QuickBooks Payroll helps businesses manage employee payroll and accounting tasks with ease. With this software, you can calculate employee earnings, deduct payroll taxes at the federal and state levels, disburse salary, or maintain financial records. The QB Payroll subscription renewal is necessary after a one-year term of subscription is completed on any QB version. If you don’t renew the QB Payroll subscription, then accounting and payroll tasks will be disrupted. Read the following article to learn how to reactivate QuickBooks Payroll subscription, along with how to resolve common errors that may typically occur during or hinder the renewal process.

Quick View Table for Reactivate QuickBooks Payroll Subscription

Tabulated below is a summary of the blog that provides a concise overview of essential information to renew QuickBooks Payroll subscription:

| Steps to take before renewal | Check Payroll Service Subscription and Payroll Version. |

| Methods to renew | While QuickBooks Online Payroll subscription renewal is straightforward, QuickBooks Desktop Payroll subscription renewal can be done through the Company File, Intuit Account via the web, and the cancellation email. |

| What to do after reactivation? | Review Payroll in QuickBooks Online and Desktop |

| Troubleshooting subscription errors | Clear the browser’s cache, refresh Payroll Subscription, update the QuickBooks Desktop, update QuickBooks Payroll tax table, and delete the damaged paystub.ini file. |

Steps to Take Before You Reactivate QuickBooks Payroll Subscription

Before you renew QuickBooks Payroll subscription, you need to get to know the payroll service subscription and the payroll version that you use.

For that, follow the steps below.

Checking Payroll Service Subscription on QuickBooks Desktop

This is how you can check your payroll subscription status on QuickBooks Desktop:

- Launch QuickBooks, and head to Employees.

- Head to My Payroll Service and tap on the Manage Service Key option.

- Verify your Service Name and Status, and ensure that the Service Name is correct and the Status is Active.

- If the service key is labeled as Canceled, then click on Edit and verify.

- If the number is incorrect, then provide the correct service key.

- Click on the Next tab and uncheck the box for Open Payroll Setup.

- Once done, tap on Finish.

Checking Payroll Version on QuickBooks Desktop

Follow the steps below to check your payroll version for QB Desktop:

- Open the QuickBooks Desktop company file.

- Sign in as Primary Admin or Payroll Admin.

- Select Employees, then choose the Payroll Center.

- Payroll service will be visible under Subscription Statuses within the Payroll tab.

- Services are labeled as assisted, enhanced, basic, or standard.

Checking Payroll Version on QuickBooks Online

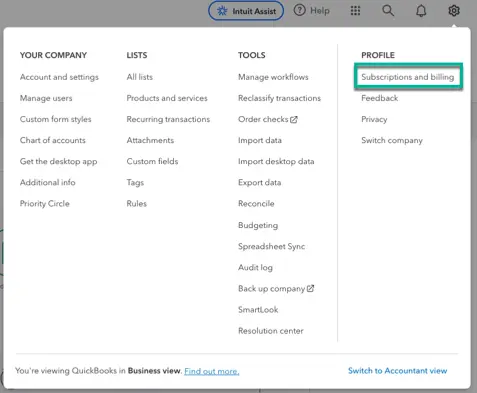

Here is how you can check the payroll version if you are on QuickBooks Online:

- Open QB Online on your web browser

- Log in to QuickBooks Online payroll as the primary administrator

- Head to Settings and select Subscriptions and Billing

- Payroll service will be mentioned there as Core, Premium, or Elite

Once you have checked and verified the QB payroll version and payroll service subscription, you can proceed with QuickBooks Payroll subscription renewal through the methods below.

Learn How To Renew QuickBooks Payroll Subscription with Step-by-Step Procedures

You may go through the following methods to reactivate QuickBooks Payroll subscription. One by one, steps are provided for both the Desktop and Online versions. Choose the product you use.

Section 1: QuickBooks Online Renew Payroll Subscription

Follow the steps below to reactivate QuickBooks Payroll subscription in the Online version:

- Launch the QB Online

- Head to Settings and click on Subscriptions and billing

- Now choose Resubscribe for payroll

- Go through the subscription summary and verify your details

- Enter your payment details and select a Payment method

- Complete payment and select Resubscribe

Once done, your QuickBooks Online Payroll subscription will be renewed immediately, and you can continue to use the tools and software. Now move on to the next section for desktop payroll subscription.

Section 2: QuickBooks Desktop Payroll Subscription Renewal

There are three options to reactivate payroll subscription QuickBooks Desktop version. However, before that, you need to check and make sure that you have the latest QB version or update QB Desktop to the latest release.

- QuickBooks Desktop Payroll Assisted

If you use the QuickBooks Desktop Payroll Assisted and need to reactivate your payroll service subscription, then you are required to contact our expert for assistance. - QuickBooks Desktop Payroll Enhanced, or Basic

If you use the QuickBooks Desktop Payroll Assisted and need to reactivate your payroll service subscription, then you are required to contact our expert for assistance. - QuickBooks Desktop Payroll Enhanced, or Basic

You can follow the procedures listed below for QuickBooks Enhanced Payroll subscription renewal as well as for the Basic subscription.

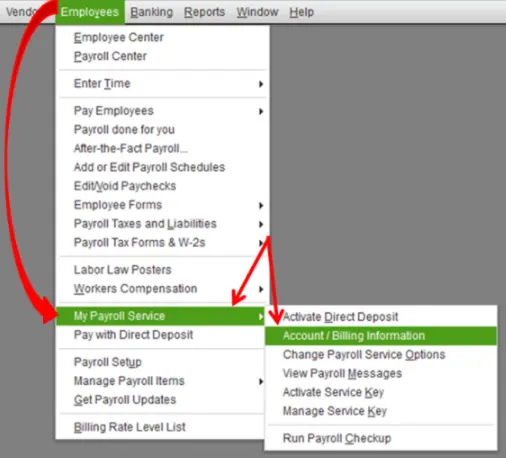

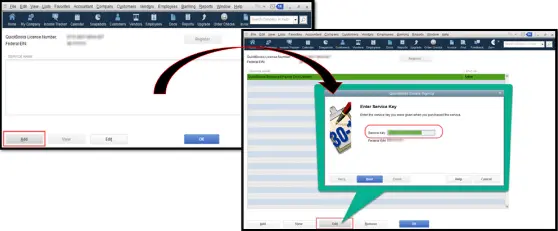

Through your Company File

- Open your QuickBooks Desktop company file

- Head to the Employees menu and choose My Payroll Service

- Now, select Account/Billing Info

- It will open the Intuit Account sign-in page

- Head to the Service Information section and select Reactivate under Service Status

- Select Submit and choose Place Order

- Tap on Next, followed by Return to QuickBooks

- Now, verify the Service Status on the Account/Billing Info pages

If you are facing Error 30159 in QuickBooks during the payroll renewal process, you should fix it right away.

Through your Intuit Account via the Web

- Pull up a web browser and log in to your Intuit account

- Open your Intuit Account

- Head to Status and select Resubscribe

- Select a Payment Method and fill in your payment details

- Now, choose Place Order to reactivate QB Desktop payroll

Note: The QB payroll subscription reactivation will be effective after at least 24 hours. Once reactivation is done, your subscription status will display as ‘Active’. After reactivation, you can install the recently released payroll tax table updates.

Through a Cancelation Email

- Open the subscription cancellation email

- Opt for Resubscribe and log in using Intuit Login credentials

- Complete payment, then click Save and Continue with the reactivation process.

Note: Verify that all the previously entered information is correct and valid. - You’ll receive a reactivation link to reactivate

- Finally, the message ‘Your Subscription has been Reactivated’ will appear on your screen

Note: The reactivation process may take up to 24 hours to complete, after which you may restart QuickBooks and use payroll services again.

Review your QuickBooks Payroll Data after Reactivation

Once you have completed the QuickBooks Payroll subscription renewal process, you might be required to set up the payroll from scratch. Review your payroll data entirely, including employees and tax setup.

- Reviewing QuickBooks Online Payroll

Follow these steps to review the QBO Payroll:- Open your QuickBooks Online account

- Head to Payroll, then select Employees

- See and verify information like deductions, W-4, sick/ vacation, and as such, for each employee

- Now open Settings to confirm your tax rates by selecting Payroll Settings

- Reviewing QuickBooks Desktop Payroll

With the steps below, you can review the QB Desktop Payroll:- Launch QuickBooks Desktop

- Open Employees and click on Employee Center

- Under the Employees tab, verify info, including deductions, W-4, sick/vacation, and more for each employee

- Now, head to Lists and click on Payroll Item List to verify your tax payroll items

Click on OK and save the verified payroll service data. Now you can continue with the payroll operations, like tax calculation and more. In case you find out that QuickBooks Payroll is not calculating taxes or fails to deduct taxes, you need to troubleshoot that.

If you face any errors or problems during the QuickBooks Payroll subscription renewal process, then check the following troubleshooting methods to counter them.

Troubleshooting Errors Related to QuickBooks Payroll Subscription Renewal

Through following the steps below, you can resolve and fix any arising errors or issues as you renew QuickBooks Payroll subscription.

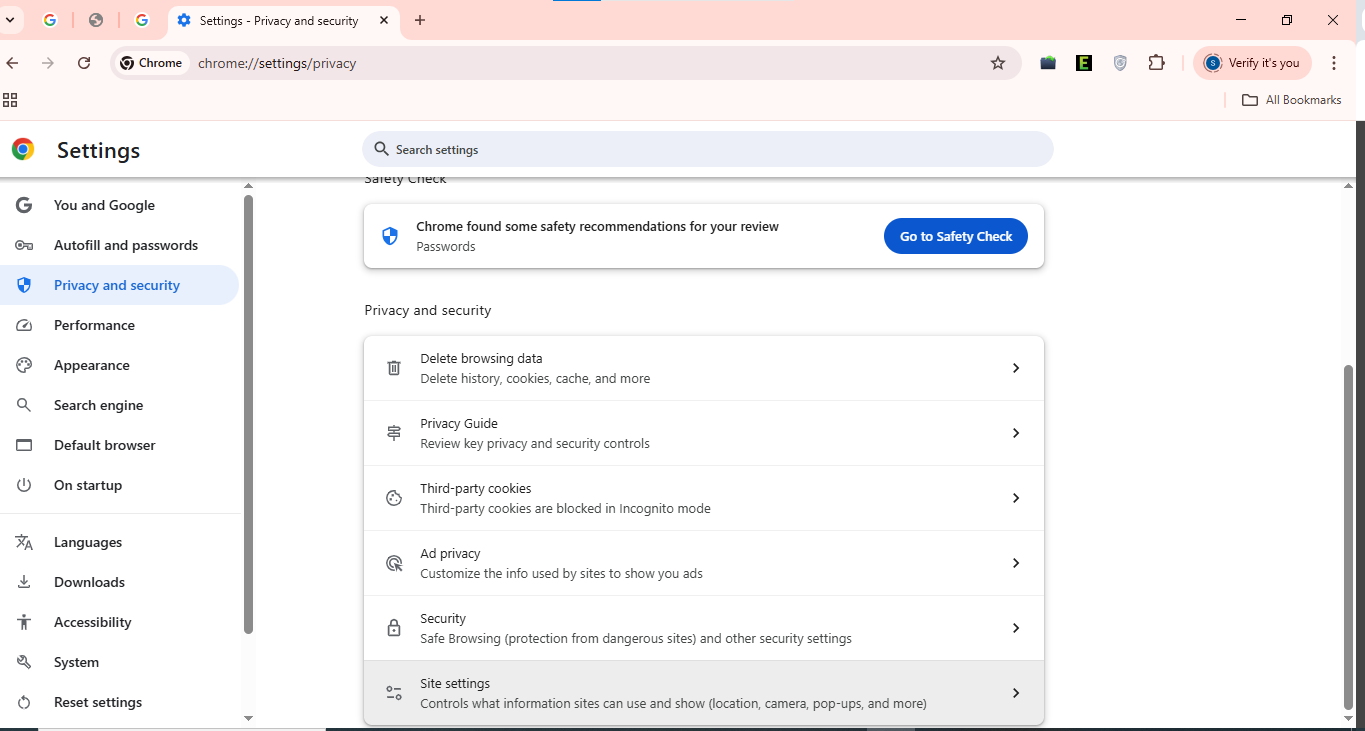

Solution 1: Clearing the Browser’s Cache

If you don’t get the option to resubscribe QB payroll despite signing in as the Intuit Account admin, accumulated browser data, cache, or Intuit cookies might be the problem. Caches and cookies often give way to unexpected problems in the browser.

Therefore, follow these steps for clearing your browser’s cache.

Google Chrome

To clear the cache in the Google Chrome browser, do as follows:

- Open Settings and navigate to Privacy and Security

- Click on Cookies and other site data

- Next, select See all cookies and site data

- Enter “Intuit” in the search bar

- Tap on Remove all shown

- Finally, reopen Google Chrome

Safari

Take these steps to remove cookies & cache in the Safari browser of Apple:

- Open Safari and navigate to Preferences

- Head to the Privacy section and tap on Manage Website Data

- Enter Intuit in the search bar to find cookies

- Then, click on Remove All, followed by Remove Now

- Click Done and restart the Safari browser

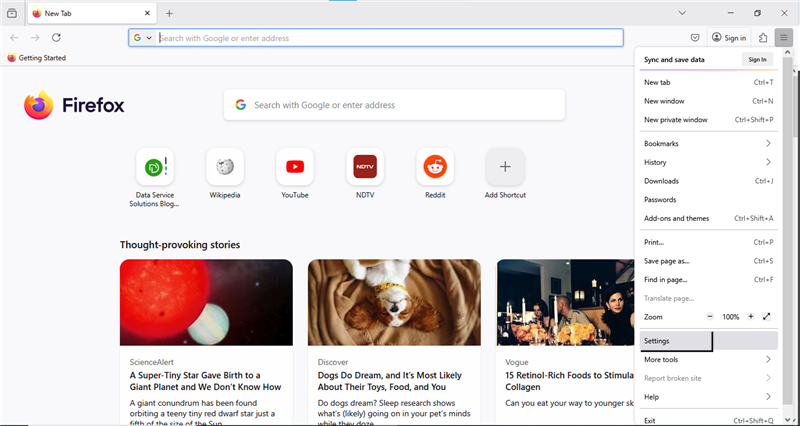

Mozilla Firefox

Delete the cookies in the Mozilla Firefox browser with the simple steps below:

- Open Mozilla Firefox and go to Settings

- Select Privacy and Security

- Then, go to the Manage Data section in Cookies and Site Data

- Enter ‘Intuit’ in the search bar

- Press Enter to find Intuit cookies

- Now, click on Remove All Shown, then Save Changes

- Once done, restart Mozilla Firefox

Delete the cache from your supported browser to eliminate any interruptions with QuickBooks Payroll subscription renewal. If you still face any issues, then try reinstating QB payroll service key by following the upcoming method.

Solution 2: Refreshing the Payroll Subscription

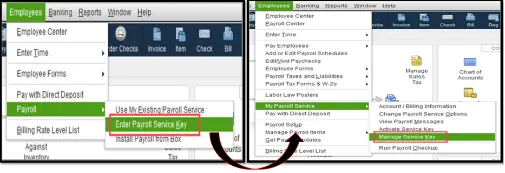

Follow the steps listed below for reinstating QuickBooks payroll service key, which will then refresh your QB payroll subscription and reactivate your account.

- Open the QuickBooks Home Page screen

- Tap and hold the Ctrl + K keys

- You will see your payroll service keys

- Verify Status if it’s Inactive

- Note down your payroll service key numbers

- Select Edit, remove, and re-enter the service numbers

- Click on Next

- Once finished, tap OK

Once you finish reinstating your payroll service key, your QB subscription status will turn to active. If it doesn’t work, then update your QuickBooks Desktop to the latest version.

During the payroll update Process, you might be getting the QuickBooks Error PS038. Don’t worry, you need to fix it easily

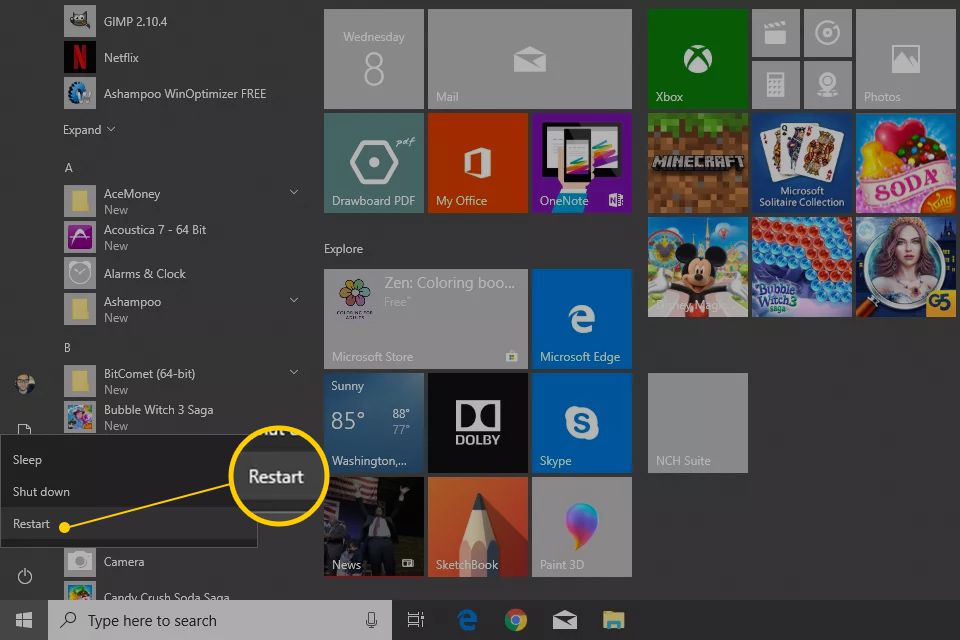

Solution 3: Updating the QuickBooks Desktop

Problems during the QuickBooks Desktop Payroll subscription renewal process may usually occur due to an outdated version of the software. Follow the steps below to update to the latest version.

- Open Intuit’s website

- Head to the Downloads & Updates page.

- Open the Product menu and choose QuickBooks Product from the dropdown.

- Now specify your QuickBooks version and its year from the Version dropdown.

- Select Get the latest updates, then Save/Save File.

- Download the update patch and open it.

- Now, follow the on-screen instructions to install the update patch.

- Finally, restart your computer to load the update.

You will need to update the tax table as well to refresh your payroll settings by following the process below, after you have successfully updated QuickBooks Desktop to the latest version.

Solution 4: Updating the QuickBooks Payroll Tax Table

Follow the steps below to update your QB tax table in order to resolve the hindrance with the QuickBooks Payroll subscription renewal process:

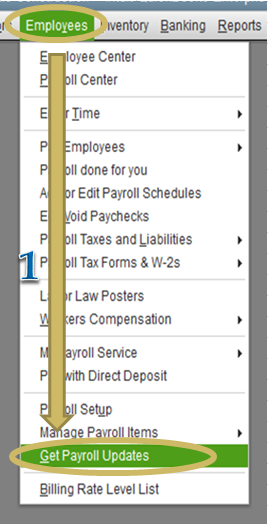

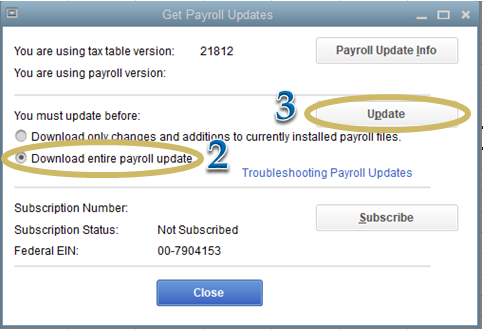

- Open the Employees menu

- Click on Get Payroll Updates

- Select the Download Entire Update checkbox

- Now, Choose Update

Once it has been downloaded, you will get notified when payroll tax form updates are installed or a new QuickBooks Payroll tax table update is installed. Select OK and run a payroll update to refresh your payroll settings.

If you still fail to renew QuickBooks Payroll subscription even after the payroll tax table is updated and the account status is active, then a damaged paystub.ini file may be causing the error. Follow the next process to delete it, so that the application can recognize the QuickBooks Payroll subscription renewal.

Solution 5: Deleting the Damaged Paystub.ini File

In some cases, a damaged paystub.ini file may interfere with your QB application, causing it to fail to recognize a renewed QuickBooks payroll subscription despite updated billing information and an active account status. To remove the damaged paystub.ini file, follow the steps below.

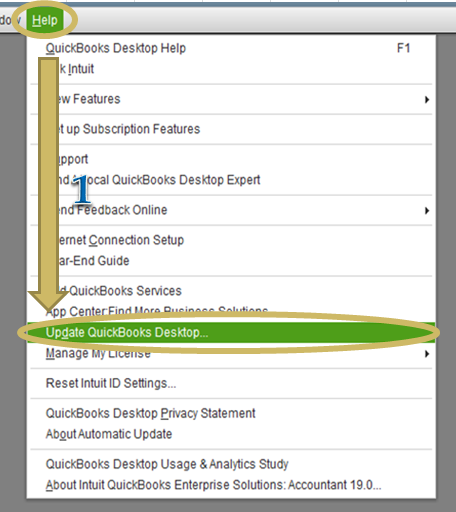

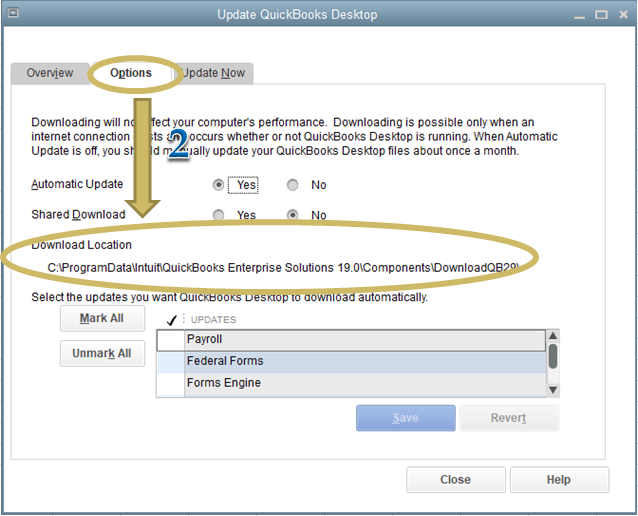

- Head to the Help menu and select Update QuickBooks

- Now select the Options tab and navigate to the Download Location

- Type ‘Paystub’ in the search box and press Enter

- Now select the file and choose Delete

Once you delete all the pay stub files that are shown on screen, revalidate the payroll service key as follows:

- Open QuickBooks, press Ctrl + K

- Note down your service key

- Delete and then re-enter the service key

- Now tap on Next and Finish

After this, run a payroll update so that your QB payroll settings are refreshed by following the steps outlined in Solution 4.

Is QuickBooks Payroll Subscription Renewal Necessary?

Yes, it is strongly advised for you to reactivate QuickBooks Payroll subscription to access many features and tools that help with accounting tasks, such as:

- Employee payroll calculation, deduction, and tax withholding

- Filing payroll taxes plus sending payments to tax authorities.

- Paystubs, W-2s, and 1099s generation and filing.

- Time tracking tools for generating hourly payroll.

- Creating accounting, labour costs, and financial records.

- Reduce manual labour, paperwork, or handwritten reports.

- Direct deposit services for both employees and contractors.

- Compliance with state, IRS/federal, and local tax regulations.

To use all these features without any disruptions, you’ll have to reactivate QuickBooks Payroll subscription. Know what to do before moving on to the renewal process below.

Bringing It All Together

In summary, you must reactivate QuickBooks Payroll subscription for continued access to payroll services and accounting tools, as well as to maintain compliance with tax regulations. The QB Payroll subscription renewal can be completed on either the Online version or the Desktop version through the Company File, Intuit Account, or via a cancellation email.

Frequently Asked Questions (FAQs)

How to Reactivate Payroll Subscription in QuickBooks Desktop?

For a premium or basic payroll subscription, you can reactivate or renew QuickBooks Payroll subscription in the Desktop version, through your Company File, Intuit Account via web, or a cancellation email. Whereas for the assisted payroll subscription, you have to contact a QB expert, and they’ll help you reactivate it.

What happens when my QuickBooks Payroll Subscription expires?

If your QuickBooks Payroll subscription expires, then accounting tools and payroll tasks will be inaccessible. Although you can view or export your payroll data, you can not make any changes to it. In case you do not reactivate QuickBooks Payroll subscription then your payroll data will be gone after a specific time period.

How do I verify Payroll Subscription in QuickBooks?

You can review your payroll data entirely, including employees and tax setup, by following the steps:

Reviewing QuickBooks Online Payroll

1. Open Payroll and select Employees

2. Verify information like deductions, W-4, sick/ vacation, and as such, for each employee

3. Head to Settings, select Payroll Settings, and confirm your tax rates

Reviewing QuickBooks Desktop Payroll

1. Select Employees and then Employee Center

2. Verify info under the Employees tab, including deductions, W-4, sick/vacation, and more for each employee

3. Head to Lists and select Payroll Item List to verify your tax payroll items

Click on OK and save the verified payroll service data.

How do I Reinstate my QuickBooks Payroll Subscription?

To reinstate your QuickBooks Payroll subscription, follow these steps:

1. Launch the QuickBooks Home Page screen

2. Press and hold Ctrl + K

3. Payroll service keys will be shown

4. Verify the Status whether it’s Inactive

5. Copy the payroll service key numbers

6. Click Edit, delete the service number you see, and paste the copied service number

7. Tap Next until Finish

8. Select OK, and the Status will become Active

You May Also Read–

Fix QuickBooks Error 12152 with Tried & Tested Solutions

QuickBooks Desktop Keeps Crashing, Closes, or Freezes: Fixes

QuickBooks Search Not Working? Here’s What to Do Now

Fix Quickbooks Payroll Update not Working in Windows or Mac

Fixing QuickBooks Error PS038: Can’t Run QB Payroll

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.