks can help fix the update problems. To end these QB processes, follow the steps provided below –

- Exit QuickBooks, then right-click on the taskbar and select Task Manager.

- Next, go to the Details tab and click End Task for the following QB background processes –

- QBW32.exe or QBW.exe

- QBCFMonitorService.exe

- qbupdate.exe

- QBDBMgr.exe or QBDBMgrN.exe

- QBMapi32.exe

- Once done, right-click on the QB Desktop icon, select Run as Admin, and download the updates again.

Now, check if you can install the payroll updates in QuickBooks. However, if QuickBooks payroll update error 22304 persists, move to the next solution.

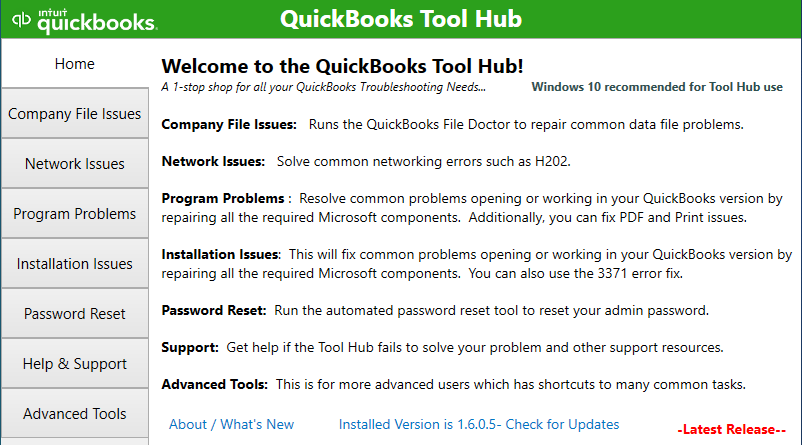

Solution 4 – Repair QB Desktop

If your QB Desktop program is damaged or improperly installed, you will face issues installing the latest updates. Thus, you need to repair QuickBooks using QuickBooks Tool Hub in the following manner –

First and foremost, download and install QuickBooks Tool Hub so that you can run the relevant tools to fix QuickBooks Error 22304. Secondly, open QB Tool Hub and run the Quick Fix My Program tool. If the Quick Fix My Program tool doesn’t help repair the error, run the QuickBooks Program Diagnostic Tool. If nothing works, run the QuickBooks Install Diagnostic Tool.

Now, check if you can update QB and install the payroll updates successfully. If not, move to the next solution to fix the 22304 error in QuickBooks.

Solution 5 – Reinstall QB Desktop

Installation problems in your current QBDT version can lead to errors while updating the payroll. To resolve the installation problems, install a fresh version by performing the reinstallation process given below –

Note: For a seamless reinstallation, make sure the system requirements are met and that you have your license number and product details handy.

- Firstly, go to the Windows Start menu and click the “Programs or Features” or “Uninstall a Program option to open the program list.

- Now, select your QuickBooks Desktop version from the list, then choose Uninstall/ Change, Remove, and click Next to continue with the uninstallation.

Note: If you can’t find the “uninstall/change, remove” option, log into Windows again as an admin user, then try to uninstall QB.

Once QB Desktop is uninstalled, move to the next step and reinstall it.

Step 2 – Install QuickBooks Desktop

The next step is to install QuickBooks on your PC. While reinstalling, QBDT will automatically create new folders and rename the old ones. You can implement the following steps to proceed with the QuickBooks reinstallation process –

- Go to CAMPs or open the download site to download your QBDT version, then save the downloaded file to an easily accessible location.

- Open the downloaded setup file, then follow the on-screen instructions and accept the software license agreement to install.

- Further, click Next, then enter the product and license numbers, and select Next again.

- Ensure an active internet connection before proceeding, then choose the Installation Type.

- Now, select Express as the Installation Type, then click Next and choose Install.

- Once the installation process ends, launch QuickBooks and continue with the activation process.

- Next, move to the Help menu and click the Activate QuickBooks Desktop option.

- Lastly, follow the on-screen prompts to verify your information and complete the QBDT activation process.

Once QuickBooks is successfully reinstalled, launch it and run the QB and payroll updates again. However, if you still face QuickBooks payroll error 22304 while installing the updates, move to the next solution.

Solution 6 – Review the Internet Connection Settings

Your internet connection can be the source of the payroll update issues in QB. To test your internet connection, open your web browser and visit a safe site. If you cannot open the page, contact your internet service provider for assistance. On the other hand, if you can access the site, follow the steps given below to check the internet connection settings –

- Open QuickBooks, move to the Help menu and select the Internet Connection Setup option.

- Next, select “Use my computer’s Internet connection settings to establish a connection when this application accesses the Internet” and click Next to continue.

- Select Advanced Connection Settings, then move to the Advanced tab and click Restore Advanced Settings.

- Lastly, hit OK and select Done to save the new settings.

Once the settings are saved, reopen QuickBooks and update it. Then, run the payroll updates, but if you cannot install them, move to the next solution.

Solution 7 – Review the QB Payroll Subscription Status

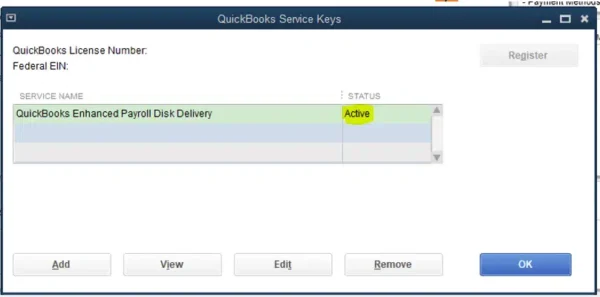

An inactive payroll subscription can also be a reason behind error code 22304 in QuickBooks. To get rid of this issue, check the payroll subscription status by using the steps provided below –

- Exit your company files and restart your computer, then open QB and move to the Employees tab.

- Select My Payroll Service, click Manage Service Key, and review your Service Name and Status to ensure it is correct.

- Check if the Service Status is displayed as Active; otherwise, click Edit.

- Next, verify the service key, but if it’s incorrect, input the correct service key.

- Lastly, click Next, unmark the Open Payroll Setup box, and select Finish to end the process.

Once the payroll subscription is activated, download the QB payroll updates again. However, if you are still unable to install the updates, follow the next troubleshooting solution.

Solution 8 – Configure Windows Firewall and Antivirus

A misconfigured Windows firewall or antivirus program might create restrictions, preventing QB from connecting to the internet. This can lead to update errors in the app, including QuickBooks error code 22304. To fix this error, you need to configure the firewall and antivirus settings by going through the detailed process given below.

Firstly, let’s configure the Windows Firewall settings automatically using the QuickBooks File Doctor tool. To do so, download and install the QuickBooks Tool Hub utility. Then, run the QuickBooks File Doctor Tool.

Once done, check if the firewall is still restricting the QB payroll update process. If the update error persists, move to step 2 and configure the firewall settings manually.

Step 2 – Manually Configure Windows Firewall

If you can’t remove firewall blockages with QuickBooks File Doctor, perform a manual configuration. To configure the firewall manually, create Windows firewall exceptions in the following manner –

Add Firewall Exceptions for QuickBooks Ports

By creating exceptions, QuickBooks will have uninterrupted access to the internet to download the latest updates. To create firewall exceptions for QB ports, follow the detailed steps given below –

Note: If you use multiple QB versions on the same computer, you must configure the firewall for each version. Additionally, include each QB Desktop version’s port number in the “specific ports” field in step 4 below.

- Firstly, type “Windows Firewall” in the Windows search panel, open the firewall, and select Advanced Settings.

- Right-click the Inbound Rules option, click New Rule, and select Port.

- Click Next, ensure TCP is checkmarked, then find the specific port number for your QBDT version by following the list below –

- QuickBooks Desktop 2020 and later: 8019, XXXXX.

- QuickBooks Desktop 2019: 8019, XXXXX.

- QuickBooks Desktop 2018: 8019, 56728, 55378-55382.

- QuickBooks Desktop 2017: 8019, 56727, 55373-55377.

- Now, enter the port number in the Specific Local Ports field and click Next to continue.

Note: If you use QBDT 2019 or later versions, you need to include the Dynamic Port Number, which is assigned explicitly during QB installation. These ports provide exclusive rights to QB to connect to the internet. You can also renew the assigned port number in QBDT 2019 and future versions by selecting Renew. To renew the number, select Scan Now from the Scan Folders tab, then set the firewall permissions again. - To find and add the Dynamic Port Number as per the QB version, follow the steps mentioned below –

- Firstly, type “QuickBooks Database Server Manager” in the Windows search bar, open the program and go to the Port Monitor section.

- Next, locate your QBDT version, note the port number, and include it in the QB port exceptions list.

- Further, click Next, select Allow the Connection, then hit Next again.

- Ensure all profiles are marked (if prompted), select Next, and create a new exception named “QBPorts(year).”

- Click Finish and proceed to create outbound rules in the same manner. Repeat Steps 1 to 7 above, but select Outbound Rules instead of Inbound Rules in Step 2 to successfully create the outbound rules.

Once the QB port exceptions are created, rerun QuickBooks and run the payroll update process again. However, if you still encounter QuickBooks error 22304 while installing payroll updates, create exceptions for QB executable files in the next section.

Add Exceptions for QuickBooks Executable Files

Certain executable files are essential to perform various tasks in QuickBooks. Thus, you need to create firewall exceptions for these files to remove restrictions and resolve the update issues. Follow the steps mentioned below to create exceptions for the .exe files –

- Type “Windows Firewall” in the Windows search panel, open the program, and navigate to the Advanced Settings tab.

- Right-click Inbound Rules, select New Rule, click Program, and hit Next.

- Select This Program Path, then hit Browse and pick a QuickBooks Desktop executable (.exe) file from the list referred to below-

| Executable files | Location |

| AutoBackupExe.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| Dbmlsync.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| DBManagerExe.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| FileManagement.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| FileMovementExe.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| QuickBooksMessaging.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| QBW32.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| QBDBMgrN.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| QBServerUtilityMgr.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| QBCFMonitorService.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| QBLaunch.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| QBUpdate.exe | C:\Program Files\Common Files\Intuit\QuickBooks\QBUpdate |

| IntuitSyncManager.exe | C:\Program Files\Common Files\Intuit\Sync |

| OnlineBackup.exe | C:\Program Files\QuickBooks Online Backup |

- Further, click Next, choose Allow the Connection, then select Next again.

- Ensure all the profiles are selected (if required), hit Next, and create an exception named “QBFirewallException(name.exe), then click Finish.

- Lastly, follow this process to create outbound rules for the executable files. While creating these rules, perform steps 1 to 6, but choose Outbound Rules rather than Inbound Rules in step 2 above.

After creating the exceptions, reopen QuickBooks Desktop and download & install the payroll updates. However, if the update error keeps occurring, configure the antivirus program in the next section.

Step 3 – Configure the Antivirus Program

Incorrect or misconfigured antivirus settings can cause restrictions that prevent you from downloading and installing updates. To fix the update problems, configure the antivirus settings and ensure QB has proper permissions to connect to the Internet. Follow your antivirus program’s specific guidelines to do the same. You can visit the program’s official website or contact your vendor for detailed instructions on configuring the antivirus.

Once you’ve done this, rerun QuickBooks and download and install the payroll updates again. But if the update error persists, move to the next solution to fix it.

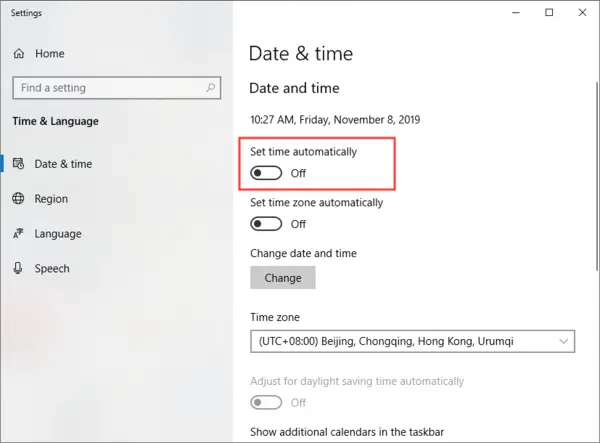

Solution 9 – Ensure Your PC’s Date and Time Settings are Correct

Incorrect date and time settings can interfere with the update process in QB. Thus, to fix QuickBooks error 22304, check the date and time settings on your PC in the following manner –

- Right-click the system clock on your desktop, select Adjust Date/Time, and click Change Date/Time.

- Now, specify the current date and time, then select OK twice to save the changes.

Now, update QuickBooks Desktop again and check if you can install the payroll updates. If you still encounter the payroll update error, move to the next troubleshooting solution.

Solution 10 – Rename the QuickBooks CPS Folder

The CPS folder contains essential files that are needed to update QuickBooks payroll. Thus, if this folder is damaged, it can lead to update errors, like QB error 22304. To fix this, rename the CPS folder by implementing the following steps –

- Firstly, go to This PC (or select My Computer) and move to Local Disk C.

- Next, click Program Files (x86) and look for the QB files under the QuickBooks 20XX folder (where XX stands for your QuickBooks version).

- Further, open the Components folder, double-click the Payroll folder, and locate the CPS folder.

- Right-click the CPS folder, select Rename, and add.OLD at the end of the file name and hit Enter to save the changes.

Once the folder is renamed, try updating QuickBooks payroll again to check if the payroll update error is resolved.

Main Reasons Behind QuickBooks Error Code 22304

You might encounter error code 22304 in QB for various reasons. It is essential to know these reasons to understand the error better, which will help in the resolution process. The following leading causes are responsible for this payroll update error in QB –

- Your QuickBooks Desktop is not up-to-date, which can cause issues while installing payroll updates.

- You are not running the QB and payroll update with proper admin rights, which are required to perform other crucial operations, like installing the updates.

- Your QB Desktop might be damaged or corrupted, or the program may not be correctly installed on the system.

- The QuickBooks company file might be damaged or have some internal glitches.

- The QuickBooks payroll subscription is inactive, which can be another reason for the 22304 error code.

- The internet connection might be weak, or the settings might be incorrect.

- Windows firewall or your antivirus app might create blockages while running the QB payroll update process.

- The CPS folder in QuickBooks might be damaged, or the folder might contain corrupted files.

- Incorrect date and time settings on your PC can also cause payroll update issues.

These are some of the main reasons why you are unable to install QB payroll updates. Now, let’s learn how to resolve this error in the next section.

Conclusion

With the help of the detailed solutions provided above, you can fix QuickBooks error 22304 with ease.

FAQs

Is it important to update the QuickBooks payroll?

Yes, you need to download and install payroll updates to access the latest features and tax table information. An updated payroll ensures accurate paycheck processing, proper tax deductions, and compliance with regulations and laws.

Can outdated billing details cause QuickBooks payroll error 22304?

Outdated billing details can prevent you from installing the latest payroll updates. To fix the outdated billing info, follow the instructions below :

– Sign in to QuickBooks and make sure you are an authorized user, then go to the Employees menu.

– Select My Payroll Service, click Account/Billing Information, then sign in using your Intuit account login details.

– If required, verify your information, then select Billing Detail.

Note: the level of information needed depends on your contact role. If you don’t see any information under Billing Details, you’re not the current billing contact, and you need to change the holder.

– Next, select Edit billing info, enter your new billing information, and select I Agree to confirm the changes.

How can I automatically update QuickBooks Desktop?

You can set automatic updates in QB Desktop in the following manner –

– From the Help tab, choose Update QuickBooks Desktop, then go to the Overview tab and ensure Automatic Updates is selected.

– Then, go to the Options tab, click Yes for automatic updates, and select Mark All.

– Lastly, hit Save, and the updates will be downloaded automatically the next time Intuit makes them available.

You May Also Read-

Troubleshooting methods for QuickBooks Error 6010 100

How to Fix QuickBooks Error 40003 – Payroll Error

Are you facing issues with QuickBooks error 1722? Fix it now

Let’s Eliminate QuickBooks Error 15311 with Effective Solutions

Fix QuickBooks Error C=184 with Step-by-Step Troubleshoot

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.