Recording a deposit in accounting software like QuickBooks is the most convenient way to merge several deposits into a single transaction. This makes managing accounting-related data easy. This guide takes you through the procedure and everything you need to know about recording a deposit in QuickBooks Desktop and Online. Moreover, it will provide you with experts’ tips on the same.

Comprehensive Steps to Recording a Deposit in QuickBooks Desktop

When you record a deposit in QuickBooks, use the Bank Deposit feature or enter the details. Both methods are effective in managing your books.

Now, let us look at different ways to record several transactions in a single record, one by one.

Step 1. Make Transactions to the Undeposited Funds Accounts

Make sure that you have placed transactions in the Undeposited Funds accounts. If you haven’t done it yet, follow these pointers given below:

- Start by clicking the + New button

- Choose the Receive Payment option

- Head to the Customer drop-down menu and then select the targeted customer

- Click to check the box to access the invoice.

- Move to the Deposit Dropdown menu to select the Undeposited Funds

- Then complete the form, which is displayed on your system screen

Now, select the Save & Send, Save & Close, Save, or Save and New options based on the requirements.

Step 2. Record the Bank Deposits in QuickBooks to Merge Transactions

After getting hold of the transaction slip from the bank, you could record the deposit in this software together. To do so, follow the given pointers below.

- Head to Record Deposits or Make Deposits on the Homepage

- Select the payments you wish to merge in the Payments to Deposit section

- Then, select the OK button

- Head to the Make Deposits option to choose the accounts you’re wishing to deposit money into from the Deposit option

- Verify the amount of the transaction. Verify the account and the selected payments, and compare the bank’s deposit slip.

- Fill in the day details, you visited your bank to make the transactions

- Finally, add a memo and after finishing it, select Save and Select

Lastly, make sure that you are making one deposit at a time for every deposit slip.

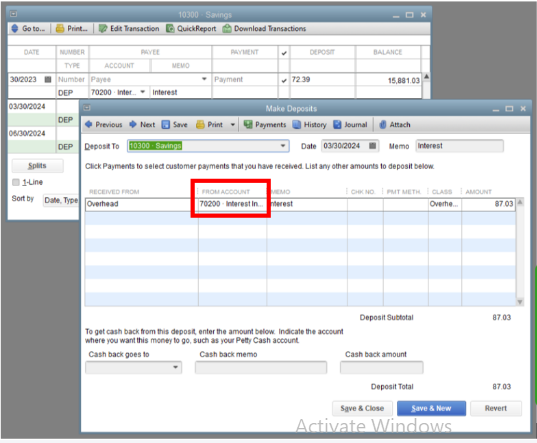

If You Need to Put a Deposit in Two Separate Bank Accounts:

To add a deposit into multiple accounts, follow these pointers:

- Open QuickBooks and select Record Deposits/Make Deposits on the Homepage

- Head to the Payments to Deposit section to select the transaction you want to merge

- Select OK

- Navigate to the Make Deposits section

- Then, select the account you wish to add the transaction to from the Deposit to dropdown

- Then add a new line under the payment you want to select

- Head to the From Account dropdown and move to its second line

- Select the second account

- Now, enter the amount to put in the second account as a negative value

- Lastly, select Save & Close

If You Need to Deposit into an Account Other Than a Bank Account

To deposit into an account other than a bank account, follow these steps:

- Navigate to the QB Homepage and select Record Deposits/Make Deposits

- Head to the Payments to Deposit window and select the transaction you wish to merge.

- Select OK to confirm

- Move to the Make Deposits section

- Here, select the account you want to put the deposit into from the Cash Back goes to dropdown

- Enter the amount you want to put into the account

- The remaining amount will be transferred into the account you selected from the Deposit to field

- Lastly, select Save & Close

Manage Your Bank Deposits in QuickBooks Desktop

To check and manage previous deposits and transactions, you need to review previous bank deposits.

To check what transaction you merged, follow these pointers:

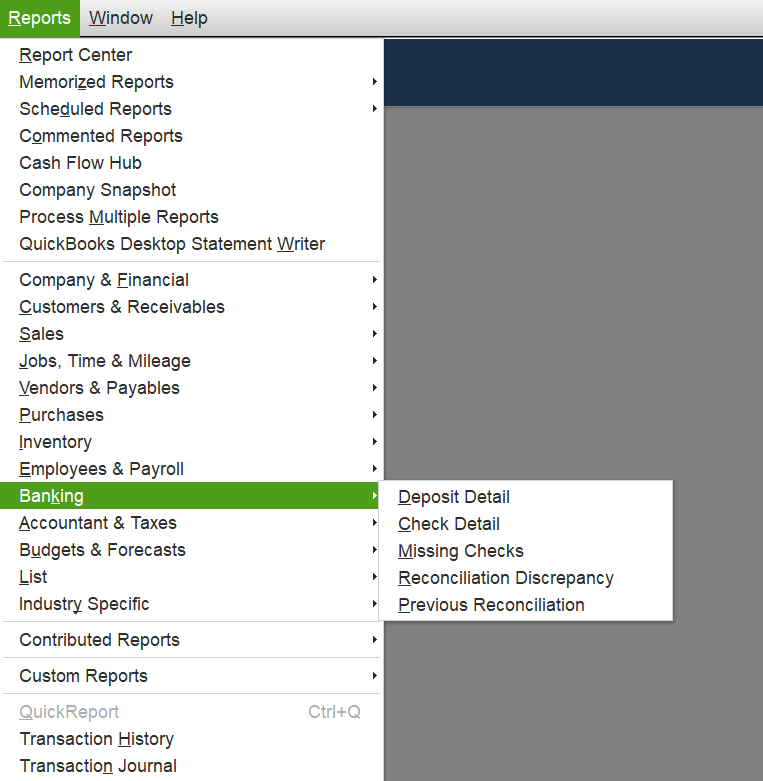

- Start by clicking the Reports menu

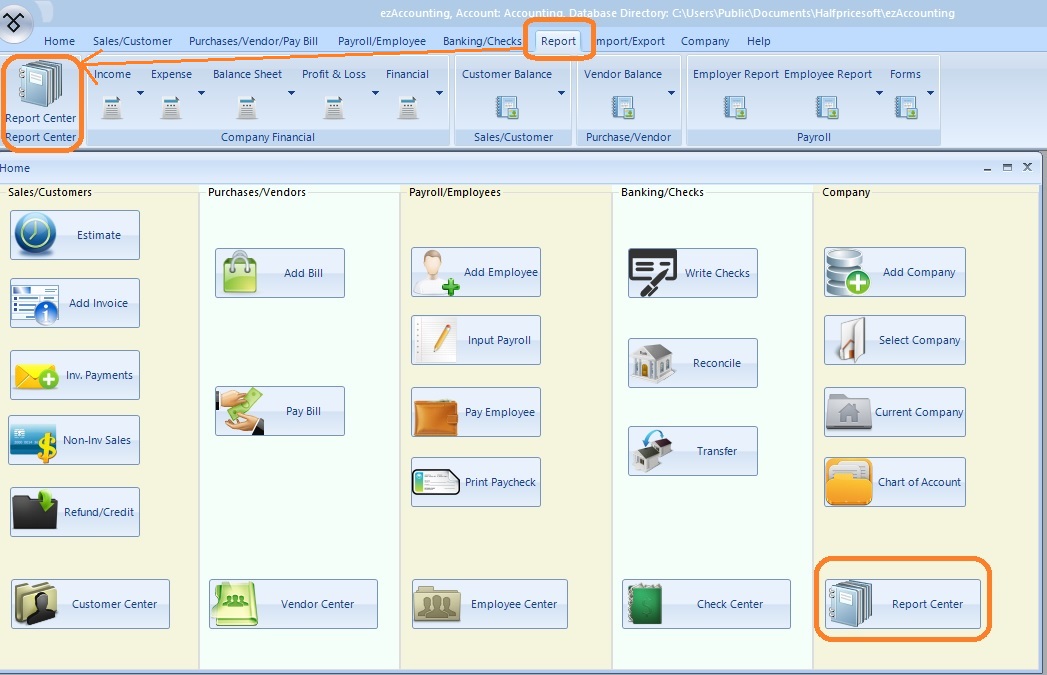

- Click to select Report Center to move to the Banking

- Now, locate the report on Deposit Details and then tap on the Run icon.

After reviewing that, you need to delete one Bank Deposit. Follow these pointers to try this:

- Select the Report Center in the Report menu

- Go to the Banking section

- Find the Deposit Detail report file and click to select the Run icon

- Now open the deposits you want to delete

- Head to the Make Deposits tab to access the payments from the deposits.

- Now review them and ensure that you need to start over

- Tap the right key in the window to select Delete Deposit

- Then select OK to confirm

All the payments on your deposit will go back to the Undeposited Funds account. Lastly, you need to start over and create a new deposit.

Record Recurring Deposits in QuickBooks Desktop

When you are recording the same deposits, you can make an existing deposit a recurring deposit. To try this step, you need to follow the pointers below:

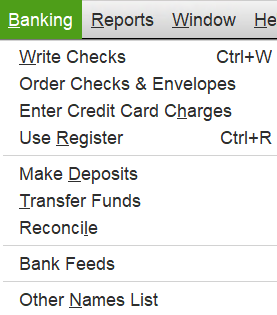

- Start by selecting the Banking menu, and after that, choose Use Register

- Then search for an existing deposit and open it

- Click the right key to deposit, and then select Memorize Deposit

- You can also set QuickBooks Desktop to record the deposit automatically. Then select Automate Transaction Entry, and move to Add to my Reminders List to get notifications for creating the deposits

- Go to How Often and drop down to select the frequency on a monthly, weekly, or daily basis

- Find the Next Date section to set the starting date for the recurring deposits. It will start from the first day

- Find the Number Remaining section to enter the deposits you want to create in the QuickBooks software

- Head to the Days in Advance to Enter section to set the number of days in advance that QuickBooks can record the deposit

- Enter 0 to record the deposit on the day you select

- Lastly, select OK

Recording a deposit in QuickBooks Desktop will be easy from now on. Now, QuickBooks can automatically start recording the deposit on the date and time you choose.

Simple Steps to Recording Deposits in QuickBooks Online

Recording deposits in QuickBooks Online is easy and can be done with a few quick steps. To do so, follow the steps below carefully.

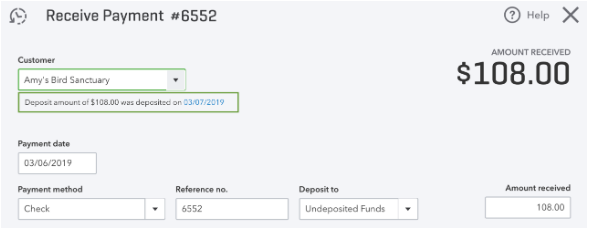

Step 1. Put Transactions into the Undeposited Funds Account

Firstly, you need to put transactions in the Undeposited Funds account. However, if you have already done this, then skip this process. But if you haven’t, follow these pointers below:

- Start by pressing the +New button

- Choose the Receive Payment option

- Select a targeted customer from the Customer drop-down menu

- Click to check the box to get the invoice

- Select the Undeposited Funds option in the Deposit dropdown section

- Fill in the displayed form on your system

Finally, choose the Save and Send, then Save and Close, or Save and Send, or Save & New options

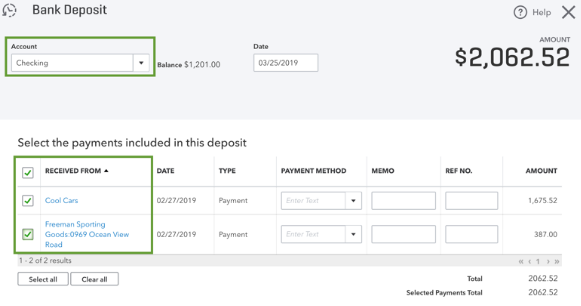

Step 2. Merge Deposits With a Bank Deposit

After putting transactions into the Undeposited Funds account, you need to merge the deposits in QuickBooks with a Bank Deposit. Here are the steps on how to do so:

- Click Select and New together and choose Bank Deposit

- Head to the Account dropdown menu to select the account in which you want to deposit the money

- To combine these deposits, check the box for Each Transaction

- Ensure that you are keeping a Tab on the Total Number of chosen deposits, and that it matches your Deposit Slip

Click on the Save and New for recording a new deposit, or you can Save and Close to finish the process

If You Need to Include Bank Processing Fees

Remember that some banks may add service charges and processing fees. You need to make changes to the initial transaction. Alternatively, you can add the fee while working on the deposit section. To do so, follow the given pointers:

- To get the Add Funds, scroll down to the deposit area

- Create a line of items for free

- Now decide who is gonna pay the fee

- Go to the Account dropdown in the Bank Charges

- Try to enter a negative number for the free amount

- Now, carefully review the bank fee and the total transaction

- At the end, select Save and New or Save and Close

How to Create a Bank Charge Account ( If You Don’t Have One)

You need a dedicated expense account to lodge bank charges. Here’s how to create the Bank Charges account when you don’t have one:

- Head to the account dropdown and select +Add New

- Move to the Account creation window

- Select Expenses as the account type and Bank Charges

- Lastly, give this account a simple name, such as “Bank Charges.”

Here’s How to Manage Bank Deposits in QuickBooks Online

Let’s know how to manage bank transactions in QB Online. To manage bank deposits, follow these steps:

Review Previous Bank Deposits

To review your past bank deposits, follow this process:

- Navigate to the Reports

- Move to Sales and Customers by scrolling down

- Then, select the Deposit Detail report

Make sure you are selecting individual deposits to get more details.

Delete a Transaction from a Bank Deposit

This is how to delete a transaction from a bank deposit in QuickBooks Online:

- Head to Sales and then All Sales

- Choose the View/Edit dropdown menu to get the payment you want to delete (The Status should be “Closed”

- To open the bank deposit, select the date link near the customer’s name

- Mark the checkbox for the payments you want to delete

- Lastly, select Save and New/Save and Close

After following this process, the payment will go back to the Undeposited Funds account. Also, you can put it into another deposit.

Delete a Bank Deposit

Follow this process to delete a bank deposit:

- Move to the Settings and then the Chart of Accounts

- Look for the bank deposit where you put the deposit.

- Select View Register

- Then, search/select the bank deposit to get more details

- Lastly, select Delete

After this, you are set for recording a deposit in QuickBooks Online, which will make things easy for you to manage bank details.

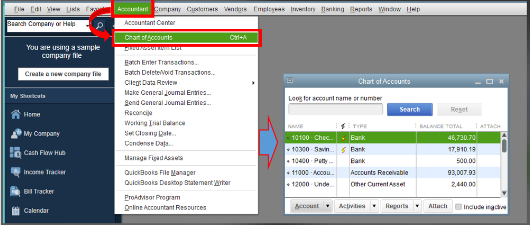

Here’s How to Categorize Deposits in QuickBooks Desktop

To ensure that the selected account in the From Account field is correct, it is essential to categorize the deposits in QuickBooks. In the particular case, you didn’t categorize deposits, and you realized that the affected account is incorrect, then you can fix this issue quickly.

Here’s how:

- Start by launching QuickBooks Desktop

- Navigate to the QB Desktop account, then head to the Accountant menu

- In the Accountant menu, click Chart of Accounts

- After that, locate and select the account to open

- Look for the deposit and select it to review the information

- Lastly, in the Form Account field, update the account.

Why Do We Need to Record a Deposit in QuickBooks?

While creating a deposit at the bank, you might transfer multiple payments from several sources. In that matter, the bank typically records everything as a single record with a single combined amount. In a particular case, when you don’t enter that same transaction as separate records in QB Desktop, they may not match how the bank records that deposit.

Thus, recording a deposit in QuickBooks Desktop or online becomes essential as it merges every deposit so the records match the real-life bank deposits.

Final Thought

To keep accurate financial records and to manage them conveniently, you need to learn to record a deposit in QuickBooks Desktop. This method will provide a guarantee of the integrity of your company’s accounting system. The month-end or year-end closing will become simpler to handle, and moreover, you will be able to promote effective cash flow management. In this blog, you will get all the essential information that you need to record a deposit in QuickBooks.

FAQs Related to Recording a Deposit in QuickBooks Desktop

How to record a deposit in QuickBooks Online?

With the easy interface, you can easily make bank deposits in QuickBooks Online by following simple steps. Firstly, you need to merge it into the Undeposited Funds account. After doing so, you can use the bank deposit feature to combine them. Next, you must manage bank deposits by reviewing the previous bank deposits. You can combine transactions in QB with a bank deposit. To do that, start by selecting + New, followed by Bank Deposit. After that, choose the account you want to add deposits to from the Account dropdown menu, and save it.

How do I record a deposit in QuickBooks?

Follow these steps to record a deposit in QuickBooks Desktop:

1. Move to the QB Homepage to select Record Deposits/Make Deposits

2. Select the payments you want to combine and choose OK in the Payments to Deposit window

3. Head to the Make Deposits field

4. Select the account you want to add the deposit from the Deposit dropdown

5. Ensure that the account and selected payments are matching with the deposited receipt from the bank.

6. Now, enter the date you made the deposit at the bank

7. Add the memo if needed

8. After completing every step, select Save & Close

How to record bank deposits in QuickBooks?

The process of recording a bank deposit to QuickBooks Desktop is easy and simple if you follow these steps. First thing you need to do is put payments into an Undeposited Funds account. After that, you need to follow certain steps. First, open the QB Homepage and select Record/Make Deposits. Choose OK in the Payments to Deposit section. Make sure that the account and selected payments match the deposit from the bank. At last, add a memo as needed and at the end select Save & Close.

Can I record multiple transactions as a single deposit?

Yes, you can record multiple deposits in QuickBooks Desktop. The Record Deposit feature in QuickBooks Desktop provides you with the facility to record multiple deposits.

Which account is going to be credited after Depositing Funds?

After the payment is received in QuickBooks Desktop, it will be credited to the account that has the Deposits Funds. The Undeposited funds will be credited in the amount that is deposit

You May Also Read:

7 Tested Ways to Tackle QuickBooks Direct Deposit Not Working

Easy Depositing Undeposited Funds in QuickBooks

QuickBooks Error 50004: Activate Direct Deposit with Ease

How to Fix Issues With Missing Invoices in QuickBooks Desktop

Resolving QuickBooks Not Connecting to Server Issue in 7 Proved Methods

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.