Payroll management is important for any business among SMEs. It contains a lot more than simply writing paychecks. It also deals with the computation of wages, withholding taxes, maintaining employee benefits, and keeping all derivations about tax law, hence creating reports correctly for tracking financial records.

QuickBooks Desktop Payroll automates most of the complexity that goes into payroll, thus making consent simple. QuickBooks payroll software keeps track of every employee’s payments and taxes while generating reports in such a way as to keep your business aligned with federal, state, and local laws.

Due to payroll software, it needs to be updated since the tax laws do change, new features get added inside the software, and other security issues are noticed. QuickBooks Payroll Update will make sure that your payroll system is working correctly and safely according to new regulations.

How to Update Payroll in QuickBooks Desktop

Want to update QuickBooks Payroll? Let’s go ahead and proceed with the steps involved for the update of QuickBooks Desktop.

Step 1: Open QuickBooks Desktop

Open the QuickBooks Desktop. Log in to your company file as an admin because updates can be downloaded and installed only with admin privileges.

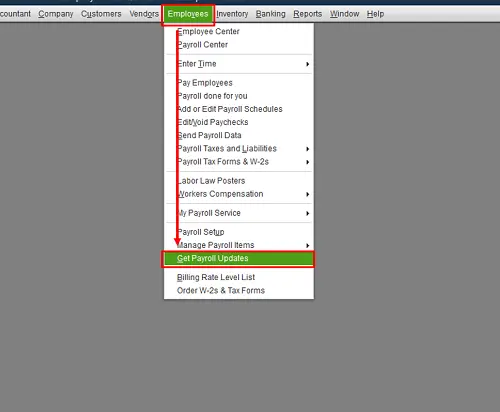

Step 2: Click on the Payroll Update Option

Click the Employees tab from the top menu bar. Under the drop-down list, select Get Payroll Updates. A window will pop up-the Payroll Update window from where you can proceed with downloading updates.

Step 3: Download Latest Updates

In the Payroll Update window, click the Download Latest Update button. It will download the latest payroll updates available, including the latest tax tables, bug fixes, and new features within the program. This will depend on the size and your Internet connection.

Note that QuickBooks Payroll always releases updates throughout the year, especially during the tax season. You can put on the automatic update features in settings to make sure that at whatever time new updates are available, such will automatically be downloaded and installed.

Step 4: Install the Update

Click on Install Now button once the download of the update is complete. QuickBooks will now install the update, this may take a few minutes. When the installation is complete, QuickBooks will prompt you to reopen the application to have changes take effect.

Close all the other programs that interfere with updating the process.

Step 5: Verify the Update

After reopening QuickBooks, you will know whether the update has been installed or not.

Best Practices in QuickBooks Payroll Updates Management

By using best practices that relate to update management of QuickBooks Payroll, you will be able to avoid any likely issues and enhance efficiency for the purpose of remaining compliant with all applicable regulations and laws. Here are some key best practices that are helpful for this purpose:

- Set Reminders for Regular Updates: The secret to saving time and costly errors is to stay on top of payroll updates. Mark it on your calendar to check at least once a month for updates or immediately upon the word of an updated release. Although QuickBooks can remind you that there is an update available, this makes sure that you will get the update.

- Always Back Up Your Data Before Updating: This is usually advisable because it means that one has kept a backup of the company file in QuickBooks before its updating, such as upgrading QuickBooks to any newer version. It makes sure that if, during the process of updating, something goes wrong, one can then easily restore the payroll data to the present state. Besides that, frequent back-ups also ensure that one is guarded against data corruption and system crashes. QuickBooks allows for the creation of backups via the File menu pretty easily, and hence, this step should never be forgotten.

- Keep Software Versions Current: While payroll updates are essential, keeping your version of QuickBooks Desktop current is equally important. New releases can offer bug fixes and new features that will keep making your payroll process easier. Keep QuickBooks Desktop Payroll current to ensure you receive the latest tools, functionality, and security patches.

- Review Release Notes: Please take a few minutes to review the release notes whenever one is available. Release notes are very informative about exactly what an update contains, such as updates to the tax tables, new features, or security patches. This will help you understand what exactly changed with the update and how it may affect your payroll processes. With this information about changes, you will be in a better position to brief your team and then actually change your workflows.

- Test Payroll After Update: Perform some minor test payroll after installing an update. Make sure everything works right, test employee pay, test tax withholding, and test any other deduction. Running a test payroll helps make sure this update will not introduce some problems that may affect your payroll processing accuracy. If you notice some problem, take care of it now while it is easier rather than waiting until your next payroll cycle.

- QuickBooks Support: If there is a problem with the update process that you are facing and cannot manage to handle on your own, then you can contact QuickBooks support at any instance. Customer service at Intuit is set up to handle the technical issues and questions that usually pop up during payroll updates. You can also contact support directly from the Help menu in QuickBooks or just go to their QuickBooks Support website for more support options, such as live chat, phone support, and community forums.

Future Considerations: Keep Ahead with QuickBooks Payroll Updates

QuickBooks Desktop Payroll has continued to evolve as business needs and regulations change. Considering the management of payroll, one needs to implement the following future-proof strategies.

- Apply Cloud Solutions Where Required: QuickBooks Desktop isn’t a bad tool in and of itself, but a lot of businesses do find themselves moving increasingly toward QuickBooks Online or integrating some sort of cloud-based payroll solution into the workflow. The real benefits of QuickBooks Online Payroll are the immediate updates, easier integrations with other cloud services, and accessibility of payroll data from anywhere. You may consider, depending on the needs of your business, some cloud-based payroll solutions that would bring better flexibility.

- Monitor the changes in legislation: With a new year, tax laws, employee benefits regulations, and labor laws change. QuickBooks Payroll does go a long way in keeping updated with changes, but knowing changes in legislation that will affect payroll processing is good. Updates for subscriptions in business law and tax give a good overview, while webinars or industry conferences keep you well out in front of this curve.

- Train Your Staff to Use New Features: Every time features are introduced into QuickBooks Payroll, invest in training your employees in their use. Truly speaking, it is bound to bring more value to a number of new tools and features, including wider reporting options and new employee benefits management functions. More impressively, everything can be integrated in a far better way with time tracking or HR systems.

- Investment in training of the team secures catching up with new tools hence enabling further optimization of payroll processing with very minimal or no errors in the process.

What is a QuickBooks Payroll Update?

A QuickBooks payroll update is any update that Intuit puts out to enable QuickBooks Payroll to raise the bars of functionality, security, and compliance. These updates are essential for perfection in payroll processing, maintaining tax compliance, and even smoothing software performance. Usually, such a payroll update would include the following:

- Tax tables are changed by Federal, State, and local governments from time to time. These would include new rates, exemption updates, or updating of the tax brackets. Follow the QuickBooks Payroll tax table update to subscribe so any such changes get installed into your payroll calculation automatically. For example, a federal withholding tax rate, social security wage base limit, or any state-particular update of the income tax will be instantly integrated into the software.

- QuickBooks contains bugs and glitches that can lead to malfunctioning of the program and cause errors. These errors could start from payroll calculations, system crashes, and poor performance of the systems. Most of the payroll updates available from Intuit include fixing such bugs so the software keeps working correctly and without any issues.

- With every update, there’s something new in payroll processing, be it improved reporting, payroll processing options, or even advanced functionality when integrating third-party applications. Such effort may include but is not limited to tracking employee benefits and flexible overtime calculations in the updated versions of QuickBooks Payroll. Adding such features assists in showing one’s payroll workflows.

- Payroll systems hide highly sensitive employee data, such as social security numbers, salaries, and even bank account details. Most payroll updates in QuickBooks involve newly discovered vulnerabilities being patched for security. Updates include difficult ways through which unauthorized access could be gained or cyberattacks against an employee’s personal data, such as phishing or ransomware attacks. Setting compliance aside, protection of employee data also has something to do with gaining and maintaining trust and protecting the business’s reputation.

Why Should Payroll Be Updated in QuickBooks Desktop?

There can be a number of reasons as to why keeping your QuickBooks payroll updates regular is important. Keeping the payroll updated at the latest saves your business and employees by ensuring tax compliance, protecting against data loss, and increasing payroll processing efficiency. Following are the key reasons for QuickBooks Payroll update:

Tax Compliance

Tax laws are dynamic, and most changes therein from federal, state, and even local jurisdictions come quite frequently. Changes may range in tax rates from bases on wages, limits on withholding, and qualification for certain credits or deductions. Changes in these features of tax law, if not upgraded within the QuickBooks Payroll system, may bring an additional compliance issue by having the wrong amount of tax withheld from the paycheck of employees.

Examples of those would be when, in 2023, the IRS updated the federal tax brackets or, at any time, some different states revised their income tax rates. If you don’t refresh your payroll system, then QuickBooks will keep using the previous tax tables. This may cause some over-withholding and some under-withholding taxes. Besides any possible or increased penalties and fines set by the taxing powers concerned, either the case of under or over-withholding will definitely cause dissatisfaction among the employees once they find out the correct tax withholding.

QuickBooks Payroll automatically includes the latest federal, state, and local tax changes, making sure your payroll system meets all tax law compliance standards and avoiding costly mistakes for you.

Pay Processing with Accuracy

Of course, one of the most sensitive areas of the business in terms of accuracy is payroll. Nobody likes to have incorrect pay calculated- either by the wrong deductions, underpaid wages, or benefits not paid, which surely would be one surefire way to make employees quite unhappy and maybe even initiate an array of legal liabilities. An updated QuickBooks Payroll makes sure that calculations are accurate with the latest formulas applied for tax calculations, wage deductions, and other payroll parameters.

For example, if your QuickBooks Payroll has become outdated and the system has not kept pace with changes in overtime laws, workers who work over the regular hours will be underpaid for overtime. With periodic payroll updates, QuickBooks will automatically refresh payroll rules to minimize the chances of errors.

Better Payroll Performance

QuickBooks Payroll just keeps getting better with each release. The previous versions faced problems related to performance, like taking more time to process and hanging, which slows down the job in payroll, especially during year-end processing. Updates very often include performance enhancements that make the payroll system faster, more responsive, and easier to use.

For example, older versions of QuickBooks Payroll may struggle to handle large team payrolls or generate payroll reports that take a little longer to render. In newer updates, QuickBooks further streamlines its functionality for speedier processing times, easier operations, and easier handling of much larger data with ease.

New Features and Improvements Availability

Another one of the major reasons for an update is due to the availability of new features and improvements. Intuit mostly makes new tools, reporting features, and third-party software integrations available, which speed up efficiency in payroll processing. Following are some examples of the improvements which may form part of payroll updates:

- Updates come in the form of an extended payroll reporting capability, enabling one to provide much more detailed insights into payroll expenses, tax liabilities, and other costs related to paying employees.

- With almost any new update, the tracking of employee benefits has gotten better. Features like this make sure that each employee’s benefit has been taken into consideration and is in accordance with company policy.

- As more and more companies utilize specialized software applications, new third-party integrations, such as time-tracking apps, HR platforms, or employee scheduling tools, are introduced with updates to QuickBooks in order to make the payroll process seamless across a suite of systems. This furthered integration also reduces manual work to synchronize data across multiple platforms.

Security and Data Protection

Data security is one of the biggest concerns when managing payroll. The payroll system carries private employee information, such as social security numbers, tax data, and financial accounts. A vertical factor is to keep QuickBooks Payroll updated in order not to expose such sensitive information to hackers and data breaches.

Security vulnerabilities that have been newly uncovered are also often patched when a QuickBooks update is issued. For example, suppose some kind of security weakness allows unauthorized access to employee payroll information. QuickBooks immediately releases an update to fix the problem and make data more secure.

This keeps your payroll system updated for any online threats that might steal sensitive employee data.

Conclusion

There are many reasons, from payroll processing and keeping taxes in compliance to keeping sensitive data secure, why it’s really important to update your QuickBooks Payroll system on a regular basis. Whether it be QuickBooks Desktop 2023 or QuickBooks Desktop Payroll 2024, regular updates keep one in tune with recent regulations, continuing to refine the payroll workflow while keeping a business secure.

FAQ’s

How do you do a payroll update in QuickBooks?

The following are the steps to update payroll in QuickBooks:

1. Sign in and open your QuickBooks account.

2. Click on Workers or Payroll- either will do, depending on the version.

3. Click Employees or Payroll Center.

4. Now, click on Payroll Settings, then Update Payroll Settings.

5. If necessary, update employee details, tax settings, pay schedules, or other payroll preferences.

6. QuickBooks will also prompt you if you need to download and install any available updates for payroll software. Follow the onscreen instructions.

QuickBooks will usually notify you that an update is available, but you can also do this within the Help menu or on the Payroll Settings page.

How do I edit my Payroll in QuickBooks?

To edit payroll in QuickBooks, follow the steps below:

1. Open QuickBooks, then go to Payroll or Workers if you are using QuickBooks Online.

2. Click Employees or Payroll Center.

3. Highlight the name of the employee or payroll item you want to edit.

4. Click to make the required edits, such as pay rate, deductions, benefits, and/or employee information.

5. Save the changes.

How do I adjust payroll taxes in QuickBooks?

Adjust Payroll Taxes:

1. Open the Payroll module on QuickBooks.

2. Highlight an employee or payroll item that needs updating.

3. Under the Employee’s details or payroll settings, update the Taxable Income or Deductions section, whichever applies.

4. If you are adjusting a previous payroll, check the option Adjust Payroll in the Pay History section and follow the prompts to update the tax amounts.

5. Review your payroll run to make sure everything is accurate before submitting it.

Why is QuickBooks not calculating payroll taxes correctly?

QuickBooks is not calculating payroll taxes correctly in the following cases:

1. Be sure that the latest payroll updates are available in QuickBooks to provide the proper tax rate.

2. Recheck the employee settings for taxes, withholding exemptions, filing statuses, and state-specific rules regarding taxes.

3. Paying an employee with the wrong type of pay item-salary versus hourly, taxable versus nontaxable-will impact tax calculations.

4. Make sure the payroll frequency-weekly, bi-weekly, or monthly-matches the employee profile and your tax filings.

5. Verify that QuickBooks has set up all deductions, benefits, and tax liabilities appropriately.

What are the payroll changes for 2024?

Different payroll changes may apply to 2024, including the following:

1. Every year, tax rates, income brackets, and wage bases (e.g., Social Security, Medicare) change. The IRS will publish new tax tables that QuickBooks will automatically use if you subscribe to QuickBooks Payroll.

2. Some states may change withholding rates or add new taxes paid for paid family leave.

3. Earnings subject to the Social Security tax could increase.

4. Most states and many localities will increase minimum wage laws in 2024, and employee compensation will need to be updated accordingly within QuickBooks.

5. Employers may need to adjust their employees’ benefit programs, such as retirement contributions, health benefits, or commuter benefits, due to new regulations.

Remember that your payroll processes should always be cross-referenced with the current IRS and state Department of Labor guidelines that may have occurred recently.

You May Also Read-

Resolution Steps if You Encounter QuickBooks Error 355

Troubleshooting methods for QuickBooks Error 6010 100

How to Fix QuickBooks Error 40003 – Payroll Error

Are you facing issues with QuickBooks error 1722? Fix it now

Let’s Eliminate QuickBooks Error 15311 with Effective Solutions

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.