The QuickBooks Payroll error 2107 usually occurs when a user tries to send payroll through direct deposit in QB Desktop. This can hamper your workflow and important business processes, as sending paychecks to your employees on time is mandatory for running a business successfully. You can resolve this issue by updating the QBDT app. In this blog, we’ll cover the in-depth troubleshooting methods you can use to resolve error code 2107 in QuickBooks Desktop.

QuickBooks Payroll Error 2107 – A Quick View Table

Given in the table below is a concise summary of this blog on the topic of the QuickBooks error code 2107:

| Description | The QuickBooks payroll error 2107 occurs while you try to send your direct deposit. This can hamper your workflow and important business processes. |

| Its causes | An improper installation of QuickBooks Desktop, an outdated Windows OS, issues with the Windows registry file, incorrect date and time settings of your PC, an outdated tax table, an unstable internet connection, special characters in your company’s legal name, and the Windows Firewall blocking QB Desktop. |

| Ways to fix it | Update the QB Desktop app, use QuickBooks Install Diagnostic Tool, update the Windows OS, utilize Quick Fix My Program, update the tax table, verify the date and time settings of your PC, change the payroll bank account, and check your company’s legal name in QBDT. |

Troubleshooting Methods to Fix Error Code 2107 in QuickBooks Desktop

The troubleshooting methods you can use to fix the QuickBooks error code 2107 in QB Desktop are given below:

Update the QuickBooks Desktop Software

An outdated QB Desktop app can lead to you not being able to send payroll data and see the QuickBooks Payroll error 2107. You can fix it by updating the QuickBooks Desktop application to the latest released version. This would also resolve any other errors that you might be facing.

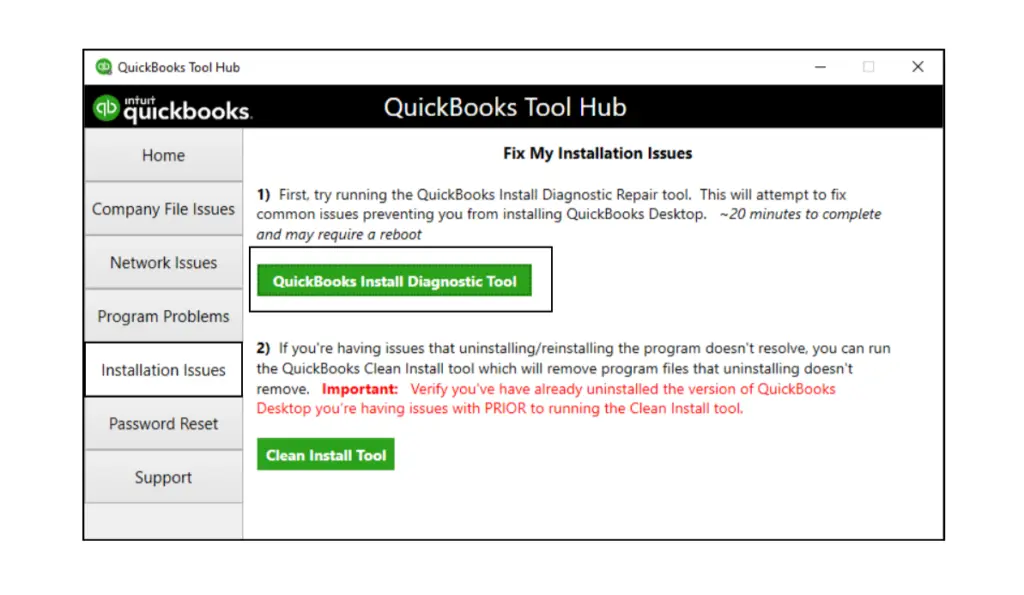

Use the QuickBooks Install Diagnostic Tool

You can use the QB Install Diagnostic Tool to fix error 2107 in QuickBooks Payroll with the following steps:

- Download and install the QuickBooks Tool Hub

- Open the Tool Hub app

- Navigate to the Installation Issues tab

- Click on the QuickBooks Install Diagnostic Tool

- Let the tool run

This would fix inherent installation problems with the QBDT app, allowing you to send direct deposit again.

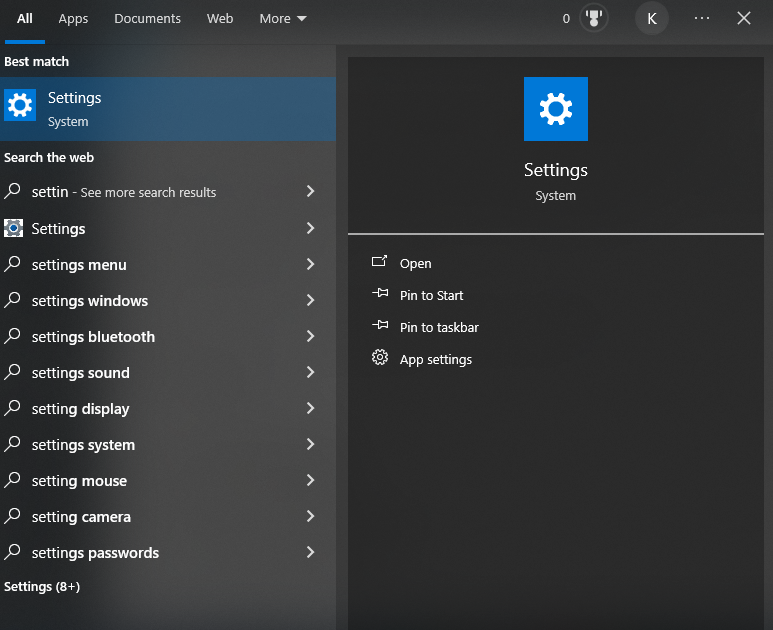

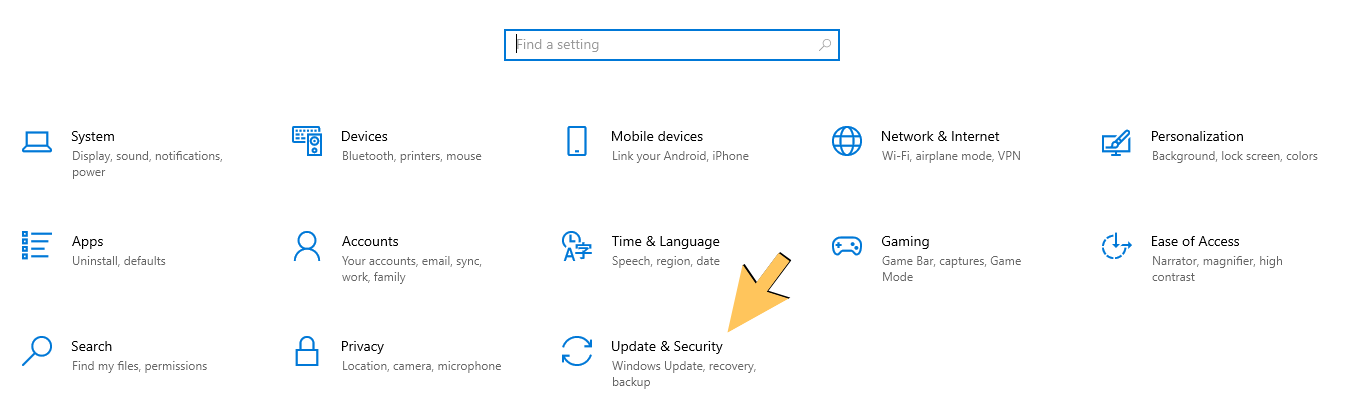

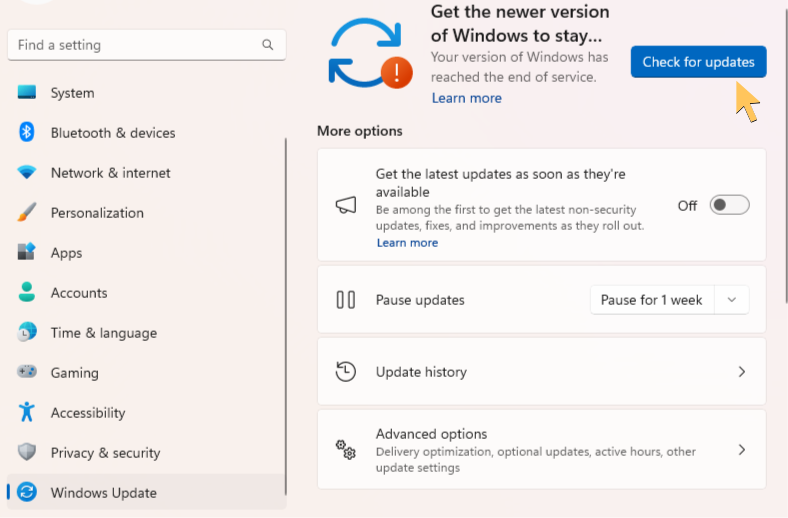

Update the Windows Operating System

An outdated Windows operating system can lead to you seeing the QuickBooks Payroll error 2107. You can update the Windows OS with the steps given below:

- Open the Start menu on your PC

- Click on the Gear icon

- Select the Update & Security option

- Now, under the Windows Update section, press Check for updates

- Windows would now check for available updates and automatically download them

The Windows OS would now be updated, fixing the error 2107 in QB.

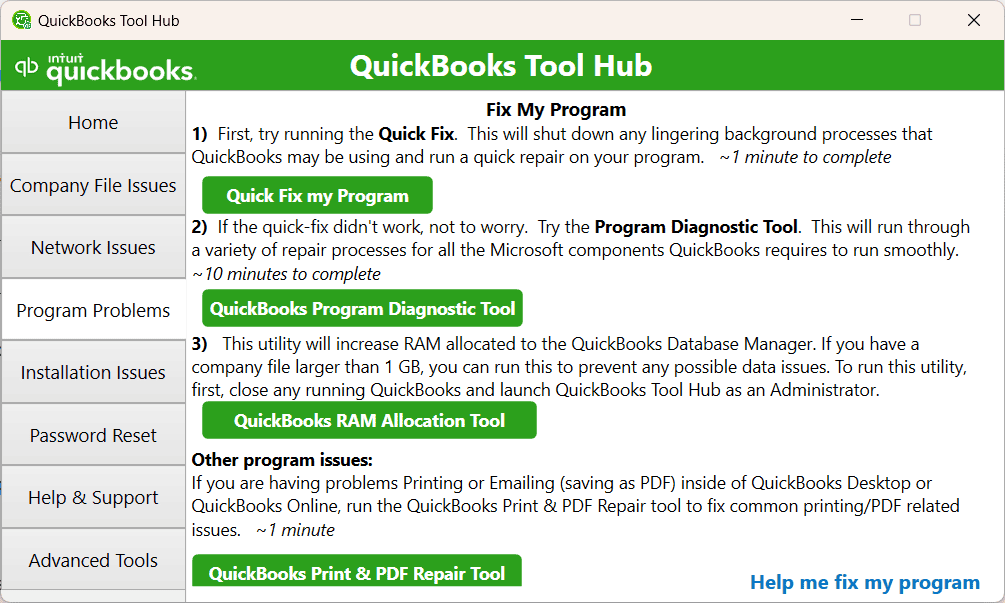

Use Quick Fix My Program from the Tool Hub

You can use the Quick Fix My Program tool from the QuickBooks Tool Hub to fix error 2107 QuickBooks Desktop with the following steps:

- Open the QB Tool Hub app

- Go to the Program Problems tab

- Select Quick Fix My Program

- Let the tool run

The tool would then fix the QuickBooks Payroll error 2107.

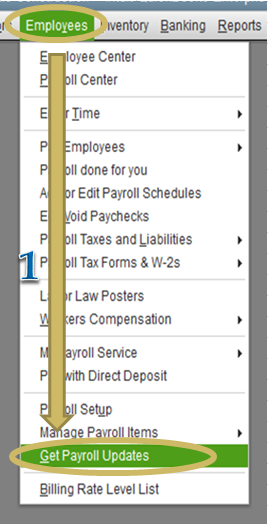

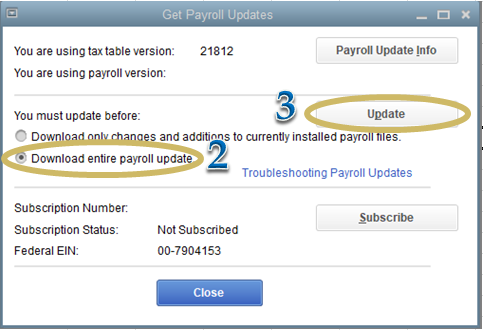

Download and Install the Latest Tax Table Updates

An outdated tax table in QuickBooks Desktop Payroll can lead to you seeing error 2107. You can fix it by updating your tax table with these steps:

- Open QuickBooks Desktop

- Navigate to the Employees menu

- Click on Get Payroll Updates

- Select the Download Entire Update option

- Press Update

- An informational window would appear after the download is complete

This would patch the QuickBooks Payroll error 2107 in QB Desktop.

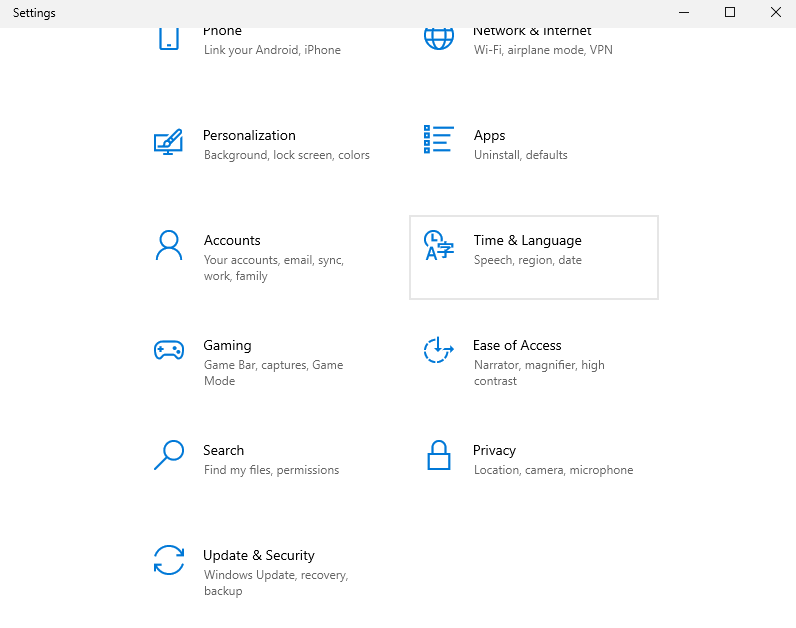

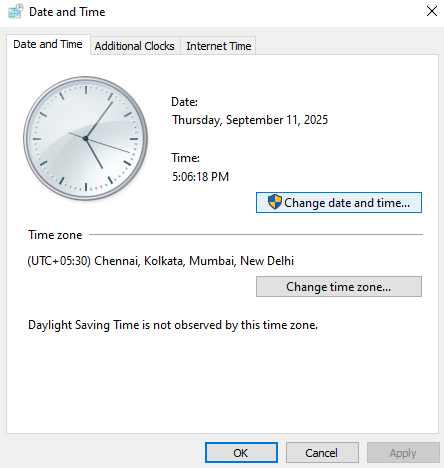

Check the Date and Time Settings of Your PC

If your system’s date and time settings are incorrect, you might not be able to send direct deposit through QuickBooks Payroll. You can change the date and time settings of your PC with the steps given below:

- Open the Start menu

- Click on the Gear icon

- Select the Time & Language option

- Press Date & time

- In the Date & time window, switch on the Set time automatically option to set your date and time automatically

- If you want to set it manually:

- Turn off the Set time automatically option

- Press Change next to Set the date and time

- In the Change date and time window, manually set the Date and Time

- Lastly, press the Change button

This would correct the date and time settings of your system.

Change the Payroll Bank Account

If your bank account has recently changed and you haven’t updated it in QBDT, you can see the QuickBooks Payroll error 2107. You can change your bank account in QB with the given steps:

Step 1: Gather the Information Needed Before Changing the Bank Account

- Get your banking information

- Have your bank’s account number and routing number with you

- Don’t use the routing number from the deposit slips

- Have your physical address noted down

- Make sure to have your payroll PIN with you

Step 2: Set Up the Bank Account in the Chart of Accounts

- Open the QuickBooks Desktop app

- Go to the Lists menu

- Select Chart of Accounts

- Click on Accounts

- Press New

- Click the Bank option

- Hit Continue

- Enter the bank account information

- Press Save and Close

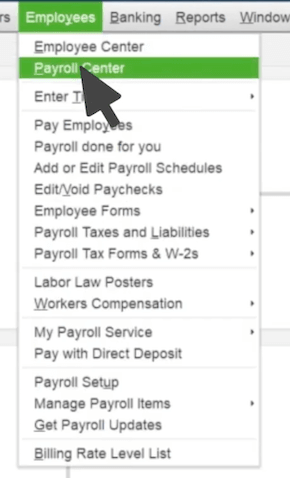

Step 3: Look For Any Tax Payments or Payroll Transactions that Are Pending

- Open the Employees menu in QuickBooks

- Select the Payroll Center option

- Click on the Payroll tab

- View any pending payroll transactions

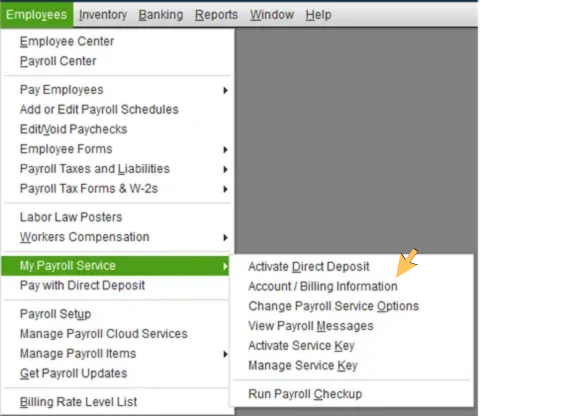

Step 4: Change Your Bank Account in QB Desktop

- Open the QBDT app

- Navigate to the Employees menu

- Select My Payroll Service

- Click on Account/Billing Information

- Sign in using your Intuit account

- Go to the Payroll Info section

- Click on Edit under Direct Deposit Bank Account

- Feed in your payroll PIN

- Select Continue

- Enter the new bank account info

- Select Update

- Click on Close after you receive the confirmation message

Step 5: If You Connected Manually, Verify Your Bank Account

Intuit will verify your bank account within 2-3 business days with a test transaction. Here are some key points you need to remember before you verify the account:

- The test transaction would appear in your account statement within 2-3 business days of changing your bank account

- The test transaction would be a debit and credit amount of less than $1.00 from Intuit Payroll Service

- You check the bank statement online to verify the amount

- Ensure the test transaction is cleared before you verify the account

After keeping these things in mind, verify your account with the following steps:

- Open the QuickBooks Desktop app

- Click on the Employees menu

- Select My Payroll Service

- Press Account/Billing Information

- Sign in using your Intuit account

- Navigate to the Payroll Info section

- Click on Verify under the Direct Deposit Bank Account

- Enter and confirm the payroll PIN

- Press Submit

Select Return to QuickBooks after you receive the Your bank account is verified message

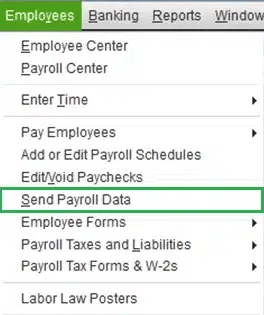

Step 6: Change the Default Bank Account in QB preferences

- Open QuickBooks Desktop

- Then, open the Employees menu

- Select Send Payroll Data

- The Send/Receive Data window would open

- Click on Preferences

- Now, in Account Preferences, choose your new bank account from the dropdown menu

- Hit OK

- Press Close

Change the default bank account in the QuickBooks Payroll Service liability check with these steps:

- Open the Employees menu in QB Desktop

- Press Send Payroll Data

- Select Preferences

- The Payroll Service Accounts window would open

- Choose your new bank account from the Pay Payroll Liabilities with dropdown menu

- Press OK

- Hit Send and type in your payroll PIN

This would change your direct deposit bank account and fix the QuickBooks Payroll error 2107.

Check the Legal Name of Your Company

If your company’s legal name in QuickBooks Desktop contains any special characters, you can face the QuickBooks Payroll error 2107. Check your company’s name with these steps:

- Open your QBDT company file

- Go to the Company menu

- Click on Company Information

- Change the Legal Name

- Delete any special characters

Performing these steps would fix the QuickBooks error 2107.

What are the Causes of the QuickBooks Payroll Error 2107?

The potential factors that can trigger the QuickBooks error code 2107 are given below:

- Improperly installed QuickBooks Desktop application

- An outdated Windows operating system

- A damaged or corrupted Windows registry

- Problems with your company file data

- An outdated QuickBooks Desktop software

- An unstable internet connection

- The Windows Firewall is blocking QB Desktop

- Using multi-user mode while sending your payroll data

Now that we know about the causes of QB error 2107, let us proceed with the methods to fix it.

Conclusion

In this blog, we talked about the QuickBooks Payroll error 2107, along with the factors that can potentially trigger this error code to appear on your screen. Additionally, we provided you with the in-depth step-by-step troubleshooting methods you can use to resolve this problem on your own.

FAQs

Why do I keep getting message error 2107 QuickBooks Payroll?

You might be getting the QuickBooks Payroll error 2107 on your screen due to the reasons given in the list below:

1. An outdated QBDT app

2. The Firewall is blocking QBDT

3. An improper installation of QB Desktop

4. Special characters in your company’s legal name

5. An outdated Windows operating system

6. Incorrect date and time settings on your system

7. Problems with the Windows registry file

8. An outdated tax table

How can I fix the QuickBooks error code 2107?

You can fix the QuickBooks error 2107 with the troubleshooting methods given in the list below:

1. Update QB Desktop

2. Utilize the QuickBooks Install Diagnostic Tool

3. Update your Windows operating system

4. Use the Quick Fix My Program tool

5. Download the latest tax table updates

6. Verify the time and date of your system

7. Change your payroll bank account

8. Verify the legal name of your company in QuickBooks

How to change my direct deposit bank account in QuickBooks?

To change your direct deposit bank account in QBDT, you would have to carry out these steps;

1. Gather the information you need to add the bank account

2. Set up your bank account in the Chart of Accounts

3. Check any tax payments or payroll transactions that are pending

4. Change your bank account in QBDT

5. Verify your bank account

6. Change the default bank account in QuickBooks Preferences

QuickBooks Desktop Compile Error in Hidden Module: Easy Fixes Explained

QuickBooks Error 1321 Cannot Update Company File – Causes & Solutions

How to Resolve QuickBooks Error Message Code 213 Step by Step

QuickBooks Point of Sale Error 181021 – How to Fix It Fast

QuickBooks Payroll Error 12152: Complete Guide to Resolve

James Richard is a skilled technical writer with 16 years of experience at QDM. His expertise covers data migration, conversion, and desktop errors for QuickBooks. He excels at explaining complex technical topics clearly and simply for readers. Through engaging, informative blog posts, James makes even the most challenging QuickBooks issues feel manageable. With his passion for writing and deep knowledge, he is a trusted resource for anyone seeking clarity on accounting software problems.